Short Trade Idea

Enter your short position between $76.49 (yesterday’s intra-day low) and $77.06 (yesterday’s intra-day high).

Market Index Analysis

- Evergy (EVRG) is a member of the S&P 500 Index.

- This index rides the AI wave up and down, but bearish catalysts are strengthening.

- The Bull Bear Power Indicator of the S&P 500 Index turned bullish with a descending trendline.

Market Sentiment Analysis

Equity markets finished mixed yesterday, as investors rotated out of AI names, sending the NASDAQ lower, and rotating into defensive sectors, pushing the Dow Jones Industrial Average to fresh highs. Investors received a dismal ADP report, showing job losses in its latest survey. Optimism remains after the Senate passed a measure to reopen the government on Monday, with the House of Representatives likely to vote as soon as today. Earnings season is slowing, with Cisco, Disney, and Applied Materials among the highlights for the rest of the week.

Evergy Fundamental Analysis

Evergy (EVRG) is an investor-owned utility (IOU) and the largest electric company in Kansas with over 1.7 million customers in Kansas and Missouri. It generates over 16,000 megawatt-hours of electricity from over 40 power plants.

So, why am I bearish on EVRG after its earnings miss?

Third-quarter revenues of $1.81 billion and earnings per share of $2.03 missed estimates of $1.87 billion and $2.14, respectively. Adding to the disappointment was a reduction in the top-line full-year EPS outlook from $4.12 to $4.02. Operating and maintenance expenses rose 0.5% from a year ago, while interest expenses accelerated by 5.6%. I am bearish about EVRG due to its dismal returns on equity and invested capital, as well as its rising debt-to-asset ratio.

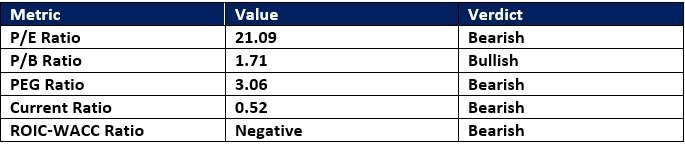

Evergy Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 21.09 makes EVRG an expensive utility. By comparison, the P/E ratio for the S&P 500 Index is 30.65.

The average analyst price target for EVRG is $83.59. It suggests moderate upside potential with rising downside risks.

Evergy Technical Analysis

Today’s EVRG Signal

Evergy Price Chart

- The EVRG D1 chart shows price action inside a bearish price channel.

- It also shows price action between its ascending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bearish with a descending trendline.

- The average bearish trading volumes are higher than the average bullish trading volumes.

- EVRG is descending as the S&P 500 Index inches higher, a bearish trading signal.

My Call on Evergy

I am taking a short position in EVRG between $76.49 and $77.06. While Evergy confirmed its dividend, the downgrade to its full-year top-line EPS guidance is notable. Shares have limited upside potential based on average analyst price targets, and valuations are high for a utility.

Top Regulated Brokers

- EVRG Entry Level: Between $76.49 and $77.06

- EVRG Take Profit: Between $67.30 and $70.29

- EVRG Stop Loss: Between $79.32 and $83.59

- Risk/Reward Ratio: 3.25

Ready to trade our analysis of Evergy? Here is our list of the top stock brokers worth reviewing.