EUR/USD Analysis Summary Today

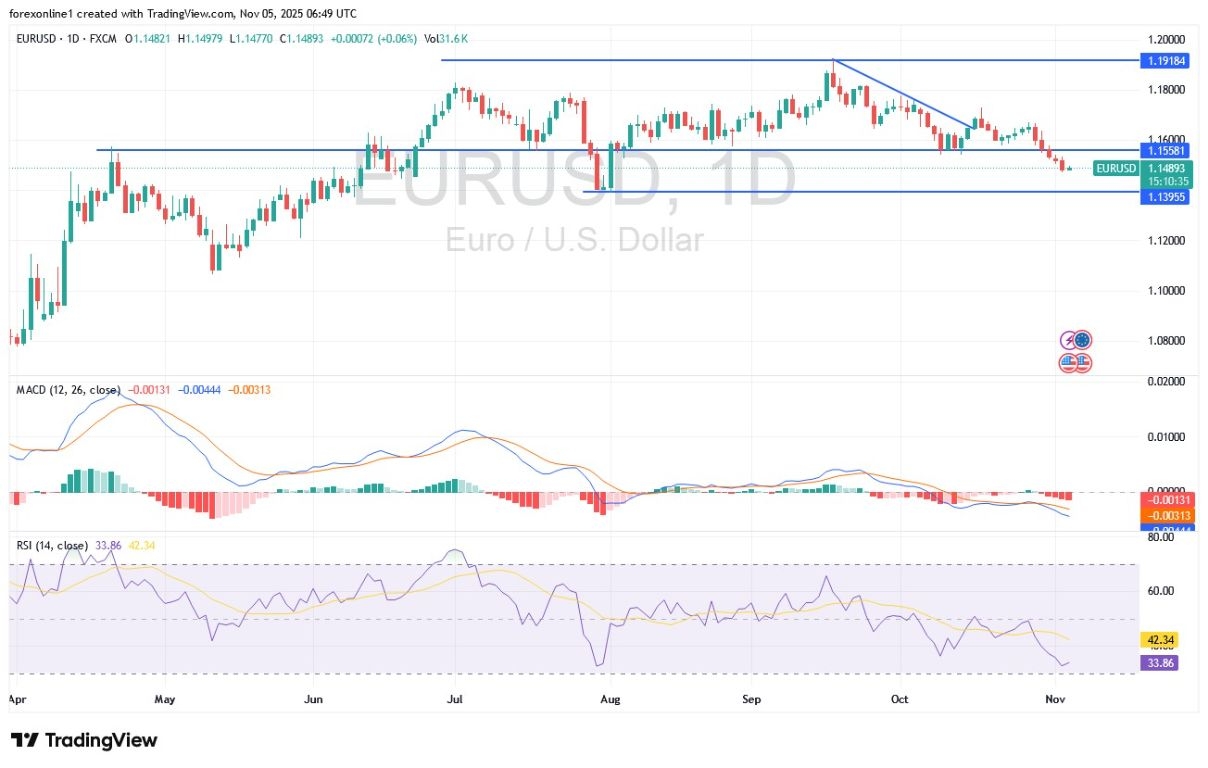

- Overall Trend: : Bearish

- Support Levels for EUR/USD Today: 1.1460 – 1.1400 – 1.1360

- Resistance Levels for EUR/USD Today: 1.1550 – 1.1630 – 1.1700

EUR/USD Trading Signals:

- Buy EUR/USD from the support level of 1.1430 with a target of 1.1600 and a stop-loss at 1.1370.

- Sell EUR/USD from the resistance level of 1.1660 with a target of 1.1400 and a stop-loss at 1.1740.

Technical Analysis of EUR/USD Today:

According to recent currency market trading, the EUR/USD exchange rate has failed to gain any momentum in global markets, falling to its lowest level in three months below the psychological support level of 1.1500. Losses extended to the support level of 1.1477, confirming our technical expectations of increased downward momentum for the EUR/USD once it stabilized below the 1.1600 support level, which has indeed occurred. Technically, further weakness in the euro is not ruled out. A positive divergence is forming in momentum indicators, and it is unlikely that any further decline will push technical indicators towards oversold levels. It's worth noting that the 14-day Relative Strength Index (RSI) is around 33, close to the oversold line, while the MACD lines are steadily trending downwards, supporting the bears' current control of the trend.

Based on the daily chart, the EUR/USD bullish scenario remains contingent on a return to the 1.1800 resistance level. Today, Wednesday, the EUR/USD will be influenced by the release of the Eurozone Services PMI, starting with the Spanish version at 10:15 AM Egypt time, followed by the Eurozone overall PMI at 11:00 AM Egypt time, and then, an hour later, the Eurozone Producer Price Index (PPI). On the US side, the focus will be on the ADP Non-Farm Employment Change report, followed by the ISM Services PMI at 5:00 PM Egypt time.

Top Regulated Brokers

US Jobs Data Under Scrutiny

Forex traders believe that the 1.1500 support level will remain the bottom of the EUR/USD range, but this will require some weaker US jobs data to provide some breathing room. Experts also pointed to developments in the financial markets as a significant factor influencing the strength of the US dollar. The US Treasury is rebuilding its cash reserves, putting upward pressure on interest rates.

Tight money markets typically keep the dollar supported, and we will be watching to see if this difficulty in obtaining dollar funding spreads internationally. This would be very negative for the EUR/USD pair if it were to occur, but there are no indications of this yet.

Trading Advice:

The EUR/USD downtrend will continue for some time, and a true upward reversal will not occur without a return of investor confidence and the end of the US government shutdown.

Financial markets remain less confident that the Federal Reserve will cut US interest rates again at the December meeting, with traders estimating the probability of an additional cut at slightly less than 70%. The US government shutdown will also become increasingly significant for markets as its economic impact continues to worsen. The Federal Reserve will be concerned about the negative impact on the US economy but will also be aware of the high degree of uncertainty.

According to experts, the longer the US government shutdown lasts, the greater the negative impact on the US economy in the short term. However, Federal Reserve Chairman Jerome Powell indicated that the Fed would be more inclined to keep interest rates unchanged in December if the lack of clarity regarding the performance of the US economy persists. Overall, significant underlying concerns remain surrounding potential changes at the Federal Reserve, particularly with a new chairman taking office next year.

Over the weekend, Treasury Secretary Bisset criticized the US Central Bank, stating that its track record in predicting inflation was very poor. He added, "We will find a leader who will implement radical reforms across the entire institution in terms of procedures and internal operations."

Ready to trade our Forex daily forecast? We’ve shortlisted the top forex brokers in the industry for you.