Decreasing profit margins, fewer subscribers to its top-rated healthcare plans, and ongoing balance issues are signs of an unhealthy healthcare company. Is more downside ahead?

Short Trade Idea

Enter your short position between 270.35 (yesterday’s intra-day low) and 281.00 (yesterday’s intra-day high).

Market Index Analysis

- Humana (HUM) is a member of the S&P 500.

- This index hovers near record highs, but correction catalysts and bubble fears are spreading.

- The Bull Bear Power Indicator of the S&P 500 has turned bearish with a descending trendline.

Market Sentiment Analysis

After Equity markets rebounded yesterday from Friday’s massive sell-off, it may be a dead-cat bounce, with futures lower this morning. The third-quarter earnings season begins today, with JPMorgan Chase, Citigroup, Goldman Sachs, and Wells Fargo reporting results. The government shutdown continues to delay key economic reports. Therefore, markets could put additional weight on Fed Chair Powell’s speech at the National Association for Business Economics (NABE) annual meeting. The ongoing tariff threat and the Trump administration’s pivots should keep markets on edge, while silver rallies to all-time highs.

Humana Fundamental Analysis

Humana is a health insurance company, the highest-ranked Kentucky company by revenues, and the fourth-largest US health insurance provider. It also manages TRICARE, a health care program of the US Department of Defense.

So, why am I bearish on HUM after its three-day slide?

Mediocre profit margins that continue to decline, negative earnings-per-share growth, a rising debt pile, and a meager dividend cast a shadow over low valuations. While Humana has to contend with changes to Medicare and Medicaid, it also struggles with an expected decrease in its highest-rated plans, down 5% to 20% in 2026 from 25% in 2025, joining Aetna as the only two insurers with a contraction in this category.

Humana Fundamental Analysis Snapshot

Metric | Value | Verdict |

P/E Ratio | 20.75 | Bullish |

P/B Ratio | 1.69 | Bullish |

PEG Ratio | 1.00 | Bullish |

Current Ratio | Unavailable | Bearish |

ROIC-WACC Ratio | Negative | Bearish |

The price-to-earnings (P/E) ratio of 20.75 makes HUM an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 29.45.

The average analyst price target for HUM is 297.13. It suggests moderate upside potential with increasing downside risks.

Humana Technical Analysis

Today’s HUM Signal

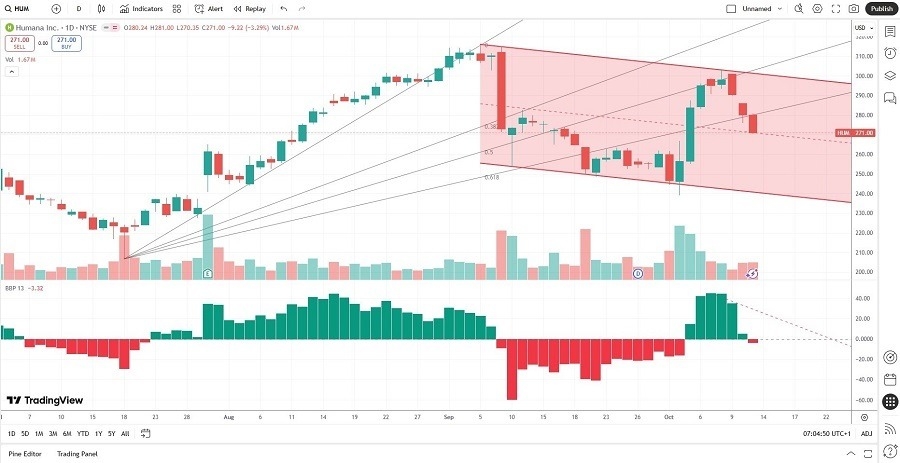

- The HUM D1 chart shows price action inside a bearish price channel.

- It also shows price action breaking down below its ascending Fibonacci Retracement Fan.

- The Bull Bear Power Indicator is bearish with a descending trendline.

- The average bearish trading volumes have increased during the three-day slide.

- HUM corrected as the S&P 500 remains near record highs, a significant bearish trading signal.

My Call

I am taking a short position in HUM between 270.35 and 281.00. The expected decrease in its top-rated healthcare plans is alarming. It could magnify the negative earnings-per-share growth and pressure its balance sheet as debt levels grow and free cash flow contracts.

- HUM Entry Level: Between 270.35 and 281.00

- HUM Take Profit: Between 206.87 and 213.31

- HUM Stop Loss: Between 298.75 and 315.35

- Risk/Reward Ratio: 2.24

Top Regulated Brokers

Ready to trade our daily stock signals? Here is our list of the best stock brokers worth reviewing.