The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

The US dollar has shot straight up in the air against the Mexican peso.

The Swiss franc against the Japanese yen is a very interesting pair. It is a measure of extreme weakness with both currencies.

he British pound has fallen rather significantly to kick off the trading session on Tuesday but has turned around to show signs of life.

Top Forex Brokers

The DAX had initially fallen during the trading session on Tuesday, but it does look like the 50-day EMA is trying to hold things together.

The euro has fallen rather significantly during the trading session on Tuesday, breaking down drastically against the Japanese yen.

The Parisian CAC fell significantly during the trading session on Tuesday, but he continues to see support in the same general vicinity, namely the €7900 level.

Resistance level at $0.6665 looks likely to be pivotal.

Silver fell rather hard during the trading session here on Tuesday, as we continue to see a lot of noise.

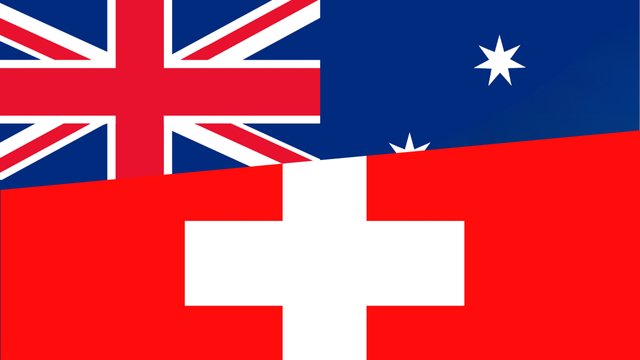

The Australian dollar has fallen rather significantly during the course of the trading session on Tuesday against the Swiss franc.

Bonuses & Promotions

The GBP/USD exchange rate rally stalled in the overnight session.

The EUR/USD pair was little changed on Wednesday morning.

Bitcoin price has held relatively steady this week as traders waited for the next catalyst and as the US dollar retreated.

The Japanese yen rose to around 155.80 yen against the US dollar, hovering near its strongest level in two weeks as the US dollar weakened on the back of weak US manufacturing data that supported expectations of rate cuts by the Federal Reserve.

GBP/USD has been gaining ground against the US dollar since the start of trading this week, with markets cautiously awaiting US jobs data at the end of the week.

What is the euro against the dollar exchange rate forecast for this week? We expect a test of 1.09 and a potential breakout from the May range, but US Labor market numbers must come in weak.