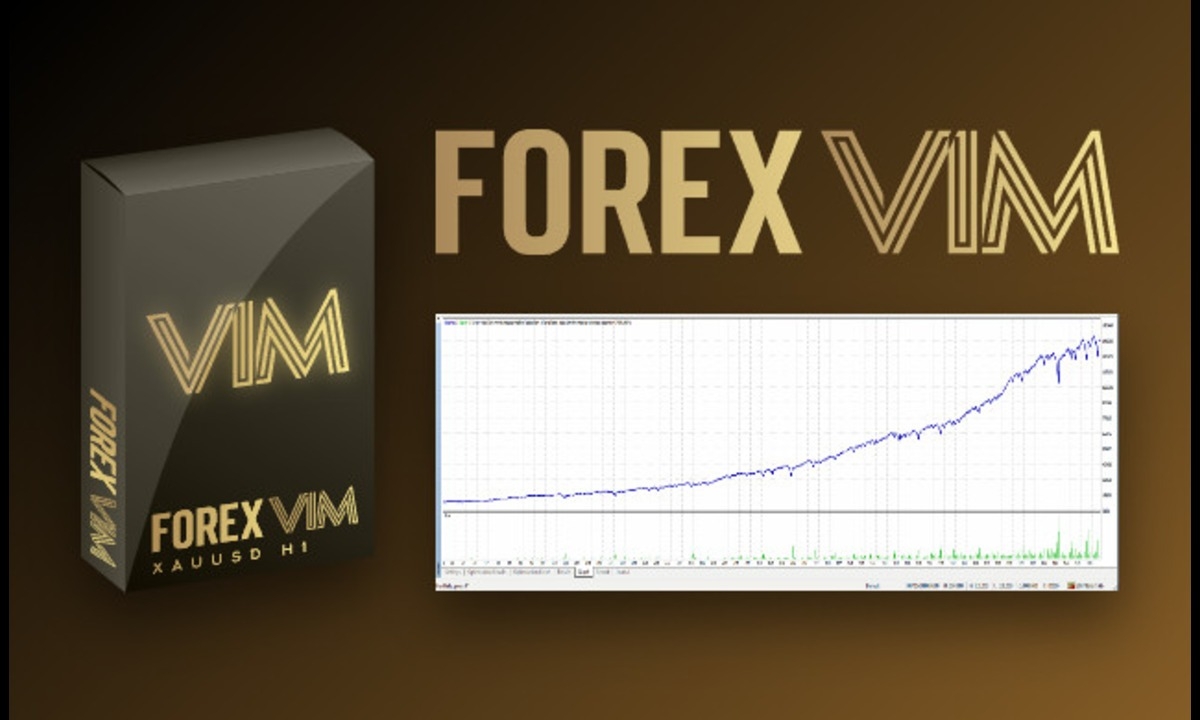

Pattern detection and data analysis for XAU/USD, turning recurring price structures into a disciplined execution flow.

Limassol, Cyprus - August 2025 - ForexVIM introduces an AI-powered approach to reading gold’s price action. The system scans for recurring formations and market structures, then routes decisions through a clear ruleset so timing and follow-through remain consistent when conditions change.

Market Challenge

Gold’s moves reflect a mix of central bank signals, global risk sentiment, and rapid swings in liquidity. Manual candlestick work is slow and subjective, while standard indicators often lag during fast sessions. Traders benefit from signals that surface early, are filtered for quality, and tie entries and exits to current structure, not stale readings.

Pattern Engine

ForexVIM automates candlestick recognition and augments it with broader context. It processes historical and real-time data to detect patterns such as doji and other reversal/continuation cues, tracks momentum shifts, and observes reactions at support and resistance. The goal is to highlight high-probability setups as they form, not after the move is spent.

Built for XAU/USD

The focus is gold (XAU/USD), an asset where volatility creates opportunity and risk in equal measure. By aligning detection with gold’s typical rhythm, bursts around macro headlines and steadier stretches between events, the system aims to keep trade plans grounded in what the market is actually doing.

From Detection to Execution

Signals are converted into practical steps: when context confirms, the strategy defines entry timing, exit logic, and management rules so actions can be tested and repeated. Filtering reduces low-probability ideas, encouraging a measured pace over reaction to short-term spikes.

Defined Boundaries

Boundaries are specified in advance and enforced consistently: per-trade stops, per-trade targets, and risk allocation that does not change mid-trade. The framework favours pre-commitment over ad-hoc adjustments, so actions remain consistent when price speeds up. Detailed logs support review of what fired, why it fired, and how settings affected outcomes.

Practical Outcome

Outcomes are more predictable: filtered setups, disciplined entries, and exits tied to pre-set rules. Decisions reflect the market’s present state, not a delayed read.

Ease of Use & Support

ForexVIM is designed to be approachable from day one. Setup is straightforward, operation is clear, and responsive support is available, helping teams put the process to work without added complexity.

About ForexVIM

ForexVIM delivers precision-driven trading solutions, combining expert market insights with high-quality tick data optimization for reliable performance. Built by experienced traders and developers, it ensures accuracy, consistency, and innovation in forex trading strategies.