Long Trade Idea

Enter your long position between $220.78 (the lower band of its horizontal support zone) and $229.25 (the upper band of its horizontal support zone).

Market Index Analysis

- Republic Services (RSG) is a member of the S&P 500 Index.

- This index attempts to keep the bull market alive, while bearish signals are strengthening.

- The Bull Bear Power Indicator of the S&P 500 is bearish with a descending trendline.

Market Sentiment Analysis

Equity markets swung widely yesterday, as they viewed Powell’s comments about a weakening labor market as signs of more interest rate cuts. He also stated that inflationary upward pressures are primarily due to tariffs rather than broad-based inflation. Another sign of tariff impacts is average transaction prices for new cars, which exceeded $50,000 for the first time. Citigroup also warned of frothy, overvalued markets as the AI bubble expands. Uncertainty over the US-China tariff spat should keep volatility elevated.

Republic Services Fundamental Analysis

Republic Services is the second-largest US waste disposal company by revenue. It conducts non-hazardous solid waste collection, waste transfer, waste disposal, recycling, and energy services. It also operates 79 landfill gas-to-energy and other renewable energy projects.

So, why am I bullish on RSG, despite its 10%+ correction?

Republic Services provides a necessary community service that is not affected by economic conditions. Excellent profit margins and a bullish long-term revenue outlook add to a bullish investment case, and its operating margins confirm an exceptional management team behind RSG. The dividend keeps rising, and I like the approach to recycling and renewable energy. Smaller strategic acquisitions are positive for the RSG outlook.

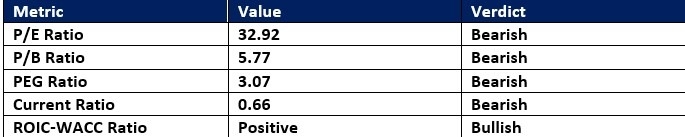

Republic Services Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 32.92 makes RSG an expensive stock. By comparison, the P/E ratio for the S&P 500 is 29.91.

The average analyst price target for RSG is $258.55. It suggests moderate upside potential with acceptable downside risks.

Republic Services Technical Analysis

Today’s RSG Signal

Republic Services Price Chart

- The RSG D1 chart shows price inside a massive horizontal support zone.

- It also shows price action between the descending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bearish, but a positive divergence has formed.

- The average bullish trading volumes are higher than the bearish trading volumes.

- RSG corrected as the S&P 500 advanced, a bearish development, but bullish and breakout factors are rising.

My Call on Republic Services

I am taking a long position in RSG between $220.78 and $229.25. RSG has excellent profit margins, a superb management team, a sound business model that can resist economic uncertainty, and a rising dividend.

- RSG Entry Level: Between $220.78 and $229.25

- RSG Take Profit: Between $253.38 and $258.75

- RSG Stop Loss: Between $205.81 and $211.27

- Risk/Reward Ratio: 2.18

Ready to trade our free stock signals? Here is our list of the best stock brokers worth checking out.