Today’s NZD/USD Signals

- Risk 0.25%

- Trades may only be taken before 5pm Tokyo time Thursday.

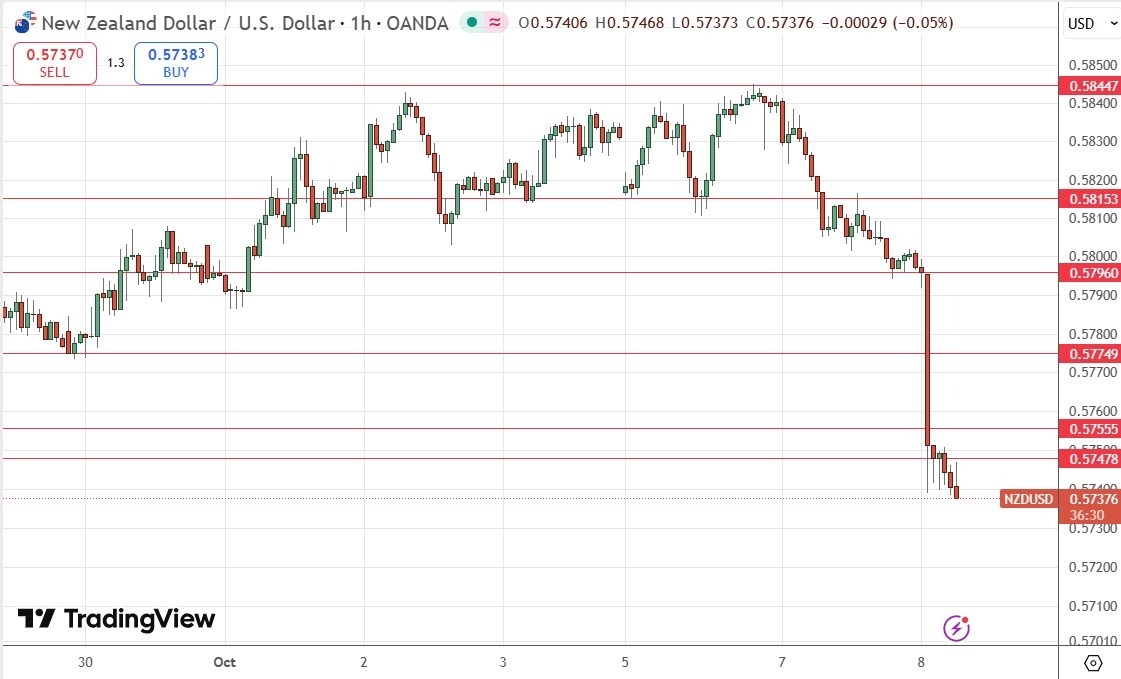

Short Trade Ideas

- Short entry following a bearish price action reversal on the H1 time frame rejecting the area between $0.5748 to $0.5756, or $0.5796.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Nothing on the long side today – the price might rebound strongly from lows later, but I think this is unlikely. Anyway, if it happens, it will probably be very unpredictable and unreliable.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

NZD/USD Fundamental Analysis

The Kiwi had a big morning (or evening, depending upon your time zone) today as the Reserve Bank of New Zealand, which was widely expected to cut its Official Cash Rate by 0.25% after the terrible GDP data showing a contraction rate of 0.9% last quarter, to try to ease pressure on the economy to soften the impending slowdown or even recession.

Although the cut was a surprise, it was not a huge surprise, which explains why the price has not dropped even further since the cut was announced. It is an open question how much further the Kiwi might fall in light of this policy tilt, but it might not be much further.

Turning to the USD, the Federal Reserve has taken a bit of a hawkish tilt on its rate cut path lately, reducing expectations of cuts in 2026 to only one cut of 0.25%. This has helped the US Dollar find some strength and begin to rise from its recent long-term lows.

NZD/USD Fundamental Analysis

The price chart below shows a healthy drop after the central bank meeting, with the price reaching new multi-week lows and printing on obvious zone of new resistance in the $0.5750 area, which is both a major half and quarter number.

There is major support below but not until $0.5650, so the price still has plenty of room to fall technically.

There has not yet been a test of the nearest resistance level.

As the nearest zone of resistance is so close, there could be a good technical opportunity to enter a new short trade in this currency pair.

In this NZD/USD forecast I see that the price should give more short pips after printing a solid bearish reversal at either the nearest resistance zone centred on $0.5750, or at the recent bearish inflection point of $0.5775.

Very aggressive traders might even short new lows on short-term charts.

There is nothing of high importance scheduled today concerning the NZD. Regarding the USD, there will be a release of the most recent FOMC Meeting Minutes at 7pm London time.

Top Regulated Brokers

Ready to trade our free Forex signals? Check out our list of the top 100 Forex brokers.