Short Trade Idea

Enter your short position between $305.02 (a minor horizontal support level) and $308.51 (the lower band of its bearish price channel).

Market Index Analysis

- McDonald’s (MCD) is a member of the Dow Jones Industrial Average, the S&P 100, and the S&P 500 indices.

- All three indices hover near record highs amid an expanding AI bubble, but lack market breadth, as bearish catalysts accumulate.

- The Bull Bear Power Indicator of the S&P 500 shows a negative divergence and does not support the uptrend.

Market Sentiment Analysis

Equity futures are moderately lower this morning. Super Micro Computer shares tanked, Qualcomm and Robinhood moved lower, joining a chorus of massively overvalued stocks that corrected after their earnings. E.l.f. Beauty reminded markets that tariffs have an impact, plunging 20%+, and yesterday’s ADP report showed no job creation in small companies with fewer than 250 employees, which traditionally account for 75% of all jobs. Warner Bros. Discovery, Airbnb, and Moderna highlight today’s earnings reports, followed by the Tesla shareholder meeting.

McDonald’s Fundamental Analysis

McDonald’s is a fast-food chain with the second-largest number of locations globally. It is also a significant real estate owner and investor, and the second-largest private employer with over 1.7 million employees.

So, why am I bearish on MCD after its earnings release?

Despite a double earnings miss, revenues came in at $7.08 billion and earnings per share of $3.22 versus expectations of $7.17 billion and $3.36, respectively; shares marched higher. MCD had to lean heavily on promotions, entered the second year of losing low-income diners, and its non-US same-store sales outlook disappointed. The end of its partnership with Krispy Kreme, higher input costs, and current valuations add to my bearish outlook.

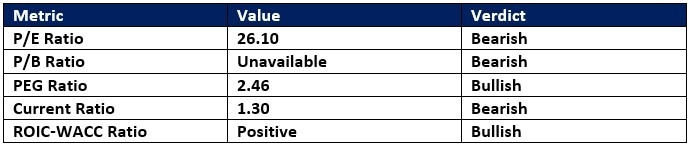

McDonald’s Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 26.19 makes MCD an expensive stock in its industry, but a reasonably priced one overall. By comparison, the P/E ratio for the S&P 500 is 30.43.

The average analyst price target for MCD is $330.33. It points towards limited upside potential with rising downside risks.

McDonald’s Technical Analysis

Today’s MCD Signal

- The MCD D1 chart shows price action below its horizontal resistance zone.

- It also shows price action breaking down below its ascending Fibonacci Retracement Fan.

- The Bull Bear Power Indicator turned bullish but remains below its descending trendline.

- The average trading volumes rose during the post-earnings advance, but overall trail average bearish volumes.

- MCD corrected as the S&P 500 pushed higher, a significant bearish trading signal.

Top Regulated Brokers

My Call on McDonald’s

I am taking a short position in MCD between $305.02 and $308.51. Competition from healthier alternatives, the ongoing loss of its core low-income diners, its weak non-US same-store sales outlook, and overall stagnant EPS growth at high valuations all enforce a bearish scenario.

- MCD Entry Level: Between $305.02 and $308.51

- MCD Take Profit: Between $276.53 and $283.47

- MCD Stop Loss: Between $318.04 and $326.32

- Risk/Reward Ratio: 2.19

Ready to trade our free stock signals? Here is our list of the top stock brokers worth checking out.