The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

Gold continues its uptrend, with traders eyeing a break above $2800 for a potential move to $3000, while $2700 and $2600 provide key support.

NASDAQ 100 continues to find buyers on dips, with 20,000 acting as strong support and a breakout above 22,000 potentially leading to new highs.

USD/MXN trades sideways between 20 and 21, with traders monitoring U.S. tariff policies and global risk sentiment for potential breakout moves.

Top Forex Brokers

The S&P 500 remains bullish near 6000, with support at 5700 and a potential breakout above 6200 signaling further upside amid strong U.S. economic growth.

USD/ZAR stabilizes after January volatility, with February expected to bring calmer trading as investors monitor Fed policy, U.S. rhetoric, and South African economic factors.

USD/INR remains stable near 86.5600 as RBI intervention limits volatility, with traders watching 86.6000 resistance and a slow upward trend in February.

EUR/USD remains range-bound near 1.04100, with traders watching the ECB’s expected rate cut and U.S. economic data for potential shifts in sentiment.

USD/JPY continues to find buyers on dips, with strong support near 155, as the Fed’s higher rates contrast with Japan’s dovish stance.

NASDAQ 100 trades sideways between 21,000 and 22,000, as traders assess tech earnings and AI concerns while looking for buying opportunities on dips.

Bonuses & Promotions

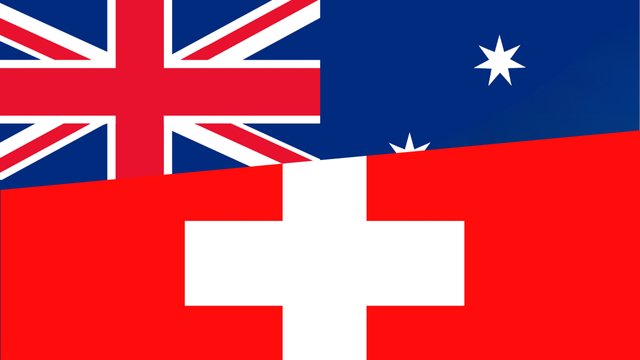

AUD/CHF finds support at 0.5650, with potential upside toward 0.5750–0.5800, though technical barriers like the 200-day EMA may limit gains.

The Dow Jones 30 continues to push higher, with traders eyeing a breakout above 45,100 for a potential move toward 46,000 amid strong market sentiment.

USD/CAD stays in consolidation, with 1.45 as key resistance and 1.43 as support, as traders assess U.S.-Canada trade risks and central bank divergence.

EUR/USD remains range-bound between 1.03 and 1.05, with traders fading rallies as uncertainty over ECB and Fed policy keeps the pair in consolidation.

Bitcoin continues its uptrend, with traders accumulating near $100K while watching for a breakout above $110K to signal the next major move.

Nifty 50 struggles to gain momentum, with 23,400 as key resistance, while long-term growth prospects remain strong despite inflation concerns.