The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

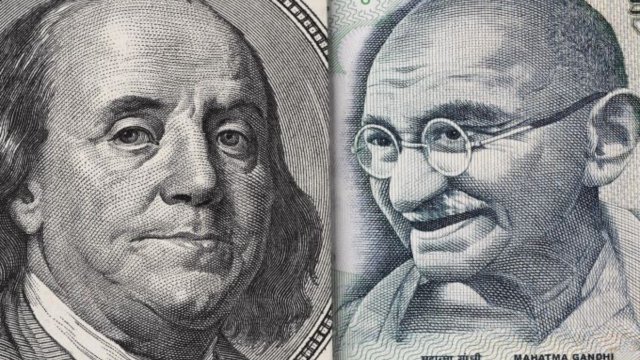

I noticed that we continue to hang around the 84 Rupee level.

In my daily analysis of the DAX, the first thing I bring to the forefront and your attention will be the fact that we are remaining somewhat sideways after an initial bump to break above the 200 day EMA.

In my daily analysis of the Euro against the Swiss Franc, it's obvious that we have seen a lot of noisy behavior and upward pressure as we are trying to break above the 0.95 level.

Top Forex Brokers

In my daily analysis of the British pound against the Canadian dollar, the first thing I see is that we have broken above the 50-day EMA.

The US dollar has rallied quite nicely against the Swiss franc.

In my daily analysis of the US dollar against the Canadian dollar, it's obvious that we have seen a certain amount of stability over the last couple of trading sessions and this makes a certain amount of sense considering we are hanging around the 50 day EMA.

The Swiss franc has shown itself to be very noisy over the last couple of days against the Japanese yen and I find that very interesting considering that the market is likely to continue seeing a lot of noise.

The GBP/USD exchange rate was in a tight range on Tuesday morning ahead of a series of important economic data from the UK and the US.

The euro wavered against the US dollar as traders focused on the upcoming US and European economic numbers.

Bonuses & Promotions

Bitcoin retreated slightly as traders waited for important economic numbers from the United States.

Last week’s strongly bullish move has continued to push the price higher, helped by improved risk sentiment and a stronger Aussie, but the move may now have run out of steam as it transitions into a bullish consolidation.

USD/TRY Forecast: Bullish at 33.50, target 33.75; Bearish at 33.75, target 33.50. Lira mixed as Turkish central bank intervenes amid financial volatility.

As of this writing, the GBP/USD currency pair was trading at $1.2756. Last Friday, it attempted to rebound upwards, but its gains did not exceed the resistance level of 1.2773.

The USD/JPY currency pair has stabilized modestly in recent days as some traders continued to buy the dip.

The EUR/USD pair failed to sustain its gains at the beginning of the week, reaching the resistance level of 1.1008, the highest for the pair since the beginning of 2024.