For three trading sessions in a row, the price of gold is moving in an upward correction range and pushed towards the resistance level at $1838 an ounce before settling around $1833.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

News surrounding coronavirus vaccines and President Trump's transition initiation caused losses to the safe haven USD.

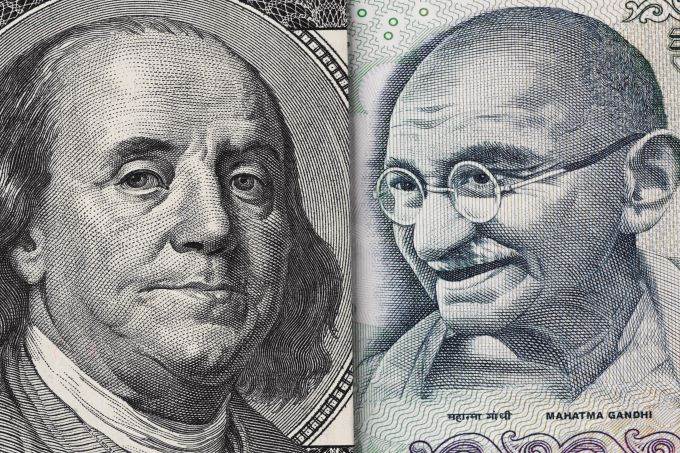

The USD/INR has seen another rather vicious move upwards early this morning as reversals come fast and hard.

Top Forex Brokers

The pair is currently trading at its highest levels in three months and at strong resistance levels.

The upside potential remains reduced to its 61.8 Fibonacci Retracement Fan Resistance Level, providing Forex traders with a secondary selling opportunity.

With deteriorating conditions for the US economy and the US dollar, Forex traders should sell any rallies from current levels.

Bitcoin pulled back a bit during the trading session on Wednesday, only to find buyers yet again.

The US dollar rallied significantly during the trading session against the Japanese yen on Wednesday, but continues to find resistance near the 50-day EMA.

Now that we have closed as high as we have, it is going to be very difficult to start shorting anytime soon.

Bonuses & Promotions

The NASDAQ 100 will continue to lead stock markets higher based upon liquidity and simple momentum.

We will likely explode to the upside due to the “Santa Claus rally” that seems to happen every year about this time.

Pay attention to the fact that the dollar will continue to fall, which will put a natural floor under this market.

People will be trying to get away from the US dollar and closer to silver to protect their wealth.

Clearly, the buyers are in control as of late and likely will continue to be for the short term.

The best thing you can do is wait for a short-term pullback in order to take advantage of value in the euro.