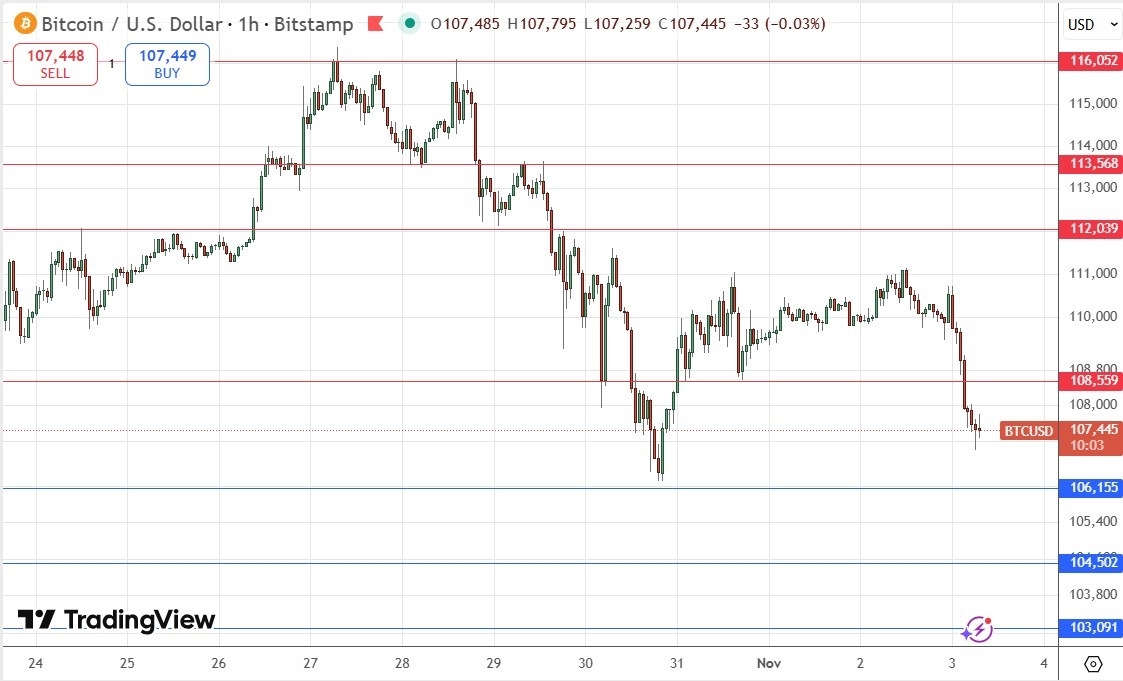

My previous BTC/USD signal on 27th October produced a profitable short trade following the bearish rejection of the resistance level at $116,016.

Today’s BTC/USD Signals

Risk 0.50% per trade.

Trades may only be taken prior to 5pm Tokyo time Tuesday.

Long Trade Ideas

- Long entry after a bullish price action reversal on the H1 timeframe following the next touch of $106,155, $104,502, or $103,091.

- Put the stop loss $100 below the local swing low.

- Move the stop loss to break even once the trade is $100 in profit by price.

- Take off 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to run.

Short Trade Ideas

- Short entry after a bullish price action reversal on the H1 timeframe following the next touch of $108,559, $112,039, or $113,568.

- Put the stop loss $100 above the local swing high.

- Move the stop loss to break even once the trade is $100 in profit by price.

- Take off 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

Top Regulated Brokers

BTC/USD Analysis

In my last BTC/USD forecast exactly one week ago, I thought that the best approach here was to look for a short trade with the price retreating from $116,016 which was an excellent and profitable call.

I think the technical picture now looks more bearish, with the price chart currently dominated by a slanted bearish head and shoulders chart pattern. Although many purists rejected slanted patterns, I think they can be even more bearish as they show a collapse in the most recent price action.

I call the effective neckline – the line in the sand which must be broken to allow a deeper breakdown – at the support level of $106,155. This is likely to be today’s pivotal point. If the price gets established below this level, it will be near a 4-month low price and will have the space technically to fall further.

A short trade entry below $106,155 is what I am looking for today, but I am not optimistic it will set up today.

Alternatively, a short trade from a rejection of $108,559 might also be a good trade and is more likely to set up.

Another reason beyond the technical situation to be bearish on Bitcoin is that for quite a while now, it has been obviously underperforming other risky assets. This is a bearish sign.

There is nothing of high importance due today regarding Bitcoin. Concerning the US Dollar, there will be a release of ISM Manufacturing PMI data at 3pm London time.

Ready to trade our free Forex signals? Here is our list of MT4 crypto brokers worth checking out.