Long Trade Idea

Enter your long position between $29.75 (the lower band of its horizontal support zone) and $31.69 (the upper band of its horizontal support zone).

Market Index Analysis

- Chipotle Mexican Grill (CMG) is a member of the S&P 500 Index.

- This index nears fresh records, but bearish catalysts continue to accumulate.

- The Bull Bear Power Indicator of the S&P 500 turned bullish but remain well below its previous high.

Market Sentiment Analysis

Equity futures suggest a bullish open after the most extended US government shutdown ended. Still, the government noted that delayed economic reports, like NFP payrolls and inflation data, will not be released, including October’s data. More Fed officials caution against further interest rate cuts in the current environment. Markets ignore those remarks and pile into the two-tier market structure, creating more AI bubble fears. Cisco rallied after reporting earnings, and investors await Disney’s results ahead of the bell.

Chipotle Mexican Grill Fundamental Analysis

Chipotle Mexican Grill (CMG) is a fast-casual restaurant chain known for preparing orders in front of customers. It has been the best-performing restaurant stock since its IPO. CMG has over 3,800 locations.

So, why am I bullish on CMG following its post-earnings plunge?

My view remains that markets overreacted to the earnings miss and downgraded outlook. I remain bullish about its expansion plans to reach 7,000 locations, driven by powerful fundamentals and the unrealized potential of its catering service. The Chipotle Mexican Grill digital push is phenomenal, as its loyalty program grew to over 40 million customers in five years. I am equally confident in CMG’s ability to manage margin pressures while maintaining relative price stability, which should boost foot traffic in the fourth quarter.

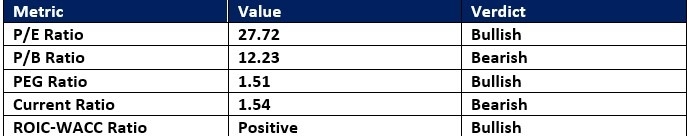

Chipotle Mexican Grill Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 27.72 indicates CMG is fairly valued. By comparison, the P/E ratio for the S&P 500 is 30.83.

The average analyst price target for CMG is $44.09. This suggests excellent upside potential with manageable downside risk.

Chipotle Mexican Grill Technical Analysis

Today’s CMG Signal

Chipotle Mexican Grill Price Chart

- The CMG D1 chart shows price action inside a horizontal support zone, nearing a breakout.

- It also shows price action trading between its descending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bearish with a positive divergence.

- Trading volumes are higher during bullish sessions than during bearish ones.

- CMG corrected as the S&P 500 Index advances, a bearish trading signal, but bullish catalysts have eclipsed bearish ones.

Top Regulated Brokers

My Call on Chipotle Mexican Grill

I am taking a long position in CMG between $29.75 and $31.69. CMG has industry-leading returns on assets and equity with healthy profit margins despite downside pressures. I expect foot traffic to recover faster than expected, and bank on its aggressive expansion plans.

- CMG Entry Level: Between $29.75 and $31.69

- CMG Take Profit: Between $38.30 and $40.65

- CMG Stop Loss: Between $26.85 and $28.26

- Risk/Reward Ratio: 2.95

Ready to trade our analysis of Chipotle Mexican Grill? Here is our list of the best stock brokers worth checking out.