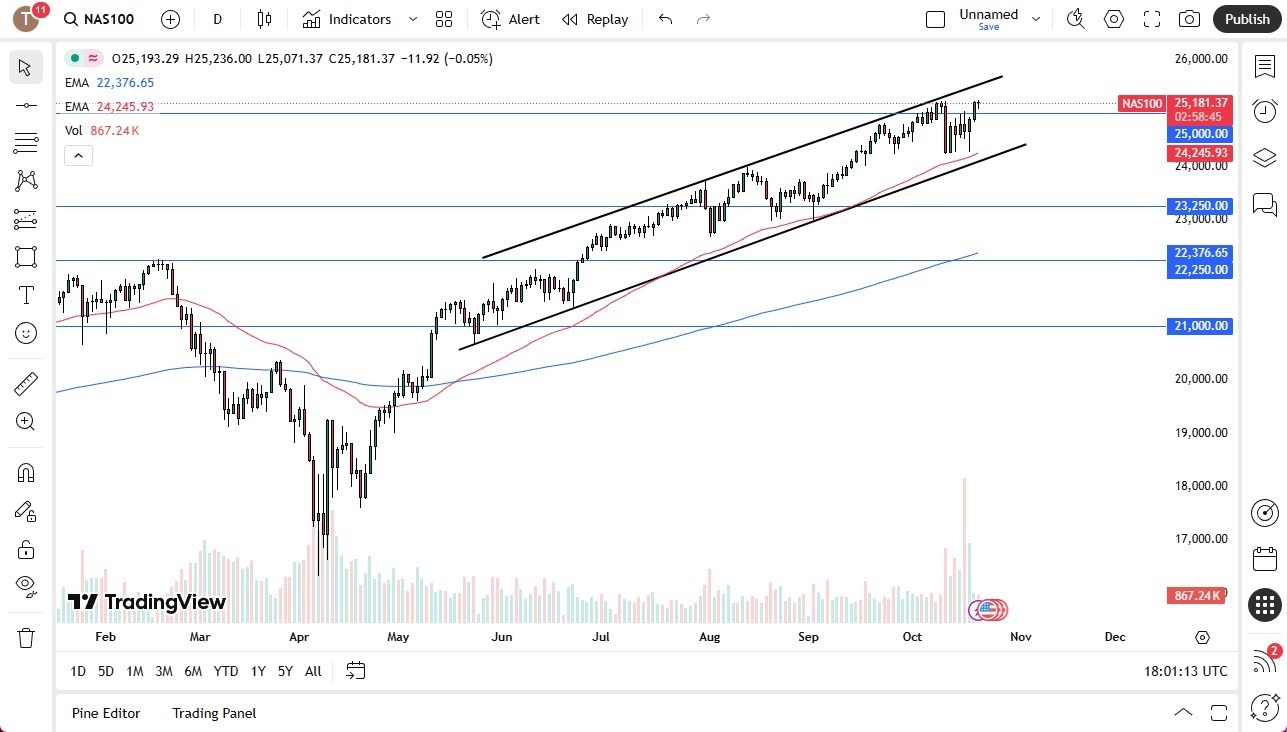

- The Nasdaq 100 was fairly quiet during the trading session on Tuesday, initially dropping, but it has turned around to show signs of life, so that's a good sign.

- Ultimately, I think this is a market that we'll try to look at at the top of the channel, meaning that we should continue to see buyers.

- The 25,000 level now looks as if it's trying to offer short-term support after breaking out above there on Monday, so therefore I look at this as a market that remains very much a buy on the dip as far as attitude is concerned.

I have no interest in shorting, and it's worth noting that the 50-day EMA has offered support near the $24,250 level and is also backed up by the bottom of the up trending channel. Keep in mind, traders are excited about the idea of loosening monetary policy, and that has people wanting to buy stocks. Furthermore, the United States economy is picking up. And that's probably going to have people looking at the idea of buying stocks in the US as well.

Top Forex Brokers

Magnificent Seven, or Possibly Ten

The Nasdaq 100 is essentially just a handful of stocks. It's not really a hundred stocks anymore. It's closer to seven, maybe 10 that matter. And they all look like they're doing okay. So as long as that's the case, I think the Nasdaq 100 continues to find plenty of inflows. Eventually, I would anticipate the Nasdaq 100 to go looking to the 26,000 level, but that might take some time.

With this, it's not until we break down below not only the 50-day EMA, but the uptrend line that I would even remotely be concerned about the overall trend. And even then, I think a simple correction would make some sense. I would just stand on the sidelines and wait for a bounce to start buying again.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.