The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

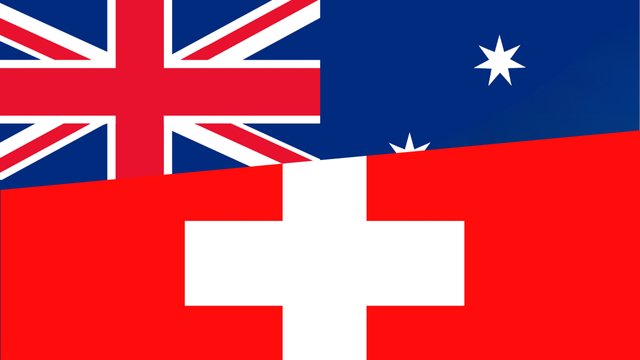

The British pound pulled back initially against the Swiss franc during the trading session on Wednesday, to reach toward the 1.13 level and the 200-day EMA, only to turn around and show signs of life again.

The AUD/CHF pair has seen a lot of noisy behavior, as we had reached the 200 Day EMA.

I notice that we have added a lot of strength show up in the favor the US dollar, as we have bounce from a crucial level in the form of the 0.84 level.

Top Forex Brokers

The West Texas Intermediate Crude Oil market fell a bit during the trading session on Wednesday, as it stands out amongst a significant sell off when it comes to the overall commodity markets.

The GBP/USD pair is likely to continue to see a lot of noisy behavior.

In my daily analysis of the global indices around the world that I follow, the DAX stands head and shoulders above a lot of other ones because we are threatening a major breakout.

The first thing I see is that the British pound is doing everything it can to break out against the Japanese yen.

The GBP/USD exchange rate rose to its highest level in years and then retreated amid heightened geopolitical issues.

As I review the gold market for the trading session, it's been quite volatile. Given the recent significant rally, it makes sense to see some pullback.

Bonuses & Promotions

Bitcoin remained in a tight range during the overnight session as risky assets pulled back.

The Australian dollar pulled back sharply after the monthly inflation indicator retreated to its lowest point in three years.

The Euro rose strongly against the Dollar yesterday to reach a new 1-year high price above $1.1200 but fell back firmly later in the day into more familiar territory. The price may make another attempt at the high later today.

The Pound Sterling has maintained its highest levels in several months against both the Euro and the US Dollar in the middle of this week's trading, aided in part by new comments from Bank of England Governor, Andrew Bailey.

The Japanese yen fell below 144.65 yen against the US dollar, heading towards a three-week low after Bank of Japan Governor Kazuo Ueda said the bank has time to assess market and economic developments before adjusting monetary policy, suggesting the Japanese central bank is in no rush to raise interest rates further.

Gold futures hit another record high as the precious metal continues its sharp and record-breaking gains, fueled by the Federal Reserve's interest rate cut.