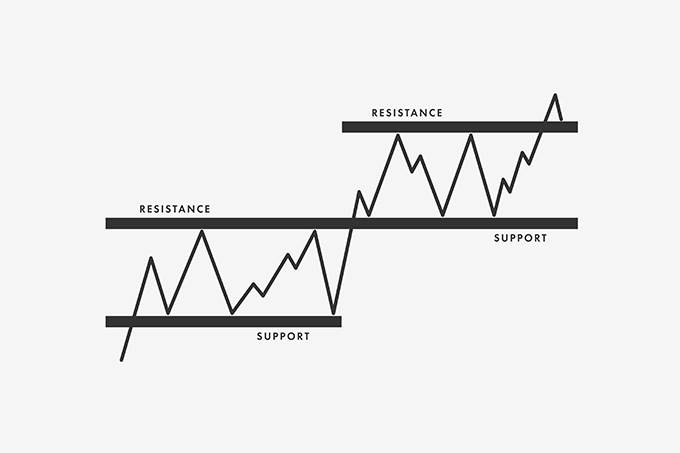

Get our trading strategies with our monthly & weekly forecasts of currency pairs worth watching using support & resistance for the week of May 31, 2020.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

Get the Forex Forecast using fundamentals, sentiment, and technical positions analyses for major pairs for the week of 31 may, 2020 here.

The DAX Index has come off short term highs made early last week but is still enjoying the fruits of a solid trend upwards since hitting lows near 8,500.000 mid-March.

Top Forex Brokers

Get the weekly Forex forecast for major currency pairs for the week of May 31, 2020 here.

Canadian companies are creating new jobs to comply with government-mandated Covid-19 protocols to allow a gradual resumption of economic activity.

An external member of the Bank of England’s Monetary Policy Committee, Michael Saunders, who voted for an unsuccessful expansion of the bond-buying program.

The Euro broke higher during the trading session on Thursday as we continue to see the Euro gain from the idea of Germany backstopping the entire Union.

Bonuses & Promotions

The British pound rallied initially during the trading session on Thursday reaching towards the 50 day EMA before pulling back again.

The Australian dollar went back and forth during the trading session, in what has been very choppy trading.

The US dollar initially tried to rally during the day on Thursday but found resistance in the same area that it has more than once, as the ¥108 level continues to be very resilient.

The S&P 500 has gone back and forth during the trading session on Thursday, showing signs of exhaustion.

Donald Trump is signing an executive order looking into policing the social media companies in the United States, and while it may or may not actually produce anything of purpose, the reality is that it did shake the NASDAQ 100 a bit.

Gold markets rallied significantly during the trading session on Thursday to reach towards the $1728 level, and close near that level again.