Long Trade Idea

Enter your long position between $562.69 (the upper band of its horizontal support zone) and $573.99 (yesterday’s intra-day high).

Market Index Analysis

- Mastercard (MA) is a member of the S&P 100 and the S&P 500 indices.

- Both indices recorded fresh record highs amid rising bearish indicators.

- The Bull Bear Power Indicator for the S&P 500 is in extreme bullish territory at unsustainable levels, suggesting upside exhaustion is forming.

Market Sentiment Analysis

Equity markets extended their record run, once again fueled by AI-related stocks, with NVIDIA leading the way. Investors ignore concentration risks, as the rest of the market is not doing as well. The divergence between the AI-led indices and the Russell 2000, which declined, is another red flag. While most agree that an AI bubble exists, opinions on whether and when it will burst differ. Optimism about earnings seasons, today’s anticipated interest rate cut, and a significant trade deal between the US and China have overshadowed bearish catalysts, such as a decline in consumer confidence, a weak labor market, and rising debt.

Mastercard Fundamental Analysis

Mastercard is a multinational payment card services provider. It is one of the top three credit/debit card issuers globally. It also offers data insights, cybersecurity, and fraud management services.

So, why am I bullish on MA ahead of its earnings?

I expect Mastercard to report an earnings beat on both the top and bottom lines with an upbeat full-year outlook and increased guidance. The latter is due to its announced integration of Mastercard’s Agent Pay platform into PayPal’s wallet, which could allow an AI agent to make purchases on behalf of consumers. PayPal recently partnered with OpenAI, which opens the gate for Mastercard to increase revenues. I also like MA’s excellent positions in high-margin cross-border transactions, which justifies higher valuations.

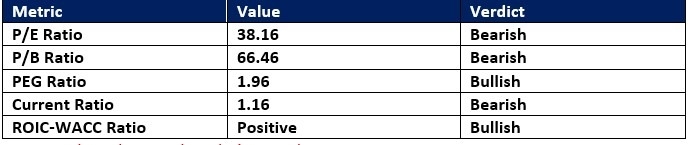

Mastercard Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 38.16 makes MA an expensive stock. By comparison, the P/E ratio for the S&P 500 is 30.52.

The average analyst price target for MA is $651.41. It suggests good upside potential with acceptable downside risks.

Mastercard Technical Analysis

Today’s MA Signal

Mastercard Price Chart

- The MA D1 chart shows price action breaking out above its horizontal support zone.

- It also shows price action below its descending Fibonacci Retracement Fan.

- The Bull Bear Power Indicator is bullish with an ascending trendline.

- The average bullish trading volumes are higher than the average bearish trading volumes.

- MA corrected as the S&P 500 recorded fresh records, a bearish confirmation, but bullish catalysts have emerged.

Top Regulated Brokers

My Call on Mastercard

I am taking a long position in MA between 562.69 and 573.99. I am bullish on its outlook, which I expect Mastercard to upgrade during its earnings call. The technological framework and push into AI agent payments are encouraging catalysts for future growth.

- MA Entry Level: Between $562.69 and $573.99

- MA Take Profit: Between $651.41 and $683.98

- MA Stop Loss: Between $527.33 and $542.07

- Risk/Reward Ratio: 2.51

Ready to trade our daily stock signals? Here is our list of the best stock brokers worth reviewing.