Pressure on the South African government is rising to end the nationwide lockdown. Business groups ignore health risks and urge resumption of activities,

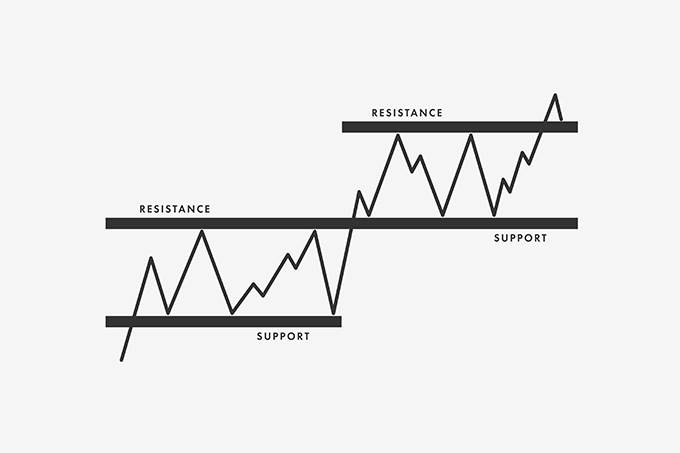

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

Mervyn King, the Bank of England Governor during the 2008 financial crisis, warns that overconfidence in a V-shaped recovery is not warranted.

Singapore notes that the gradual reopening if its economy will be impacted by virus case numbers, testing and contact tracing, and the global condition regarding the Covid-19

Top Forex Brokers

Get our trading strategies with our monthly & weekly forecasts of currency pairs worth watching using support & resistance for the week of May 10, 2020.

Get the Forex Forecast using fundamentals, sentiment, and technical positions analyses for major pairs for the week of 10 may, 2020 here.

Get the weekly Forex forecast for major currency pairs for the week of May 11, 2020 here.

Retail traders have pushed equity markets off of the March low, but trading volume remains thin, implying institutional capital is in a holding pattern on the sideline.

Switzerland reported an increase in its unemployment rate to 3.3% for April, which rose to 3.4% at the beginning of May.

Oil prices rebounded significantly from record lows, adding a minor catalyst to the Canadian Dollar, which is dependent on the energy sector.

Bonuses & Promotions

Australia and New Zealand are partially easing their lockdown measures, with new Covid-19 infection rates well-below their counterparts in the developed world.

The British pound has been all over the place during the Thursday session, as the Bank of England chose not to do anything during this announcement cycle.

The Euro pulled back a bit during the trading session on Thursday, reaching towards the 1.0750 level.

The Australian dollar has rallied rather significantly during the trading session on Thursday after initially dropping down towards the 50 day EMA.

The US dollar has initially rally during the trading session on Thursday before pulling back from the highs after the Fed Fund Rate Futures for December 2020 went negative.

The S&P 500 has tried to rally during the trading session on Thursday but failed again at the exact same spot it has over the last couple of days.