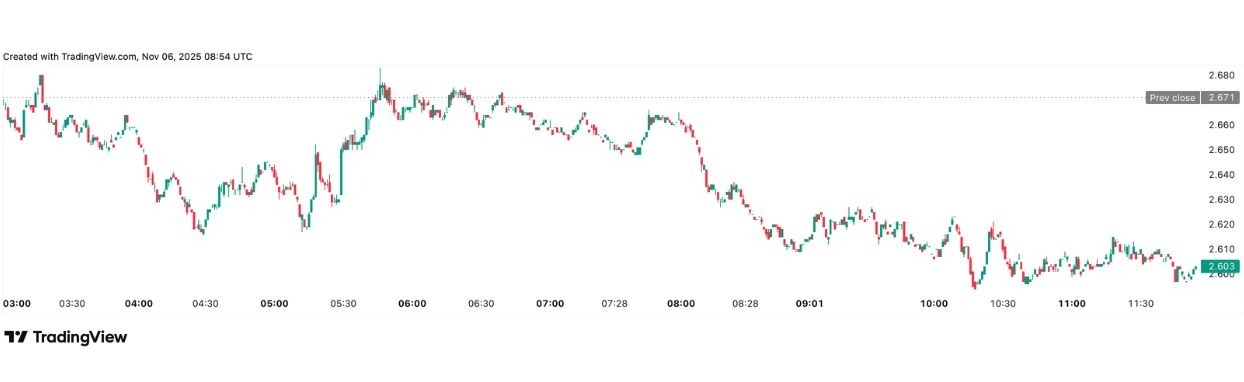

The asset continues to hover around a key support area, with intraday highs near $2.63 and lows touching $2.57, as traders wait for a stronger directional move.

Technical Indicators Suggest a Critical Inflection Point

DOT price | Source: TradingView

DOT is consolidating just above a major support level that has historically acted as a bounce zone. The Relative Strength Index (RSI) sits near 45.6, signaling neutral momentum and indicating that DOT is neither overbought nor oversold.

Meanwhile, the Moving Average Convergence Divergence (MACD) shows negative bias with moving averages (50-day and 200-day) both significantly above the current price, which suggests bearish structural pressure. The 50-day simple moving average is around $3.70, and the 200-day around $3.93, both well above the current price.

Indicator summaries also show that most moving averages are giving “Sell” signals, reinforcing the notion that DOT is trading in a weak regime.

If buyers defend the $2.50–$2.60 zone successfully, a relief rally toward the mid-$2.80s remains possible. Conversely, failure to hold this zone could expose DOT to a deeper retest near $2.30 or even $2.10.

Network Activity Shows Steady Ecosystem Growth

While DOT’s market price has struggled, on-chain fundamentals tell a different story. Polkadot continues to rank among the most actively developed networks in crypto, with one of the highest numbers of full-time developers across all blockchains.

Parachain auctions are still onboarding new projects, which brings fresh liquidity and use-cases to the network rather than relying on speculative trading alone. At the same time, cross-chain transfers between Polkadot and its canary network, Kusama, have stayed consistently active, evidence that the multichain framework is being used in practice, not just in theory.

On the other hand, large wallet holders have shown mixed behavior, with some accumulation near $2.50 and selective profit-taking above $2.80 over the past two weeks. Institutional flow into DOT remains limited compared to its earlier peaks, but long-term staking participation continues rising, reducing circulating supply pressure.

Key Levels to Watch

Immediate support lies around $2.50, with stronger back-up at about $2.30. On the upside, resistance is observed near $2.87, with a significant barrier at $3.10.

A clean break above $3.10 would invalidate the current downtrend and open room toward $3.45 and $3.80.

Final Thoughts: Decision Point for DOT

Polkadot is at a pivotal level, trading close to multi-month support while broader market sentiment remains cautious. The price structure favors consolidation, but fundamentals, particularly developer and ecosystem traction, remain intact.

A decisive move will likely depend on whether bulls can defend the $2.50 zone, a shift in market risk appetite across major altcoins, and the momentum indicators confirming accumulation rather than mere sideways drift. For now, traders should stay alert to support reaction and volume spikes, which will reveal if a rebound or a breakdown comes next.

Ready to trade our analysis of Polkadot? Here’s our list of the best MT4 crypto brokers worth reviewing.