The FTSE 100 initially tried to rally somewhat significantly in the futures market on Wednesday but gave back most of the gains to form a bit of a shooting star.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

The British pound has pulled back a bit from the highs over the last couple of days, and of course Wednesday was not any different.

The S&P 500 has tried to rally during the trading session on Wednesday but has turned back around to show signs of exhaustion near the same gap that it had on Tuesday.

Top Forex Brokers

The NASDAQ 100 took off to the upside during the trading session on Wednesday but gave back the gains to form a shooting star.

The silver markets initially tried to rally during the trading session on Wednesday but gave back the gains in order to form a bit of a shooting star.

Bitcoin will undergo its third halving event next week, eagerly anticipated by investors and traders alike.

GBP/USD: Pivotal point at 1.2396

EUR/USD: Support at 1.0814 has broken down

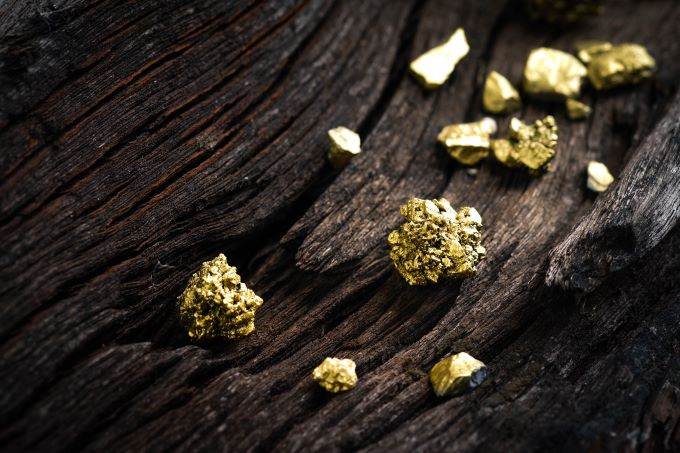

Gold markets fell during the trading session on Wednesday, reaching down towards the trendline that has been intact for several weeks.

Bonuses & Promotions

The West Texas Intermediate crude Oil market pulled back just a bit during the trading session on Wednesday as we approached the 50 day EMA.

Yesterday’s US ADP report showed the most massive job losses in its history, with over 20.2 million lost private-sector jobs.

New Zealand’s economy is intertwined with the one of Australia, and both are heavily dependent on China.

Australia reported an unexpected 15% surge in March exports, but the Australian Dollar was unable to benefit from it.

Risk aversion still supports stronger yen gains against most other major currencies.

Fear of weak demand for the yellow metal in the event of a worsening trade dispute between the United States and China stopped gold gains.