While Brazil does not experience the second wave of Covid-19 infections, the largest economy in Latin America has little time to prepare.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

Mexico surpassed 900,000 Covid-19 infections, and Mexican President López Obrador calls for more interest rate cuts by the Banco de México to assist the gradual economic recovery.

The Euro initially tried to rally a bit during the trading session on Thursday, but then broke down as the 50 day EMA offered a bit of resistance.

Top Forex Brokers

The NASDAQ 100 has rallied a bit during the trading session on Thursday, reaching towards the 50 day EMA.

The British pound initially tried to recover the losses from the previous session on Thursday, but then found the area above the 1.30 level to be far too expensive to hang onto.

The S&P 500 has gone back and forth during the trading session on Thursday, stabilizing a bit after the extreme negativity during the Wednesday session.

The West Texas Intermediate Crude Oil market has shown itself to be a bit threatened during the trading session on Thursday as we have broken below the $36.25 level during the day.

The Australian dollar has gone back and forth during the trading session on Thursday, as we dropped down towards the 0.70 level.

The bitcoin market initially fell during the trading session on Thursday, reaching down towards the $13,000 level before recovering.

Bonuses & Promotions

Silver markets have broken down a bit during the trading session on Thursday, slicing through the $23 level only to find buyers again.

The US dollar has initially fallen during the trading session on Thursday, to reach down towards the crucial ¥105 level.

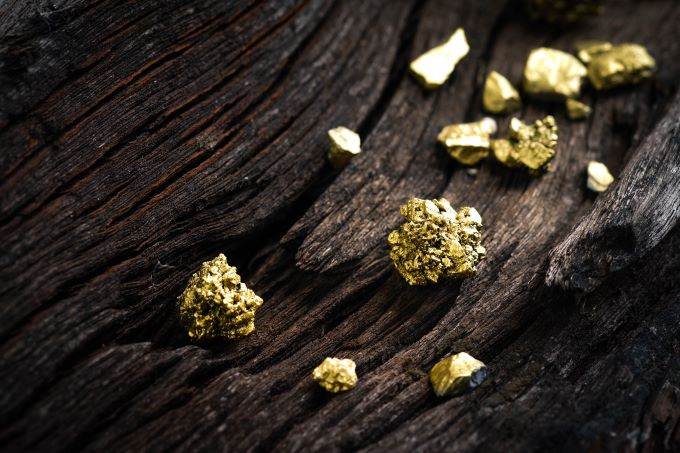

Gold markets have gone back and forth during the trading session on Thursday, with a slightly negative twist.

Investors demand to buy the USD as a safe haven, amid a violent second Coronavirus wave.

Today is an important day strongly influencing the global financial markets in general, and the forex currency market in particular.

The recent state of optimism for the possibility of reaching an agreement between the European Union and Britain on the future of their relations