Short Trade Idea

Enter your short position between $190.00 (the lower band of its horizontal resistance zone) and $207.52 (the upper band of its horizontal resistance zone).

Market Index Analysis

- Palantir (PLTR) is a member of the NASDAQ 100, the S&P 100, and the S&P 500 Index.

- All three indices extend their record run, but bearish indicators continue to accumulate.

- The Bull Bear Power Indicator of the NASDAQ 100 is bullish with a rapid descent below its descending trendline.

Market Sentiment Analysis

Equity markets are pointing to a lower open this morning after a mixed session to start the new trading month. The AI sector was once again the driver of gains, as the bubble rages, but opinions on its duration differ. More FOMC members cautioned about the market’s perception that a December interest rate cut is guaranteed. Over 100 earnings reports are due this week, and AMD, SuperMicro, Uber, and Spotify are headlining today. The US government shutdown continues to delay core economic reports, including this week’s NFP report.

Palantir Fundamental Analysis

Palantir is a software-as-a-service (SaaS) technology company and a leading US player in artificial intelligence. It counts the intelligence and defense sectors as significant clients, and its share price rode the AI hype higher.

So, why am I bearish on PLTR after its earnings release?

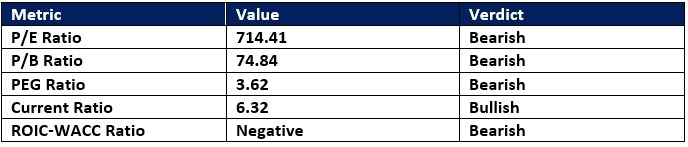

Despite a record run and the 21st consecutive quarter of beating analysts’ earnings estimates, valuations remain severely disconnected from fundamentals. Revenues rose to $1.18 billion and earnings-per-share of $0.21, while raising its fourth-quarter revenue guidance to $1.33 billion. Still, the price-to-sales ratio of 137.33 and the P/E ratio of 714.41 remain excessive, while non-US growth is another issue.

Palantir Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 714.41 makes PLTR an expensive stock. By comparison, the P/E ratio for the NASDAQ 100 is 39.70.

The average analyst price target for PLTR is $160.47. It suggests no upside potential, as share prices overshot their target, while downside risks have risen.

Palantir Technical Analysis

Today’s PLTR Signal

Palantir Price Chart

- The PLTR D1 chart shows price action inside a horizontal resistance zone.

- It also shows price action between its ascending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bullish with a negative divergence.

- The average bullish trading volumes have risen, but bearish days witness a spike in overall trading volume.

- PLTR advanced with the NASDAQ 100, a bullish confirmation, but bearish catalysts remain.

My Call on Palantir

Top Regulated Brokers

I am taking a short position in PLTR between $190.00 and $207.52. The price-to-sales ratio, excessive valuations, and soft non-US growth are core reasons I am short-term bearish. The lack of clarity over 2026 adds to uncertainty.

- PLTR Entry Level: Between $190.00 and $207.52

- PLTR Take Profit: Between $142.34 and $148.22

- PLTR Stop Loss: Between $211.67 and $218.02

- Risk/Reward Ratio: 2.20

Ready to trade our free stock signals? Here is our list of the best stock brokers worth checking out.