Long Trade Idea

Enter your long position between $188.10 (the intra-day low from its earnings release) and $199.55 (yesterday’s intra-day high).

Market Index Analysis

- Leidos Holdings (LDOS) is a member of the S&P 500 Index.

- This index nears fresh records, but bearish catalysts continue to accumulate.

- The Bull Bear Power Indicator of the S&P 500 turned bullish but remains well below its previous high.

Market Sentiment Analysis

Equity futures suggest a bullish open after the most extended US government shutdown ended. Still, the government noted that delayed economic reports, like NFP payrolls and inflation data, will not be released, including October’s data. More Fed officials caution against further interest rate cuts in the current environment. Markets ignore those remarks and pile into the two-tier market structure, creating more AI bubble fears. Cisco rallied after reporting earnings, and investors await Disney’s results ahead of the bell.

Leidos Holdings Fundamental Analysis

Leidos Holdings (LDOS) is a defense, aviation, information technology, and biomedical research company. LDOS is the largest government IT company and has contracts with the Department of Defense, the Department of Homeland Security, the Intelligence Community, and select commercial markets.

So, why am I bullish on LDOS following its earnings release?

Revenue rose 7% to $4.42 billion, free cash flow clocked in at $680 million, and earnings per share rose 4% to $3.05. LDOS repaid $450 million in debt and has no payments due until 2028. Additionally, it raised its outlook and increased its dividend. I am bullish on pipeline, with $69 billion in orders, its integration of AI and automation, and its leadership in Starlab Space Station assembly. Share buybacks are a bonus for shareholders.

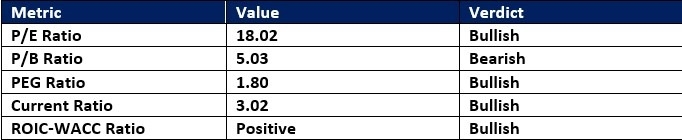

Leidos Holdings Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 18.02 makes LDOS an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 30.83.

The average analyst price target for LDOS is $218.08. This suggests moderate upside potential with reasonable downside risk.

Leidos Holdings Technical Analysis

Today’s LDOS Signal

Leidos Holdings Price Chart

- The LDOS D1 chart shows price action inside a bullish price channel.

- It also shows price action trading between its ascending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bullish with an ascending support level.

- The average bullish trading volumes are higher than the average bearish trading volumes.

- LDOS advanced with the S&P 500 Index, a significant bullish confirmation.

My Call on Leidos Holdings

I am taking a long position in LDOS between $188.10 and $199.55. The hardware expansion to power autonomous ships, the growing portfolio of classified research for the intelligence and space communities, and cost controls are leading bullish catalysts for this undervalued defense company.

- LDOS Entry Level: Between $188.10 and $199.55

- LDOS Take Profit: Between $218.08 and $224.62

- LDOS Stop Loss: Between $174.64 and $180.45

- Risk/Reward Ratio: 2.23

Top Regulated Brokers

Ready to trade our analysis of Leidos Holdings? Here is our list of the best stock brokers worth checking out.