The Brazilian real continues to lose strength against the greenback as a lot of traders out there are starting to focus on the attitude of global markets in general and global growth. Ultimately, one has to pay attention to the idea of emerging market currencies on the whole, which of course has a major influence on what happens with the Brazilian real.

The Brazilian real continues to struggle not only from an emerging market standpoint but also from the increase of infections of the coronavirus in that country. This makes perfect sense that we would see a lot of selling pressure based upon concerns of whether or not Brazil can reopen. In fact, it has gotten so bad that Brazil’s government has stopped reporting numbers, and as a result, it should not be a huge surprise to see that traders have been running away from this currency.

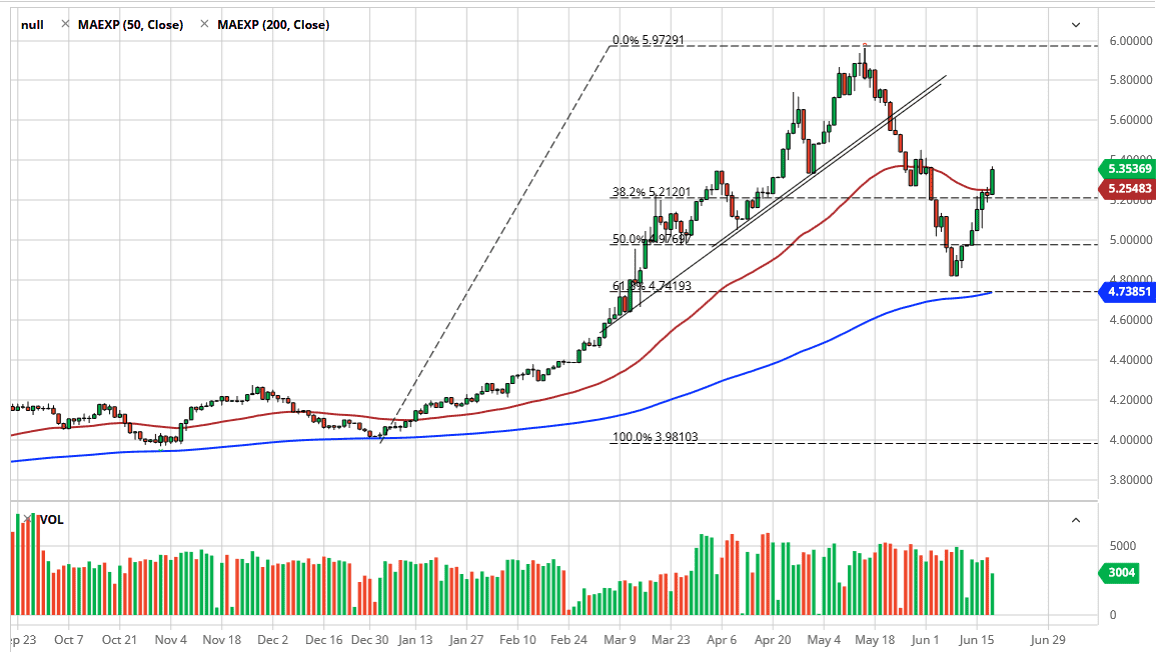

Recently, we have seen a significant pullback towards the 4.80 BRL level, but we have bounced straight up in the air since then. What is interesting is that the 5.40 level above is offering resistance, but now that we have broken above the 50 day EMA, it is highly likely that we will continue to go higher. It should also be noted that when we pulled back towards the 4.80 level, it was roughly in line with the 61.8% Fibonacci retracement level, and just above the 200 day EMA.

With that in mind, typical technical analysis would suggest that you are at least going to try to go back towards the highs. That being said, the 5.4 level above should offer a bit of resistance, so I look at any pullback as an opportunity to pick up a bit of value. After all, there are a lot of concerns out there, and most certainly with Brazil in its crosshairs.

Unless we suddenly get a major “risk-on” type of move globally, I just do not see how the Brazilian real will do better than the US dollar. At this point, I think this is a continuation of the longer-term uptrend, and therefore I am still bullish. It is not until we see some type of momentum in South America and Latin America in general that I think this market can truly start to sell this market often more of a “risk-on” type of attitude. With that, I remain a buyer of dips.