The NASDAQ 100 broke down a bit during the trading session on Friday, reaching down towards the 200 day EMA before bouncing slightly.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

The British pound has rallied a bit during the trading session on Friday, as we have broken above the 50 day EMA.

The West Texas Intermediate Crude Oil market continues to fall apart, as the Russians now have suggested that they are not going to cut output.

Top Forex Brokers

With the OPEC+ deal collapse adding to global economic issues on top of Covid-19, trade negotiations between the EU and the UK have taken a secondary role.

The silver market broke down during most of the trading session on Friday, as markets received the jobs numbers out of the United States.

Volatility in the NZD/CAD spiked after OPEC+ determined to end their agreement to limit supply and stabilize prices.

Gold markets went back and forth during the trading session on Friday, showing signs of noise and confusion.

Bitcoin markets have done very little during the trading session on Friday after rallying on Thursday.

Friday’s OPEC+ deal collapse sent oil prices tumbling, creating more massive concerns for financial markets than Covid-19 related economic disruptions.

Bonuses & Promotions

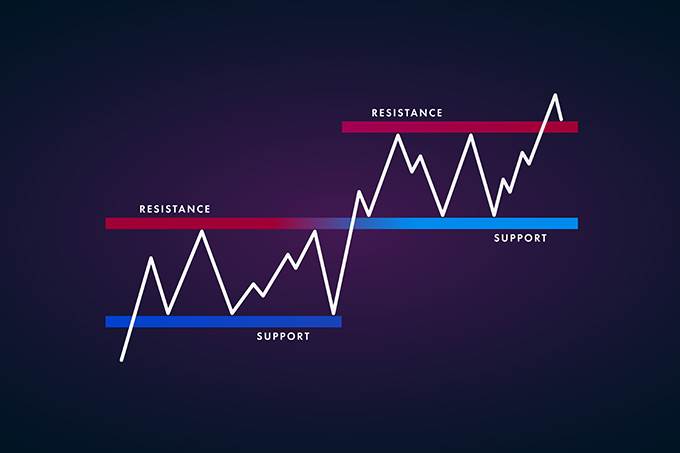

Get our trading strategies with our monthly & weekly forecasts of currency pairs worth watching using support & resistance for Tuesday, March 8, 2020 here.

Get the Forex Forecast using fundamentals, sentiment, and technical positions analyses for major pairs for the week of March 8, 2020 here.

Get the weekly Forex forecast for major currency pairs for the week of March 9, 2020 here.

After the US Federal Reserve implemented a panic interest rate cut of 50 basis points, the first monetary adjustment

Following a new 2020 high in the USD/ZAR, the 50 basis point interest rate cut by the US Federal Reserve ended the advance.

The US dollar broke down significantly heading into the jobs number as the Japanese yen safety currency came into play.