Altcoin season is once again in focus, with capital rotating from Bitcoin into smaller, more volatile assets. This shift can bring strong price moves across sectors such as DeFi, Layer 2 protocols, AI, and meme tokens, opening new opportunities for traders.

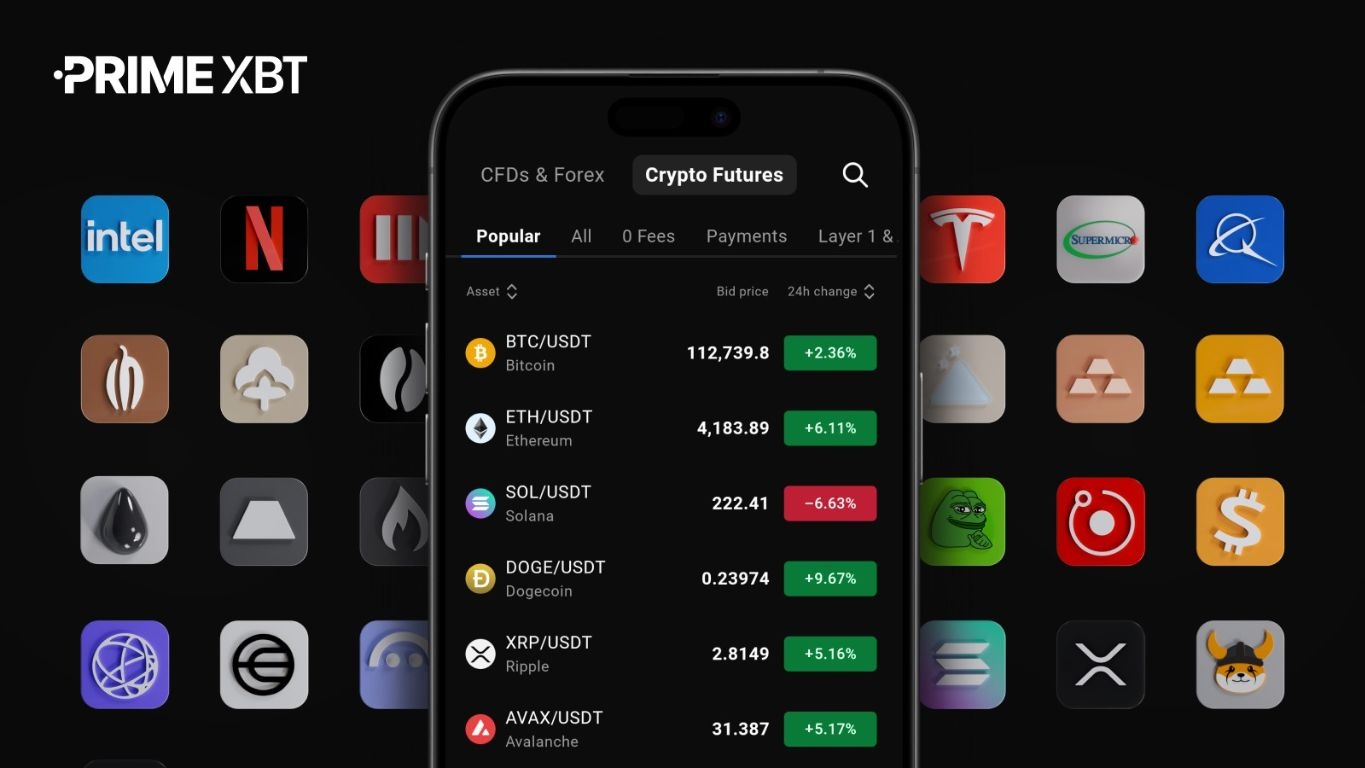

As part of this market shift, PrimeXBT, a regulated crypto and CFD broker, has expanded its Crypto Futures lineup with 101 new listings, including popular names like Arbitrum (ARB), Optimism (OP), and Sui (SUI), as well as trending meme tokens and AI projects. With this broader market access, traders gain more flexibility to engage with emerging trends and diversify exposure as the cycle unfolds.

Turning volatility into opportunity

In this environment, volatility is both an opportunity and a challenge. The same price swings that can double a portfolio can also trigger liquidations if risk is not properly managed. For leveraged traders, even small moves against a position can have outsized consequences, making risk controls essential. That’s why more traders are seeking platforms that combine wide market access with robust risk management tools, enabling them to capture opportunity while staying in control.

Leverage and margin controls

A sound approach to risk management starts with position sizing and understanding leverage mechanics. On PrimeXBT’s Crypto Futures platform traders can access up to 1:500 leverage on BTC, 1:400 on ETH, and 1:100 - 1:150 on altcoins – levels designed to scale strategies efficiently.

This access is balanced by a tiered margin system that automatically adjusts collateral requirements as position size grows, giving smaller trades more flexibility while tightening risk parameters for larger exposures.

For those trading in cross margin mode, PrimeXBT now offers adjustable leverage caps, a feature that lets traders set their own maximum leverage per instrument. The system will always apply the lower of the trader’s chosen cap or the band allowance, helping to keep exposure in line with personal risk preferences. This update gives conservative traders the ability to set lower fixed caps while still benefiting from the efficiency of cross margin, and gives active traders more transparency into their true effective leverage before they commit to a position.

Integrated risk management features

Risk management is most effective when it’s built into the workflow. PrimeXBT integrates these tools directly into its Crypto Futures platform, helping traders plan ahead. Real-time margin tracking and on-chart liquidation levels make risk visible at all times, while bracket orders allow stop-loss and take-profit targets to be set when a position is opened. The “Cross-Isolated” margin mode switch displays liquidation price, free margin, and isolated balance before confirming changes, helping traders make fully informed decisions.

Trading costs as risk factor

Risk doesn’t only come from price movement; it also comes from trading costs. High spreads and commissions can eat into profitability, leaving less margin for error. PrimeXBT addresses this by offering some of the most competitive pricing in the industry. On its Crypto Futures platform, maker fees are 0.01% and taker fees start from 0.045%, making execution costs among the lowest in the industry. A selection of tokens is offered with zero commissions, further reducing friction for high-volume trading strategies. For those trading at scale, the VIP Tiers Program provides additional structural savings, offering discounts of up to nearly 70% on trading fees as monthly volume grows. These measures turn cost efficiency into a performance edge and make trading more sustainable over the long term.

Diversification and multi-asset access

Another pillar of risk management is diversification. While altcoin season may dominate headlines, correlations between asset classes can shift quickly. Being able to hedge or diversify into forex, commodities, indices, stocks and crypto CFDs from the same platform can be a powerful way to balance exposure and smooth portfolio performance.

PrimeXBT integrates three platforms – PXTrader, MT5, and Crypto Futures – along with a built-in crypto-to-crypto and crypto-to-fiat exchange, creating a unified environment for managing positions across asset classes. Traders can fund accounts with fiat or crypto, use digital assets as collateral, and seamlessly move between markets.

For professional grade conditions, the MT5 Pro account offers some of the tightest spreads available (around $20 on BTC/USD) and a 0% stop-out level for maximum efficiency. PXTrader and MT5 Standard accounts provide competitive spreads, with up to 50% spread discounts available through the VIP Tiers Program. Meanwhile, the Rewards Center adds extra value with cashback and bonuses of up to 20%.

This unified approach allows traders to build resilient portfolios, balance risk, and manage capital without leaving the ecosystem.

From speculation to strategy

Altcoin season rewards preparation and discipline. By combining thoughtful position sizing, robust leverage controls, cost-efficient conditions, and multi-market access, PrimeXBT helps traders turn volatility into opportunity. With its focus on empowering traders through choice, transparency, and risk-first features, PrimeXBT provides a framework for smarter strategies, helping traders maintain their edge, capture emerging trends, and grow with confidence over the long term.

Start trading crypto with PrimeXBT

Disclaimer: The content provided here is for informational purposes only and is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results. The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money. The Company does not accept clients from the Restricted Jurisdictions as indicated on its website / T&Cs. Some products and services, including MT5, may not be available in your jurisdiction. The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.