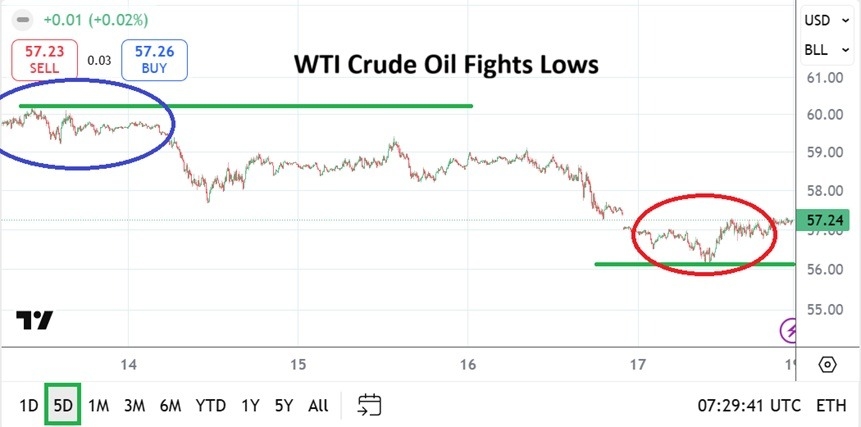

- WTI Crude Oil continues to show that rather strong headwinds are the dominant force in the commodity. After starting last Monday with some rather strong buying which took WTI above 60.000 USD per barrel in an attempt to sustain ‘the higher’ elements of its value, by Tuesday Crude Oil started to slip lower again.

- WTI Crude Oil has gone into this week near 57.240, which is lower than the value it saw on the previous Friday.

Speculators who believe the commodity is too low and needs to bounce higher should not get overly ambitious. The overwhelming force in WTI Crude Oil appears to be very solid supply. Demand is certainly constant, but it is not outpacing the production of WTI Crude Oil. Political bantering from the White House about where China and India should be buying their energy supplies from has not had any affect on the price of WTI Crude Oil either.

Top Regulated Brokers

Resistance Levels Near 58.000 Going Into This Week

While the price of 60.000 USD proved to be an area that created durable resistance early last week as this level got tested into Tuesday, the value of WTI Crude Oil began to show that 59.000 acted as resistance on Wednesday. The price for WTI broke below 58.000 on Thursday and there was no real test regarding an upwards trend on Friday. Day traders should be careful upon Monday’s opening for sudden upwards price action – like happened last Monday.

However, if no strong buying trend emerges on Monday and prices remain rather lackluster going into Tuesday, this might indicate large players for the moment believe current value represents fair equilibrium. A move below the 57.000 may be a consideration for some day traders, but it might be best to try and follow short-term trends created by momentum early this week. The lower value realms now being tested are definitely looked at as a challenge to long-term technical perceptions.

New Price Realities in WTI Crude Oil

Although price action below the 57.000 mark did happen in May with some temporary sustainability (there was a spike lower in early April of 2025 too), large producers will not be happy with these lower values.

- In order to make a profit on WTI Crude Oil many companies like a price around $65.00 USD, but larger companies are believed to be comfortable around $58.00 in order to make profits.

- Murmurs of WTI Crude Oil being too low will start to be heard by larger players and questions regarding production cutbacks may start to be rumored – but for this to happen the price of Crude Oil would likely have to remain under 58.000 USD for a few weeks.

WTI Crude Oil Weekly Outlook:

Speculative price range for WTI Crude Oil is 56.200 to 60.800

Although the price of WTI Crude Oil is within the lower elements of its historical long-term price realms, this doesn’t mean a huge change in momentum is going to suddenly emerge. Support levels should be carefully watched early this week, anything lower than 57.000 USD is rather cheap. However, if the 57.000 mark is broken lower and sustained for a while this week it could cause some speculative fights, but WTI Crude Oil has been below 60.000 USD rather consistently since the start of October.

Perhaps this is an acceptance that supply is outpacing demand and outlook remains negative for moves higher in the weeks to come. Yet, day traders should not get too comfortable. Large traders will be put to the test this week. If a push higher develops which takes WTI Crude Oil above 58.000 and challenges 59.000 this would not be surprising, but considering the results within the commodity the past few weeks, this may also attract selling once again.

Ready to trade our weekly forecast? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.