The S&P 500 has been explosive during the month of November, taking off and breaking out of a massive bullish flag pattern.

Who said technical analysis forecasts should be complicated or overwhelming?.

Our monthly Forex technical analysis forecasts are written by pro traders and experienced market analysts to ensure that you are well equipped in the Forex trading niche

The best part is that our technical analysis caters to all traders, irrespective of the skill level. You can rest assured that our Forex articles are written in the simplest of ways, breaking down complex concepts for your convenience.

Most Recent

The NASDAQ 100 has been explosive to the upside during the trading month of November, as interest rates have fallen quite drastically in the bond market.

December could be a pretty wild month for the crude oil markets, as we are currently waiting to find out whether or not OPEC will cut production.

Top Regulated Brokers

The USD/MXN has seen a lot of volatility during November, ultimately dropping down toward the 17.06 pesos level, only to turn around and bounce at the end of the month.

As we enter the month of December, we are at a major resistance barrier that has caused quite a few problems in the past.

The EUR/USD has started its trading for November having concluded a rather choppy October with rather mixed results which essentially led to a very slight monthly change of value.

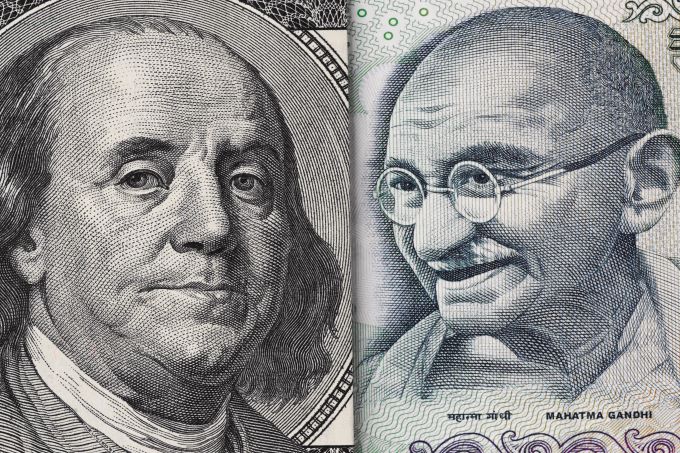

The USD/INR has produced one of the most stable price ranges of any major currency pair globally, but this has not happened without the intervention of Indian government.

The West Texas Intermediate Crude Oil market (US Oil) had a back-and-forth month during October, and I suspect we probably have more of the same ahead.

The US dollar has been consolidating against the Mexican peso during a majority of the month of October, as we continue to bang against a very serious significant resistance barrier.

Bonuses & Promotions

The S&P 500 had a very tough October, which is not a huge surprise considering that there is so much going on around the world.

The NASDAQ 100 has had a tough October, as it is currently testing the 50-Week you may indicator.

Gold markets have had a very bullish month of October, and certainly there is a lot out there going on at the moment that could cause gold to continue to be noisy.

Nasdaq Forecast: There is a lot of noisy behavior just waiting to happen, therefore the month of October will probably continue to be very volatile.

The S&P 500 has had a very rough month of September but found itself supported at the 50-Week EMA.

The WTI Crude Oil market has been very bullish for several months, but as we closed out the month of September, we are looking at a fairly significant barrier just above.