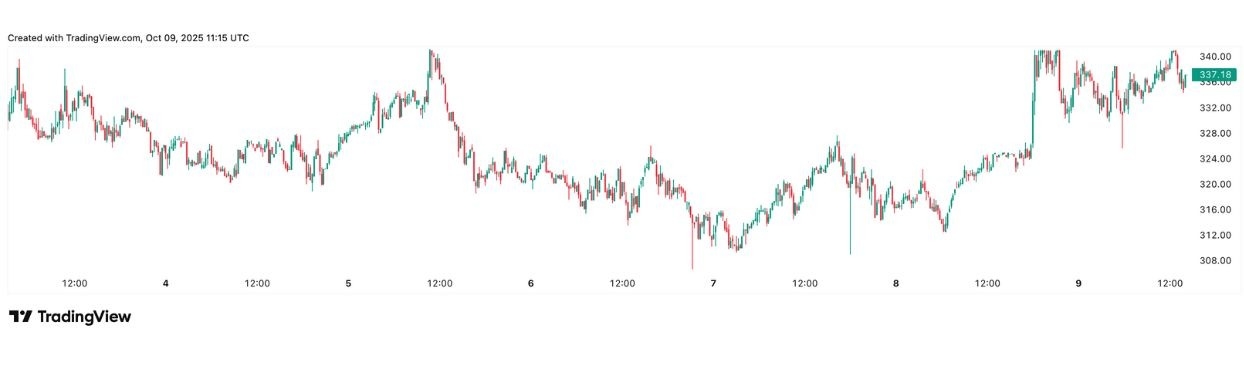

Monero (XMR) is holding steady near $336.36 after another failed attempt to clear resistance around $342.

The privacy coin remains trapped in a narrow range as buyers defend short-term support near $323, and sellers consistently fade rallies into the mid-$340s.

XMR Attempts to Reclaim Momentum After Weeks of Sideways Action

The standoff has kept Monero’s price largely unchanged this week, even as other mid-cap altcoins show wider swings.

Unless bulls can close the day above the $342 mark with conviction, the market is likely to stay rangebound. A breakdown below $323 could push XMR toward the $310–$300 area, where it found support last month.

Monero XRP Price Chart | Source: TradingView

Monero’s current consolidation follows a brief surge in late September, when prices climbed above $350 before profit-taking set in. Since then, trading has slowed and volatility has compressed, signaling indecision rather than weakness.

The structure resembles a classic mid-cycle pause. Buyers have stepped in repeatedly at lower levels, preventing further downside, while the lack of volume at the top suggests few traders are ready to chase the next leg higher.

The result is a balanced market that could swing in either direction on the next decisive catalyst.

Derivatives Point to Mild Optimism, Not Speculative Euphoria

Open interest in Monero futures has edged up to roughly $57 million, according to CoinGlass, while daily derivatives volume sits near $85 million - an average reading that signals gradual re-engagement rather than heavy speculation.

Funding rates are slightly positive across major exchanges, averaging between +0.01% and +0.02%, meaning long traders are paying shorts. That dynamic suggests a modest bullish bias, but not enough leverage to create immediate instability.

Liquidation activity remains light, with neither side overexposed. Should the $323 level break, however, Monero’s thinner derivatives order books could accelerate the decline as stop-loss orders trigger in clusters.

Technical Picture: Range Tightens as Indicators Flatten

On the 4-hour chart, Monero continues to trade between $323 and $342, marking a short-term consolidation channel. The Relative Strength Index (RSI) sits near 56 and reflects neutral momentum with a slight bullish bias.

Most short- and medium-term moving averages are rising gently below the current price, which offers support but not signaling a breakout.

A daily close above $342 could confirm a short-term trend reversal and open targets near $350–$355. Failure to hold the $323 floor would flip momentum negative, exposing $310–$300 next.

Sentiment Improves as Network Stability Returns

Market sentiment toward Monero has steadied after last month’s brief chain reorganization prompted some exchanges to adjust deposit confirmation counts. The network has since stabilized, easing immediate concerns about security and reliability.

The broader tone toward privacy coins has also improved as traders rotate back into alternative assets. Still, Monero remains more sensitive to liquidity shifts than higher-cap names, meaning large transactions can move price more sharply during quiet periods.

Key Levels to Watch in the Days Ahead

The $342 resistance zone remains the line in the sand for bulls. A daily close above that level would likely invite technical buyers and momentum traders back into the market. On the flip side, failure to hold above $323 could trigger a sharper correction toward the $300–$310 area.

Watching the interaction between open interest and price can help gauge conviction. Rising OI alongside a price increase would indicate genuine accumulation, while falling OI during a rally would hint at short covering rather than new demand.

What’s Next for Monero?

Monero’s setup remains balanced. The token trades quietly within the $322–$342 corridor, with modest open interest growth, stable funding, and neutral momentum. These are classic pre-breakout conditions - where neither side holds dominance, but pressure builds below the surface.

A clean breakout above $342 with volume could carry XMR toward $350 and test whether buyers have the conviction to extend the move. Until that happens, Monero stays in consolidation mode: steady, contained, and waiting for participation to return.

Top Regulated Brokers

Ready to trade our technical analysis of Monero? Here’s our list of the best MT4 crypto brokers worth checking out.