Wednseday, October 08, 2025: Analysis of euro price against the dollar EUR/USD

EUR/USD Analysis Summary Today

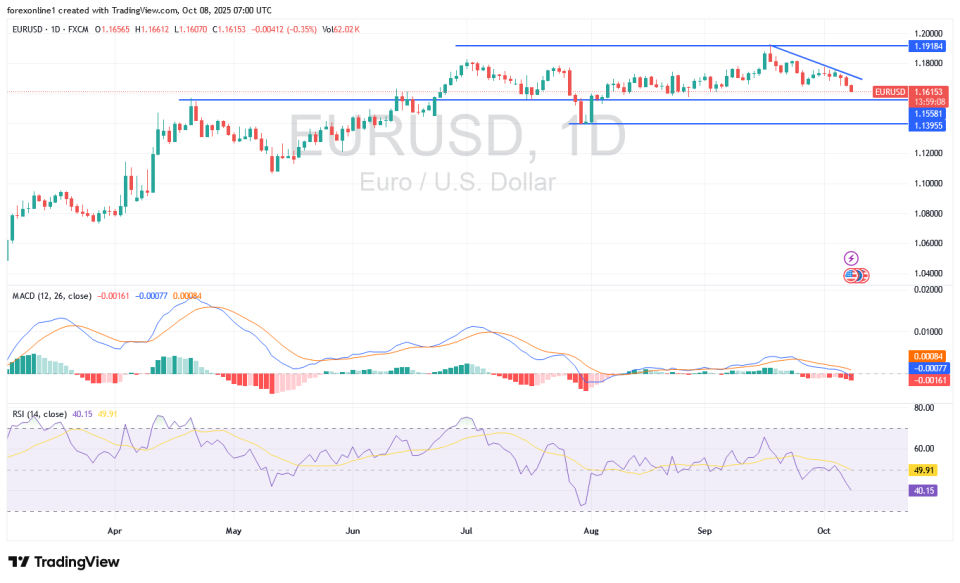

- General Trend: Bearish.

- EUR/USD Support Levels Today: 1.1590 – 1.1520 – 1.1450.

- EUR/USD Resistance Levels Today: 1.1680 – 1.1740 – 1.1800

EUR/USD Trading Signals:

- Buy the EURUSD from the support level of 1.1540, target 1.1700, and stop loss 1.1480.

- Sell the EURUSD from the resistance level of 1.1720, target 1.1500, and stop loss 1.1800.

Technical Analysis of EUR/USD Today:

Amid strong selling pressure, euro trading has witnessed a sharp decline amid political unrest in Europe and Asia. According to reliable trading platforms, the EUR/USD exchange rate has fallen towards the 1.1600 support level, the lowest level for the currency pair in more than a month. Currently, foreign exchange market analysts warn that French government instability and Japanese turmoil stemming from the yen could increase fourth-quarter volatility in currency markets.

At the beginning of the week's trading, political developments in France and Japan shocked markets. Consequently, the euro price fell sharply following news of the resignation of French Prime Minister Lecornu.

Technically, a decline in the EUR/USD rate below the 1.1600 support level is likely to lead to further losses. Recent losses for the EUR/USD have pushed the 14-day RSI towards a reading of 40, confirming the bears' strong hold on the market. Meanwhile, the MACD lines are steadily trending downwards, ensuring bears are prepared for a bearish move. Currently, the closest targets are below 1.1570 and 1.1490, respectively. From the latter level, technical indicators will begin to head towards oversold territory.

Today, the EUR/USD price will be influenced by European political developments and the statements of a number of US Federal Reserve policy officials, in addition to the minutes of the bank's last meeting, which will be announced at 9:00 PM Cairo time.

Trading Tips:

Dear TradersUp trader, wait for a stronger decline in the EUR/USD price before considering buying again. Never take risks, no matter how strong the trading opportunities.

The US dollar is receiving momentum from demand as a safe haven, according to Forex trading. The US dollar also gained net support following Takaichi's unexpected victory in the Japanese Liberal Democratic Party leadership election over the weekend, while the Japanese yen suffered heavy losses, with the USD/JPY pair rising 2% to above the psychological resistance of 150.

The United States is also facing significant political pressure that could curb EUR/USD selling, risking increased volatility. French Prime Minister Lecornu resigned after just 26 days in office, less than 24 hours after announcing his government. Following this, according to licensed trading platforms, French bonds experienced a sharp sell-off, with the 10-year yield jumping to 3.60% from 3.51% at Friday's close, amid renewed concerns about underlying instability.

Economic data showed that the Eurozone Sentix investor confidence index improved to -5.4 for October from -9.2 previously, exceeding expectations of -7.5. Sentix commented on the figures, saying, "Investors appear to have overreacted somewhat pessimistically in September." However, it added, "Germany, in particular, continues to face strong headwinds, as evidenced by the actual data."

Overall, US political developments will continue to be closely monitored. Little progress has been made in ending the US government shutdown, as votes failed to secure the necessary support in Congress. Further turbulence in US data releases will likely increase uncertainty surrounding the economic outlook.

Generally, the longer the US government shutdown lasts, the more pressure will be placed on the US dollar. However, we must also recognize that the dollar has shown good resilience so far, confirming our view that markets have raised expectations about how bad US news will be, which is necessary to increase short positions in the US dollar.

Top Regulated Brokers

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.