Mexico continues to struggle with the COVID-19 pandemic, where a lack of testing shows Latin America’s second-largest economy sliding down the ranks of most-infected countries.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

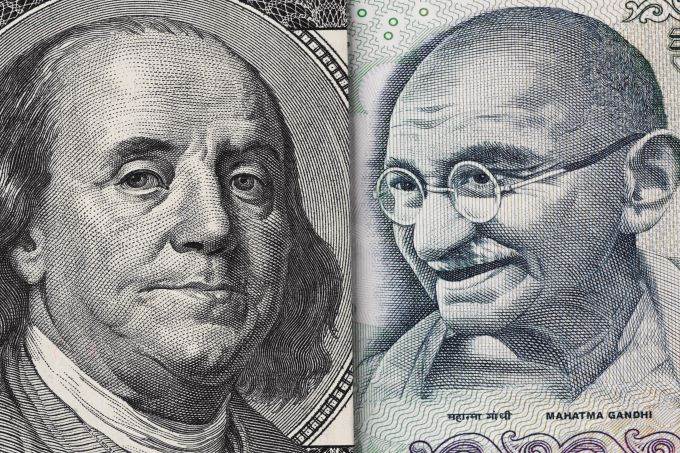

Bearish sentiment appears to be the majority feeling within the USD/INR, but as speculators know, ‘feelings’ do not guarantee profits when placing positions.

The West Texas Intermediate Crude Oil market rallied significantly during the trading session on Monday, as Pfizer announced a coronavirus vaccine with over 90% efficacy.

Top Forex Brokers

The US dollar exploded to the upside during the trading session on Monday, reaching above the ¥105 level, as it was announced that Pfizer is close to releasing a coronavirus vaccine with over 90% efficacy.

The Australian dollar initially tried to rally during the trading session on Monday, but gave back a substantial amount of the gains to show signs of hesitation in this area.

The S&P 500 E-mini contract initially gapped higher to kick off the trading session on Monday, and then went into hyperdrive after Pfizer announced its coronavirus vaccine with over 90% efficacy.

The NASDAQ 100 initially spiked during the trading session on Monday, but after Pfizer announced that they had a coronavirus vaccine with over 90% efficacy, traders began dumping some of the biggest “work from home” stocks.

Gold markets were crushed during the trading session on Monday following the news that Pfizer is close to having a coronavirus vaccine with over 90% efficacy.

Silver markets were hammered by Pfizer during the trading session on Monday, breaking through the 50-day EMA from far above.

Bonuses & Promotions

Bitcoin has been all over the place during the trading session on Monday, as the markets try to come to terms with various issues at once.

The British pound continues to fluctuate overall, and the 1.32 level continues to cause major issues.

The euro initially tried to rally during the trading session on Monday only to turn around and break down again.

Risk-on sentiment continues to recover

Throughout last week's trading, the EUR/USD was in a positive upward correction range amid investor optimism that Joe Biden would beat Trump in the US presidential elections.

The GBP/USD currency pair rose to the 1.3177 resistance during last week’s trading, its highest in two months before closing the week’s trading around 1.3147.