The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

The first thing I noticed is that the market is running into trouble above the 50 Day EMA.

The gold market has gone back and forth. They're in the trading session on Monday, as we continue to look a bit lost.

The US dollar against the Philippine peso has intention.

Top Forex Brokers

The GBP/USD exchange rate retreated for the second consecutive day as the US dollar index (DXY) rebounded.

Bitcoin price rose for the third consecutive day as risk assets rebounded.

The AUD/USD pair retreated below the 50-day moving average as the US dollar index (DXY) made a strong comeback ahead of the US inflation data.

A minor recovery in the US Dollar yesterday pushed the price lower, potentially knocking out many long-term trend traders on the bullish side, but the price seems to be finding support.

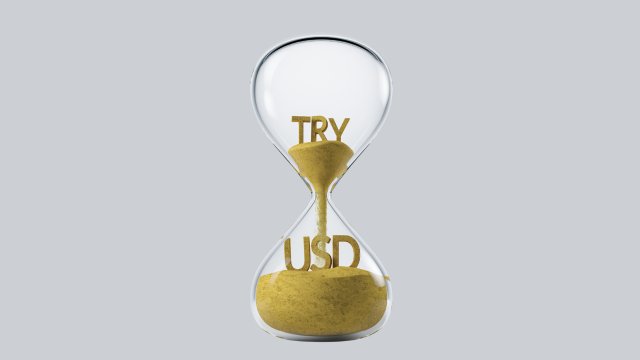

The Turkish currency maintained its range-bound variance against the US dollar at the beginning of this week’s trading, as the pair continued to fluctuate in a limited range for about two weeks.

During last Friday’s trading session, the US dollar fell and then recovered after the release of the weaker-than-expected US Labor market report.

Bonuses & Promotions

Expectations of further tightening of the Bank of Japan's monetary policy continue to support the strength of the Japanese yen against other major currencies, especially against the US dollar.

Prior to the close of last week's trading, the EUR/USD pair declined following a speech by John C. Williams, President of the Federal Reserve Bank of New York.

The gold price has maintained its position above $2500 per ounce, supported by the latest US jobs reading ahead of more data scheduled to be released later on Friday, which may prove crucial in determining the size of the US interest rate cut by the Federal Reserve this month.

Traders who believe the USD/MXN exchange rate is in overbought territory cannot be faulted.

The USD/ZAR currency pair is trading near the 17.92900 level as of this writing which is approaching values seen last Wednesday.

A recovery in the US Dollar seems to be underway today and this is pushing the price down, with the price looking likely to test recent lows later.