- The euro rose again during the trading session on Tuesday against the Japanese yen, as traders continue to price in the idea of a potentially loose monetary policy coming out of Japan. At this point, traders are blaming it on the election, but I have no idea why they thought Japan was ever going to have any other type of monetary policy. Japan has been loose for over 20 years now,and quite frankly has a demographics bomb ready to go off that will make it so that they cannot finance their debt with any type of interest at all.

- Japan is by far the most heavily indebted industrial country in the top tier of economies, and therefore in order to continue to have the economy function, low interest rates are a necessity, not a “wish.”

Technical Analysis

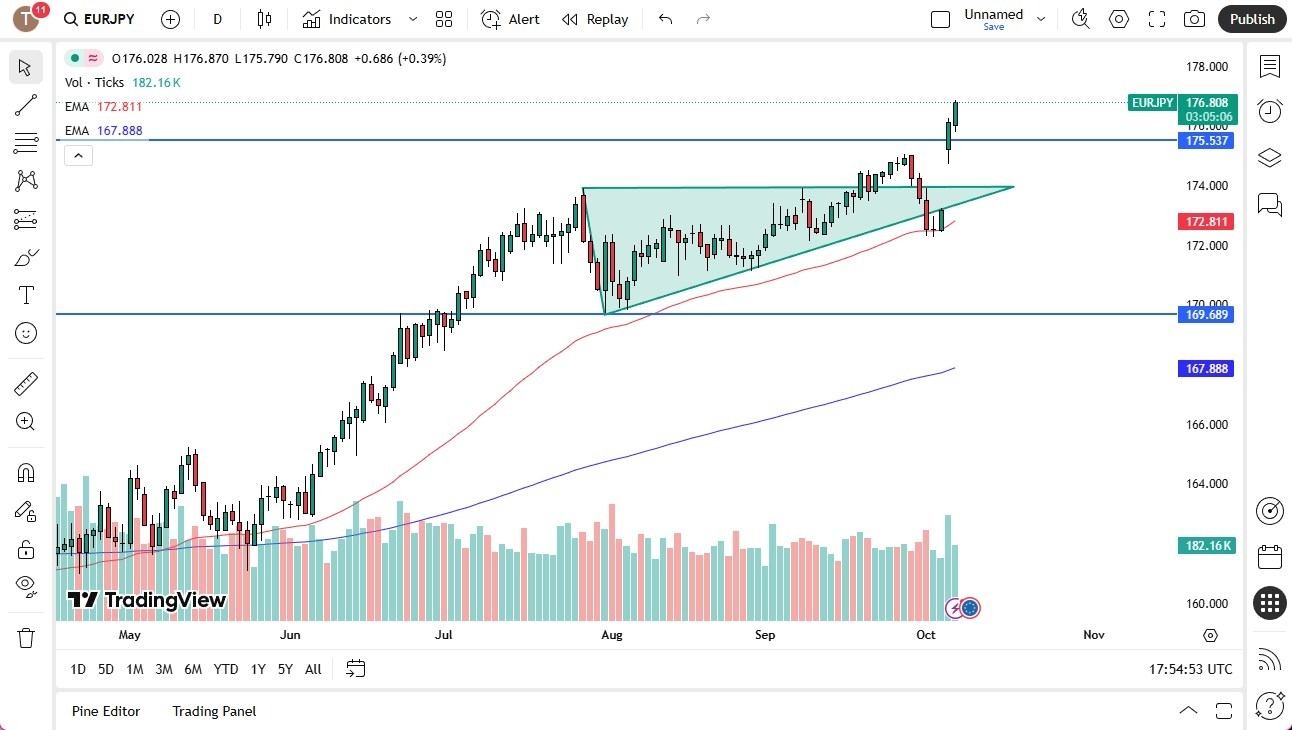

The market recently broke above the ¥172 level, pulled back to that level, and then bounced nicely. We obviously had that massive gap at the open on Monday, and despite the fact that I really want to get bullish and start buying this pair, the reality is that the gap is so big that you would be foolish to risk that type of stop loss. Yes, it could work out in your favor, but there’s also the very real possibility that we will eventually pull back in order to fill that gap, and at this point in time I believe that you would need a roughly 400 pip stop loss to make this trade even feasible. In other words, you would be looking for a massive swing trade to the upside, which of course is possible, but far beyond the scope of most retail traders.

Because of this, I’m looking for short-term drop that fills the gap or at least comes close to it and then bounces. At that point in time, I am buying this pair and hanging onto it for what will probably end up being several months. I have no interest in shorting this market in this environment.

Top Forex Brokers

Begin trading our daily forecasts and analysis. Here is a list of Forex brokers in Japan to work with.