For over a decade, DailyForex has been the trusted Forex broker authority, establishing an unrivalled reputation for rigorous research and journalistic integrity. With a methodology refined through years of industry experience, we empower traders to make informed decisions, which is particularly important when trading high-risk investments such as penny stocks. Discover more about our comprehensive review process and how we maintain transparency and impartiality here.

Editor’s Verdict

FP Markets stands out as a solid, no-nonsense Forex and CFD broker that, over the years, has evolved into one of the more reliable names in the industry, with its raw spreads, lightning-fast execution, and a well-optimized MT4 experience. While testing the platform, I found FP Markets’ suite of tools, particularly the 12 MT4 plug-ins and Autochartist signals, offered a noticeable trading edge. The pricing on the Raw account is especially attractive with many spreads starting from 0.0 pips and a competitive $6 round-trip commission.

In addition to competitive pricing, FP Markets delivers excellent infrastructure. VPS hosting, Myfxbook integration, and proprietary copy trading features reflect a forward-looking broker that’s responsive to traders’ needs. While the asset range isn’t likely to satisfy long-term investors or anyone wanting direct ownership of shares and ETFs, the offering is more than adequate for active traders and short-term strategists.

For traders who prioritize execution speed, low-cost trading, and platform reliability, FP Markets is exactly the kind of broker you want in your corner.

FP Markets Video Review

Overview

A social trading broker with its proprietary CrowdTrading platform.

Headquarters | Australia |

|---|---|

Regulators | ASIC, CMA (Kenya), CySEC, FSCA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2005 |

Execution Type(s) | ECN/STP |

Minimum Deposit | $100 |

Negative Balance Protection | |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, cTrader, Proprietary platform, Web-based |

Average Trading Cost EUR/USD | 1.2 pips |

Average Trading Cost GBP/USD | 1.4 pips |

Average Trading Cost WTI Crude Oil | $0.02 |

Average Trading Cost Gold | $0.16 |

Average Trading Cost Bitcoin | $21.08 |

Retail Loss Rate | 72.44% |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.0 pips |

Minimum Commission for Forex | $6.00 per Round Lot |

Funding Methods | 30 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

FP Markets is an Australian multi-asset broker with more than $1 billion in daily trading volume, serving clients from 80+ countries. Founded in 2005 in Australia, FP Markets has grown into a trusted brand over the past 15+ years with more than 100 employees. The upgraded MT4/MT5 trading platforms, viaTrader Tools, consisting of twelve plug-ins, present clients with a competitive edge. I have conducted an in-depth review of this CFD broker to provide traders with a complete overview of the trading environment at FP Markets.

FP Markets offers a range of value-added services, including VPS hosting for automated trading solutions, the MT4 Myfxbook service for copy trading, the MT4 MAM/PAMM module for retail account management, and the recently upgraded in-house social trading service.

Who Should Trade with FP Markets?

FP Markets is designed to cater to active traders looking for fast execution, low spreads, and flexible strategy deployment across multiple platforms. Here’s how it aligns with various trading profiles:

Trader Type | Rating | Summary |

|---|---|---|

Newer Traders | 5/5 | Beginner-friendly with solid education, demo accounts, and user-friendly platforms like TradingView. |

Copy Traders | 5/5 | Seamless copy trading via MetaTrader, cTrader Copy, and Myfxbook AutoTrade. |

Swing Traders | 3.5/5 | Wide CFD range for multi-day trades but limited by average swaps and no ETFs or stocks. |

News Traders | 3.5/5 | Good news feeds via Dow Jones and Reuters but lacks deep macro tools. |

Automated Traders | 5/5 | Full algo trading support on MT4/MT5/cTrader, plus VPS hosting for stability. |

Investors | 2/5 | Not ideal for long-term investing; lacks real stocks, funds, or managed portfolios. |

Day Traders | 5/5 | Fast execution, tight spreads, and mobile-ready—great for intraday strategies. |

Scalpers | 5/5 | Ultra-fast execution, Raw Spread accounts, and tools optimized for scalping. |

FP Markets Regulation and Security

How Does FP Markets Regulation Measure Up to the Competition?

At DailyForex we appreciate just how critical it is for you that you are placing your hard-earned cash in the hands of a well-regulated broker.

Brokers with at least one tier-1 entity will have a reputation to protect and will be more likely to provide the highest levels of oversight, transparency, and investor protection, across their entire operation.

Regulators like the FCA (UK), ASIC (Australia), or CFTC/NFA (US) impose strict rules relating to capital requirements, client fund segregation, and fair-trading practices. These are designed to minimize the risk of fraud and malpractice, while creating a trusted framework for traders. Tier-1 regulation gives you confidence that your funds are safe with a forex broker that is reliable, well-capitalized, and committed to operating under the most stringent global regulatory standards.

Number of Tier 1 Regulators:

FP Markets | FXPro | eToro |

|---|---|---|

2 | 3 | 3 |

Founded in 2005, FP Markets is an experienced broker with a clean track record, where traders’ deposits, segregated from corporate funds, are secure. The NDD execution model enables conflict-free trade execution. While external financial audits exist, FP Markets does not provide details about the auditor. Overall, my research has found FP Markets to be a transparent and trustworthy broker that’s one of the best out of Australia, and highly competitive globally.

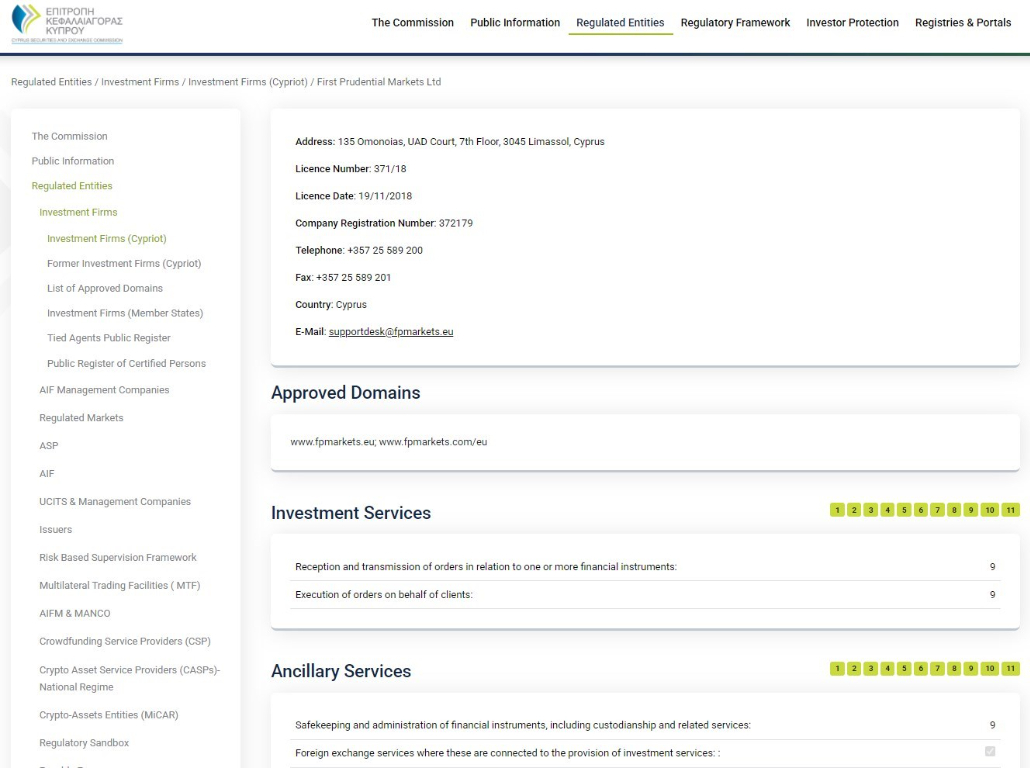

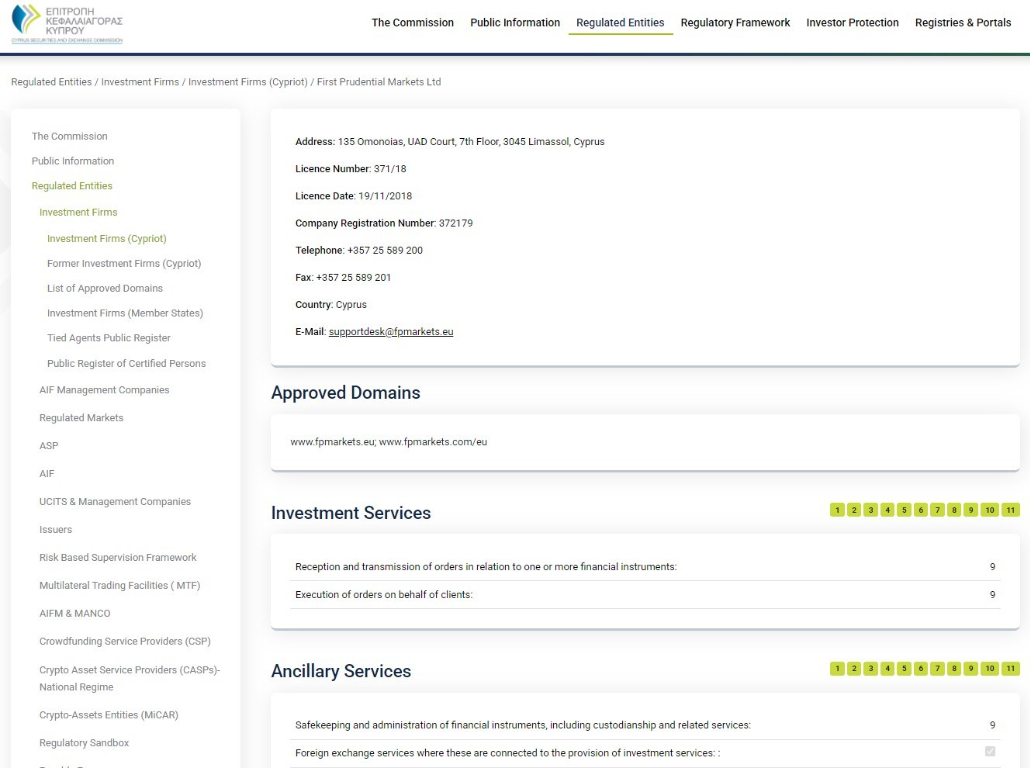

Country of the Regulator | Australia, Cyprus, Kenya, South Africa |

|---|---|

Name of the Regulator | ASIC, CMA (Kenya), CySEC, FSCA |

Regulatory License Number | 286354, 103, 371/18, 50926 |

Does FP Markets Accept US Clients?

No, FP Markets is ASIC-regulated in Australia but does not have NFA/CFTC approval and is not configured to accept US persons as clients. Explore the best forex brokers in the USA available to US clients.

Australian clients will deal with the subsidiary, regulated by the Australian Securities and Investments Commission (ASIC) – a tier 1 regulator, First Prudential Markets PTY LTD. FP Markets operates under the protection of the Act of Grace mechanism under section 65 of the Public Governance Performance and Accountability Act 2013. Australian clients remain shielded from potential damages by the Scheme for Compensation for Detriment caused by Defective Administration (CDDA Scheme).

First Prudential Markets LTD remains authorized by the Cyprus Securities and Exchange Commission (CySEC), a leading tier 1 Forex regulator. EEA traders get an investor compensation fund limited to €20,000 per client.

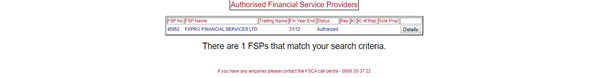

FP Markets (Pty) Ltd is now a Financial Services Provider authorized and regulated by the Financial Sector Conduct Authority in South Africa (FSP Number 50926), which emerged as one of the good, go-to regulators following uncompetitive regulatory changes in Tier-1 jurisdictions, like Europe and Australia.

Kenyan resident clients will be serviced through the Kenyan Capital Markets Authority (CMA) regulated subsidiary.

FP Markets Fees

HOW WE TEST BROKER FEES

At DailyForex, we review broker fees by opening live accounts and trading multiple asset classes to assess spreads, commissions, and overall trading costs. We compare each broker’s fees against industry averages for major currency pairs. We also assess deposit, withdrawal, inactivity, and swap fees, rewarding price competitiveness and transparency. Learn more here.

Average Trading Cost EUR/USD | 1.2 pips |

|---|---|

Average Trading Cost GBP/USD | 1.4 pips |

Average Trading Cost WTI Crude Oil | $0.02 |

Average Trading Cost Gold | $0.16 |

Average Trading Cost Bitcoin | $21.08 |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.0 pips |

Minimum Commission for Forex | $6.00 per Round Lot |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | No |

How Does FP Markets Fees Stack Up to Competitors?

Competitive trading costs are hugely important when choosing a forex broker, directly impacting your bottom line, especially if you are someone who trades frequently.

The EUR/USD pair is the most liquid and heavily traded currency pair, making it the best benchmark for spreads and commissions. Any forex broker that offers consistently low costs on EUR/USD will typically provide competitive pricing across other major, minor and exotic pairs as well. Lower costs mean that more of your profits stay in your pocket, and over time this can lead to significant savings, as less of your earnings are lost to fees.

Average Trading Cost EUR/USD:

FP Markets | FXPro | eToro |

|---|---|---|

1.2 | 1.3 | 1.3 |

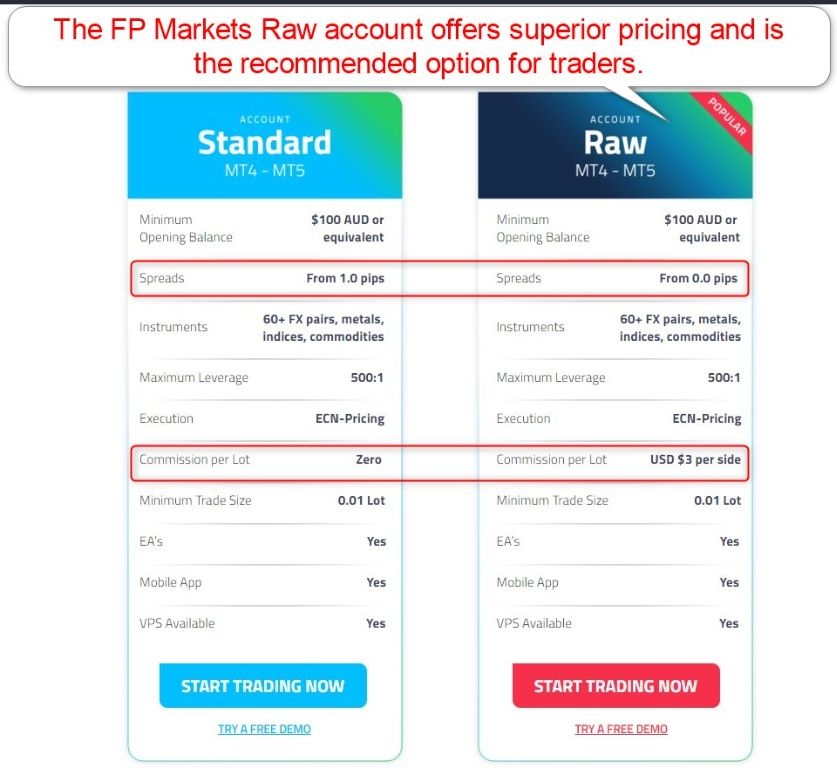

Trading fees have the most notable direct impact on any strategy, and FP Markets offers two pricing models.

- The commission-free Standard account shows an average mark-up of 1.15 for the EUR/USD. It equals $11.50 per 1.0 standard lot.

- FP Markets delivers a highly competitive commission-based alternative with raw spreads of 0.0 pips for a commission of $6.00 per round lot.

Commodities, indices, and cryptocurrencies remain free of additional costs. Equity CFDs and DMA traders face a fee between 0.06% and 0.30% with a minimum of $10 or a currency equivalent. The equity trading charges depend on the country of the listed underlying asset, and the pricing environment remains average compared to other brokers.

Other costs traders must consider are swap rates on leveraged overnight positions. Third-party withdrawal charges may apply, but there is no inactivity fee at FP Markets.

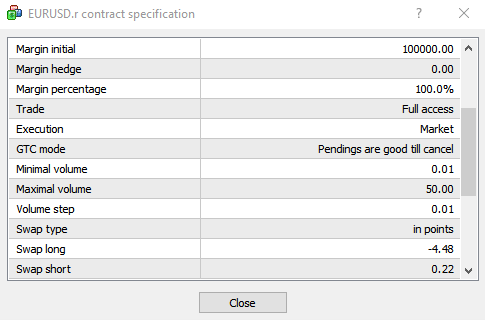

MT4/MT5 traders can access swap rates from their platform by following these steps:

- Right-click on the desired symbol in the Market Watch window and select Specification.

- Scroll down until you see Swap Long and Swap Short.

Comparing trading costs is challenging, with numerous variables impacting the final fees. I evaluated the spreads of the EUR/USD, gold, the S&P 500, and WTI crude - four of the most traded assets, available at all brokers.

Here is a screenshot of a live FP Markets MT4 trading account during the most liquid overlap session, London-New York, where traders usually get the lowest spreads.

Here is a screenshot of swap rates at FP Markets for the EUR/USD from the MT4 trading platform.

Traders who buy the EUR/USD without leverage, a 0.0 spread, and hold it for one night will pay $4.48 per day per 1.0 standard lot, but traders who sell the EUR/USD will receive $0.22.

Leverage will decrease the costs marginally, as swap rates apply only to the amount borrowed, in this example, 100%. Using a 1:500 leveraged trade will lower the borrowed amount to 99.8%, improving the swap long by $0.01 to -$4.47 and resulting in no change for the swap short. Swap rates apply with a T+2 formula to account for weekends, which means each Wednesday, most Forex positions incur a triple fee. Some exceptions exist depending on the currency pair, and a T+1 applies.

Taking a 1.0 standard lot buy position in the EUR/USD with 1:500 leverage and holding it for one night will cost the following:

$6.00 commission + $4.47 swap rate = $10.47

Holding the same trade for seven nights accumulates the following costs:

$6.00 commission + $31.29 swap rate (7 x $4.47) = $37.29

The $6.00 commission for Forex traders per 1.0 standard lots remains among the best industry wide.

My review focused on the MT4 trading platform, which is available to all FP Markets clients. The Iress trading platform, restricted by geographical location, is focused on global equity trading and features a number of additional costs. These can total above $200 per month for low-frequency traders, but FP Markets has a program in place for active traders to receive reimbursement for most costs. While non-equity trading costs remain highly competitive, equity trading tends toward the industry average.

What Assets Does FP Markets Offer?

- 70+ currency pairs

- 11 cryptocurrency pairs available

- 22 commodities and metals

- 24 index CFDs

- 159 equity CFDs

- Over 290 ETFs

- 2 bonds

Asset Selection Summary

The asset selection for MT4/MT5 traders consists of more than 250 trading instruments, an adequate level of choice for most traders. Forex traders get 70+ currency pairs, and diversification opportunities exist via cryptocurrencies, commodities and metals, indices, equity CFDs (available through the MT5 trading platform), and bonds. The IRESS trading platform lists over 10,000 equity CFDs and a few futures contracts, but its availability remains geographically restricted.

Asset List

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

FP Markets Leverage

The maximum leverage offered through the FP Markets St. Vincent and Grenadines subsidiary is 1:500 for Forex traders, while negative balance protection creates ideal conditions for scalpers and traders seeking highly leveraged trading accounts. The Cyprus and Australian regulated units limit retail leverage to a maximum of 1:30.

FP Markets Trading Hours (GMT +2 Server Time)

Asset Class | From | To |

|---|---|---|

Currency Pairs | Monday 00:02 | Friday 23:59 |

Cryptocurrencies | Saturday 00:00 | Friday 23:55 |

Commodities | Monday 01:00 | Friday 23:57 |

Crude Oil | Monday 01:00 | Friday 23:57 |

Gold | Monday 01:00 | Friday 23:57 |

Metals | Monday 01:00 | Friday 23:57 |

Equity Indices | Monday 10:00 | Friday 23:00 |

Bonds | Monday 11:00 | Friday 23:00 |

ETFs | Monday 16:30 | Friday 23:00 |

Please note that equity markets open and close each trading and are not operational continuously like Forex and cryptocurrencies.

MT4/MT5 traders should follow these steps to see trading hours:

- Right-click on the desired symbol in the Market Watch window and select Specification.

- Scroll down until you see Sessions.

FP Markets Account Types

Traders can opt for the commission-free Standard Account or the commission-based Raw Account. I highly recommend Forex traders opt for the Raw Account, as trading costs are notably lower. The minimum deposit is $100, while the maximum leverage is 1:500 for non-EU traders. All other trading conditions remain identical.

FP Markets offers Muslim traders the option of opening an Islamic account. Supporting documentation proving Islamic status might be required in certain cases.

Below is an example of the difference in trading costs for a 1.0 standard lot buy position in the EUR/USD, held for seven nights with leverage of 1:500, and a minimum commission-free spread of 1.0 pips, and the 0.0 pips alternative in the commission-based account.

Standard Account: $10 (1.0 pips spread) + $31.29 (swap rate for seven nights) = $41.29

Raw Account: $6 (commission) + $31.29 (swap rate for seven nights) = $37.29

The $4.00-per-trade difference adds up over time, as trading volume increases, allowing traders to save hundreds or even thousands in fees per month.

FP Markets offers traders two MT4/MT5 account choices.

FP Markets Demo Account

Traders can open unlimited MT4/MT5 demo accounts at FP Markets. These are ideal for algorithmic traders wanting to test EAs and fix bugs

FP Markets Trading Platforms

Every trader has their own style of trading and so access to a variety of trading platforms is useful because it allows you to choose the one that best fits your preferred strategies, tools, and experience level. Popular platforms like MT4, MT5, TradingView, and cTrader each offer unique features, such as advanced charting, automated trading, or social trading integrations.

In reality, each of these platforms provides all the main tools and features that most retail traders use. However, by offering a range of choices, including proprietary platforms designed in-house, a broker ensures that all different kinds of traders can benefit from a flexible and convenient trading experience. This variety and versatility allows you to switch between platforms as your strategies, capabilities, and requirements evolve.

Available Trading Platforms:

Platform | FP Markets | FXPro | eToro |

|---|---|---|---|

MT4 | √ | √ | x |

MT5 | √ | √ | x |

C Trader | √ | √ | x |

TradingView | x | x | x |

Proprietary | √ | √ | √ |

FP Markets offers all traders the MT4/MT5 and cTrader trading platforms, while the Iress trading platform is restricted based on geographical location. MT4/MT5 and cTrader are available as desktop clients, a webtrader, and a mobile app. The out-of-the-box MT4/MT5 versions remain substandard, but FP Markets offers twelve plug-ins with its Trading Tools package, plus the Autochartist plug-in and Trading Central services to ensure traders gain a competitive edge.

FP Markets also maintains the MAM/PAMM module for retail account management.

Additionally, a built-in copy trading function is available across MT4/MT5 and cTrader, which all support algorithmic trading.

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

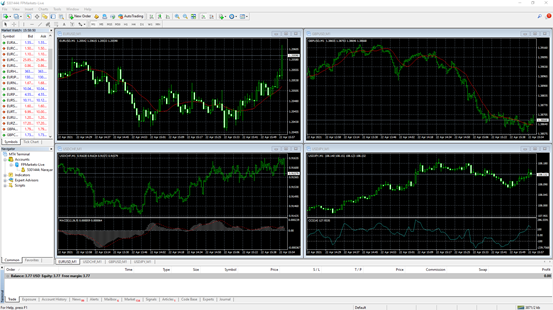

Here is a screenshot after launching the FP Markets MT4 trading platform following installation, without modifications.

The user interface is the same as when MT4 launched in 2005, featuring a dated design, but plug-ins exist to change it. Trading with MT4 is simple and does not require a lot of time for new traders to learn.

Below is the MT4 with a few customizations to the charts.

MT4 has several options for entering orders and fully supports automated trading via EAs. FP Markets does not offer APIs to allow third-party solutions to connect.

Mobile Trading Apps

FP Markets offers four mobile apps, including its proprietary option:

- The FP Markets Trading App - an acceptable introduction supporting basic functions

- MT4 - a well-established trading mobile app, including streaming news, mobile chat, and e-mail alerts

- MT5 - like MT4, but with improved technical analytics and advanced trading functions.

- cTrader - the most advanced out-of-the-box mobile trading app

How User-friendly Are the FP Markets Mobile Apps?

All four FP Markets mobile apps are user-friendly and ideal for monitoring portfolios on the go, managing existing positions, and copy trading. While mobile apps tend to be better for portfolio management than complex trade analysis, MT4, MT5, and cTrader offer advanced, technical, analytical suites. None support algorithmic trading, which is only available on the desktop versions of MT4 and MT5 but is included in the cTrader web-based platform.

What Charting Tools Exist on the FP Markets Mobile Apps?

While the FP Markets Trading App only supports rudimentary charting tools, MT4, MT5, and cTrader come with more advanced packages in their more powerful desktop versions. Despite the availability, the screen size and absence of multi-screen support make conducting complex analytics a challenge.

What Trading Tools Are Offered by FP Markets Mobile Apps?

Mobile apps cater primarily to portfolio management, real-time updates, and copy trading, and the apps available at FP Markets offer the necessary tools to perform these tasks. They include economic calendars, streaming news, and watch lists, but do not include the cutting-edge trading tools FP Markets offers for its desktop trading platforms.

FP Markets Mobile Apps Comparison

FP Markets Trading App | MT4 Mobile App | MT5 Mobile App | cTrader Mobile App | |

|---|---|---|---|---|

Android App | Yes | Yes | Yes | Yes |

iOS App | Yes | Yes | Yes | Yes |

Mobile alerts | Yes | Yes | Yes | Yes |

E-mail alerts | No | Yes | Yes | Yes |

Watchlist | Yes | Yes | Yes | Yes |

Copy Trading | No | Yes | Yes | Yes |

Chat Feature | No | Yes | Yes | Yes |

Multi-lingual | Yes | Yes | Yes | Yes |

Synchronization | Yes | Yes | Yes | Yes |

Technical Indicators | 30 | 30 | 30 | 50 |

Analytical Objects | 15 | 24 | 24 | 20+ |

Timeframes | Undisclosed | 9 | 9 | 56 |

FP Markets Unique Trading Features

In addition to the built-in MT4 copy trading functionality, FP Markets partnered with Myfxbook Autotrade, which is also available from within the MT4 trading platform. The most recent expansion includes a proprietary copy trading service - FP Markets Copy Trading. VPS hosting is available, but minimum requirements must be met to receive it free of charge.

On the downside, the Iress trading platform remains geographically restricted and subject to non-trading-related fees unless traders fulfill monthly trading volume requirements, which adds pressure to trade. Regrettably, the 10,000 equity CFDs are only available on Iress. Clients can access the trading tools from the back office of their trading account.Clients can access the trading tools from the back office of their trading account.

Research and Education

- Daily Research

- Daily Trading Recommendations

- Streaming News

- Quality Educational Content

- Live Webinars

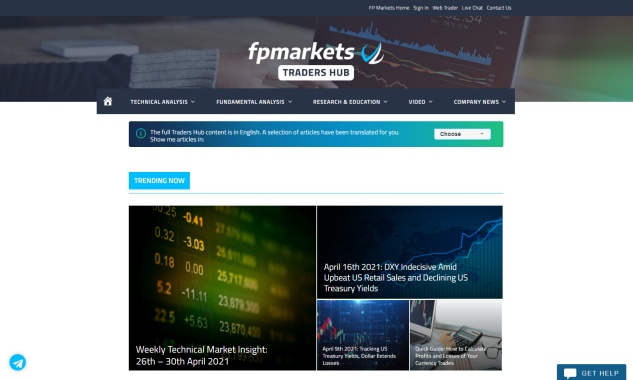

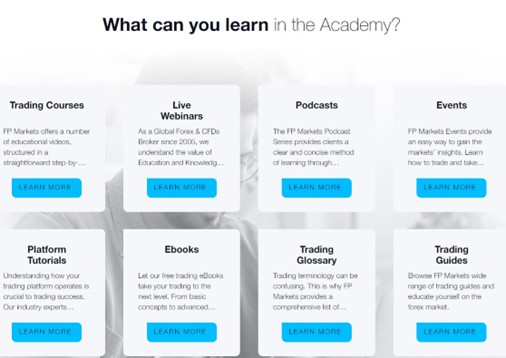

The FP Markets Traders Hub provides traders with valuable content. It offers daily research and trading ideas, presented in a quality format. A streaming news service is available as one of the twelve plug-ins for MT4, offering traders a valuable service embedded within the trading platform. New traders can benefit from educational resources, including webinars and videos. FP Markets also offers an Academy for traders, providing trading courses, live webinars, podcasts, trading guides, and more. Overall, the research & education at FP Markets are of high quality and add value to the core trading environment.

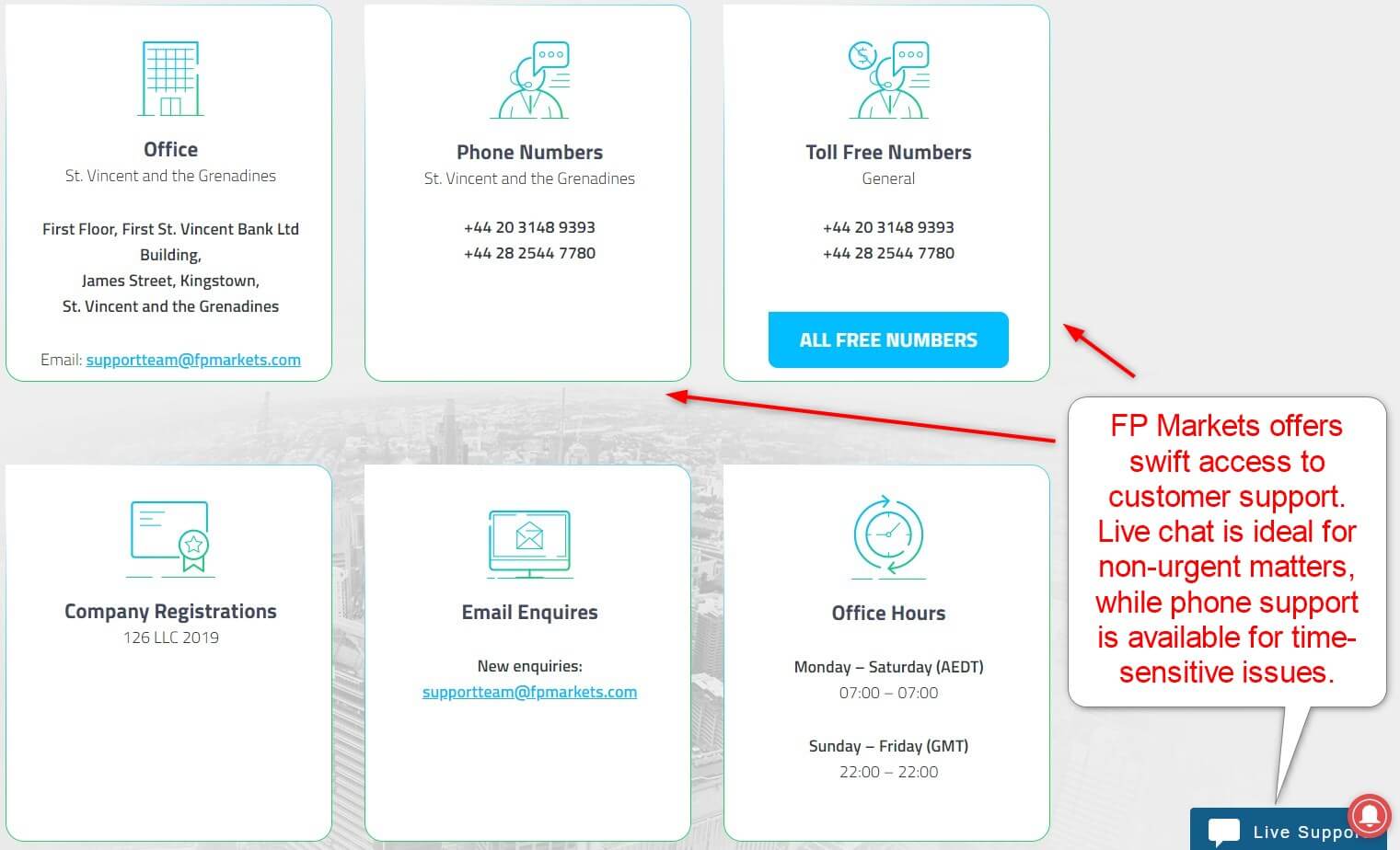

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |            |

- 24/7 customer support

- Multilingual support

- Live chat

- Phone support

- Call-back option

- Quality FAQ section

From a customer support perspective, FP Markets delivers across the board. Support is available in 34 languages, 24/7, and clients can reach out via e-mail, live chat, phone, or the call-back option. A quality FAQ section answers most questions, and a majority of traders will only require additional assistance during emergencies.

FP Markets Bonuses and Promotions

At the time of this review, FP Markets neither provides bonuses nor grants special promotions.

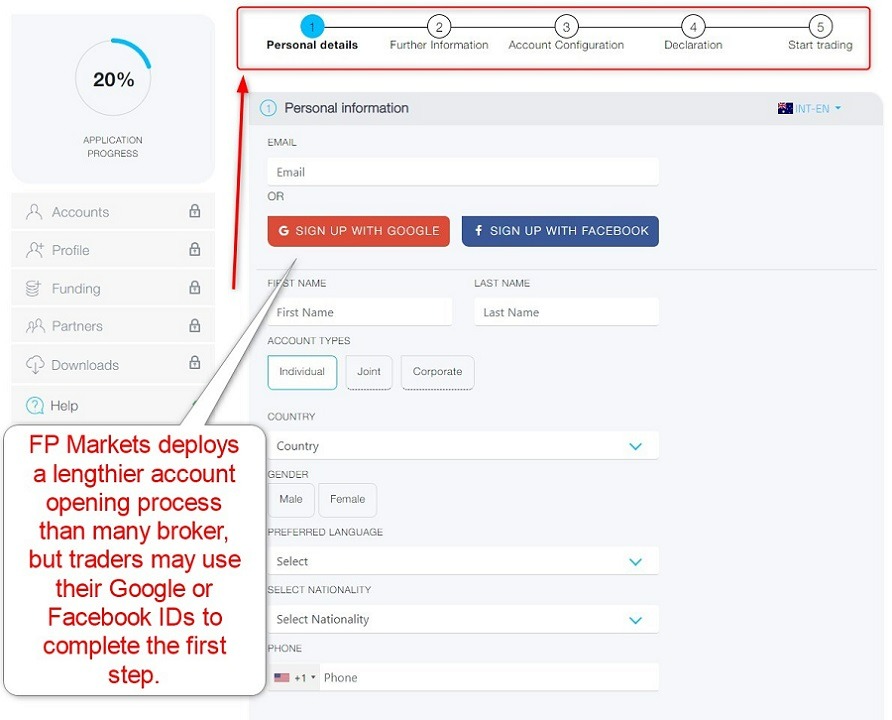

Opening an Account

- Online application process

- Medium amount of personal information

- Medium minimum deposit requirements:

- Swift verification procedure

- User-friendly back office

The online account opening process is straightforward, and traders can complete the first step via a Google or Facebook account. However, FP Markets collects more data than some other brokers.

Account holders gain access to a clean back office, from which they can manage all their trading accounts and financial transactions. Account verification is mandatory but quick, and most traders will be able to satisfy AML/KYC requirements by submitting a copy of their ID along with one proof of residency document.

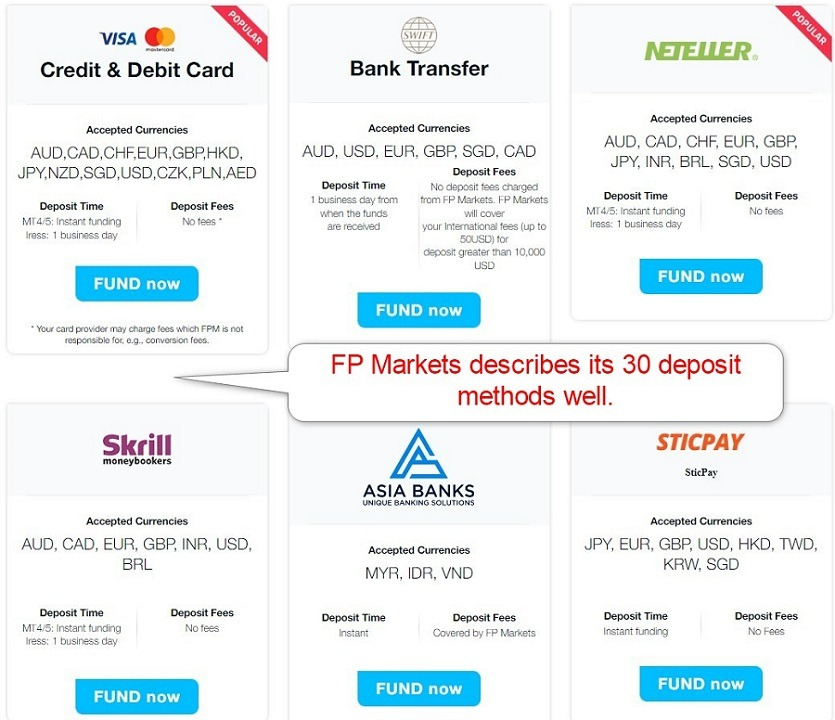

FP Markets Deposits and Withdrawals

The minimum deposit at FP Markets is $100, which is average for the industry.

FP Markets supports 30 funding methods. These include bank wires, credit/debit cards, online payment processors, and cryptocurrencies. Clients may access all available options from their back office, where FP Markets lists all payment processors transparently. The availability depends on the country of residence, and not all traders may have access to all payment processors.

The withdrawal process is fast and hassle-free, earning FP Markets a top rating in this category. The back office makes it easy to request a withdrawal, which only takes a few seconds. There are no internal withdrawal costs at FP Markets, but third-party charges may apply, depending on the selected method. Processing times also depend on the chosen method, and FP Markets notes one business day for internal processing times. In compliance with AML guidelines, the name on the trading account and payment processor must be identical.

Payment Methods

Withdrawal options |       |

|---|---|

Deposit options |       |

FP Markets User Experience

FP Markets has catered to international Forex traders for 15+ years. It has stood the test of time and adds an exceptional regulatory track record, which translates to an excellent FP Markets user experience

Bottom Line

After evaluating every aspect of the FP Markets offering, I came away genuinely impressed with what this broker has to offer- particularly for Forex and CFTD traders. The Raw account pricing is exceptionally attractive, the withdrawal options and processes are excellent, and the infrastructure is solid and dependable. FP Markets might not be the broker for you if you’re a long-term investor or a newcomer looking to buy stocks and forget about them. But, if you’re a trader who values execution, control, and competitive costs, FP Markets hits the sweet spot.

How We Make Money

DailyForex generates revenue by publishing promotional materials from paying brokers and service providers, which has no impact on the objectivity of our reviews. Our mission is to offer clear, accurate, and transparent evaluations of Forex and CFD brokers, using a rigorous, data-driven approach. Our partners may be placed highly within certain areas of the site, but our broker ratings are always based on objective analysis. Find out more here.

FAQs

Is FP Markets a market maker?

By default, all ASIC-regulated brokers are market makers, but FP Markets deploys a no dealing desk (NDD) execution model. It may act as a market maker if it chooses or needs to do so.

Is FP Markets an ECN broker?

FP Markets offers an ECN execution with its Raw Spread Account.

Is FP Markets a legit Forex broker?

FP Markets is compliant with two regulators and operates as an authorized entity out of one jurisdiction. Therefore, FP Markets is legit.

Is FP Markets a reliable Forex broker?

FP Markets is operational since 2005. It maintains an elevated level of transparency and has established itself as a reliable broker. It continues to earn the trust of clients for over fifteen years and counting.

What are the FP Markets' withdrawal options?

FP Markets maintains 21 withdrawal options, including bank wires, credit/debit cards, Neteller, Skrill, Fasapay, Paytrust88, Ngan Luong, and broker-to-broker transfers.

Is FP Markets good?

FP Markets offers traders a competitive commission-based cost structure, quality trading tools, deep liquidity, and fast order execution. Therefore, FP Markets ranks among the leading brokers industry wide.

Is FP Markets good for beginners?

Beginner traders have access to quality educational content, in-house research, services provided by Trading Central, copy trading, and retail account management. It makes FP Markets ideal for beginner traders.

Is FP Markets regulated?

FP Markets remains regulated by the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC).

What type of broker is FP Markets?

FP Markets deploys a hybrid market maker/ECN model with NDD order execution.

What is the highest leverage offered by FP Markets?

The highest FP Markets leverage is for Forex traders at 1:500 from its St. Vincent and the Grenadines subsidiary.

Is FP Markets free?

All brokers charge some kind of fee to their traders. FP Markets offers one commission-free trading account, but trading costs are higher there than in its commission-based alternative. Equity traders using IRESS will face monthly fees. Active traders get rebates, lowering subscription fees or eliminating them.

How long does FP Markets withdrawal take?

FP Markets processes most withdrawals within one business day. Some payment processors feature instant to near-instant processing, while bank wires and credit/debit cards can take two to ten business days.

What is the minimum deposit for FP Markets?

The FP Markets minimum deposit is $100.

What country is FP Markets from?

FP Markets has its headquarters in Australia.