The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

The US dollar has fallen on Thursday against the Mexican peso, just as we had seen negative pressure during the trading session on Wednesday.

The GBP/JPY pair stabilizes around the ¥185 level, showing signs of strength. Risk appetite will be key in determining if the pound can continue its upward move.

During my daily analysis of currency markets, the New Zealand dollar has caught my attention during the trading session, as we have bounced from the 50-Day EMA, an indicator that a lot of people will be paying close attention to.

Top Forex Brokers

During my daily analysis of the GBP/USD pair, I see that we are bouncing a bit, and it does look like we are ready to go going higher

The Turkish lira appreciated against the US dollar during today's trading, while the pair stabilized within the same limited range around 34 lira per dollar.

The USD/JPY exchange rate continued its downtrend ahead of upcoming interest rate decisions from the Bank of Japan and the US Federal Reserve.

The GBP/USD exchange rate recorded an increase in mid-week trading, with some analysts attributing the weakness of the US dollar to the strong performance of US presidential candidate Kamala Harris.

During yesterday's trading session. The US dollar rose after inflation in the United States exceeded expectations in August, as the important core inflation reading of the consumer price index reached 0.3% on a monthly basis, exceeding the consensus expectations of 0.2%.

Since the beginning of this week, the gold price has been on an upward rebound, with gains reaching the resistance level of $2,528 per ounce, starting from the support level of $2,485 per ounce in the same week.

Bonuses & Promotions

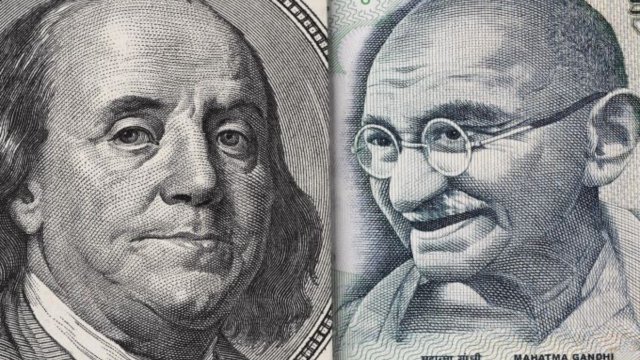

The notion that the USD/INR exchange rate is overbought and that it will soon start to create downwards momentum is likely wrong.

The New Zealand dollar initially pulled back against the Swiss franc in the early hours on Wednesday, as we saw more of a risk off type of move.

Forex trading is rarely a one way street. Shifts in momentum can strike quickly and hurt day traders without any warning.

The New Zealand dollar fell initially during the trading session on Wednesday only to turn around and show signs of life.

The EUR/JPY pair is one I am watching very closely.

The USD/INR pair is still a very bullish market.