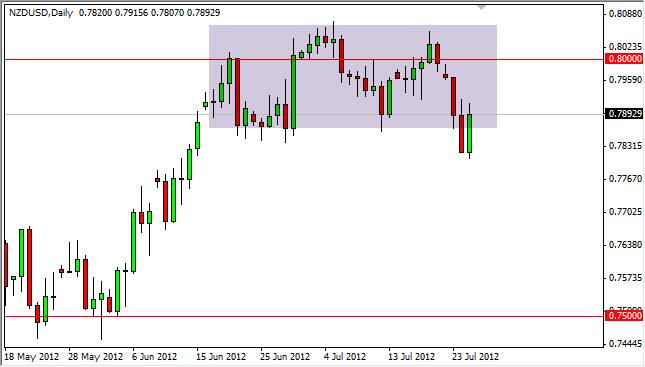

NZD/USD rose during the session during the Wednesday session as the "risk on" rally came back into the market. Looking back over the previous 40 hours, we have seen a breakdown out of consolidation by the Kiwi dollar, and now we have ran back of to retest that area. This is classic technical analysis, as it proves support then becomes resistance. I think this will be the case in this pair as well.

It should be noted that the Kiwi dollar sold off a bit after this massive spike late in the US session. This is normally when the "perma-bulls” step out to bid up the market. We talk about possible Federal Reserve monetary easing coming into play, one would think that the Kiwi dollar would've fared much better. This obviously shows that there isn't true conviction behind the simulative effect of this move by the central bank, or even that it will happen.

0.79

It should also be noted that the rally stopped right at the 0.79 level, and this suggests that the sellers stepped in late in the day. If not, at the very least we saw a lack of volume on the upside as he could not break through the substantial selling area. Either way, it suggests to me that we are going lower.

The rectangle that was broke down through on Tuesday suggested that we were going to fall another 200 pips or so. This has me aiming for the 0.7650 level, an area that had been resistance previously, so of course could be supportive at this point in time. It certainly would make sense and I feel fairly confident that we will see that level sooner or later.

Remember, the Kiwi dollar is very risky sensitive and there are plenty of potential negative headlines out there in order to move this pair. It's been fairly resilient over the last couple weeks in the face of pretty dire economic announcements. This is probably because of the late summer volume, and I believe that once the traders come back in a few weeks, we should see the truth behind this currency pair going forward. In the meantime, I feel that the path of least resistance is down.