Long Trade Idea

Enter your long position between $416.00 (the upper band of its horizontal support zone) and $425.24 (yesterday’s intra-day high).

Market Index Analysis

- Domino’s Pizza (DPZ) is a member of the S&P 500 index.

- This index is forming a horizontal resistance zone with rising breakdown signals.

- The Bull Bear Power Indicator of the S&P 500 shows a negative divergence and does not confirm the uptrend.

Market Sentiment Analysis

Equity markets retreated yesterday, with futures mixed this morning, as Tesla, the first of the Magnificent Seven to report earnings, slid after posting a record sales surge while missing earnings estimates. IBM also disappointed investors and dropped after the close. T-Mobile and Blackstone will report before the bell today, while Intel will report after the bell. Meanwhile, US government debt hit $38 trillion, and accumulated the last $1 trillion at a record pace outside the pandemic. US President confirmed a meeting with President Xi next week, but slapped sanctions on the two largest Russian oil firms amid disappointment with an uncertain meeting with President Putin.

Top Regulated Brokers

Domino’s Pizza Fundamental Analysis

Domino’s Pizza is the world’s largest pizza chain, with over 21,000 locations across 83 countries and over 5,700 cities. It is well known for its 30-minute-or-less delivery promise.

So, why am I bullish on DPZ after its earnings data release?

DPZ reported a slight earnings beat last week despite heavy promotions, and I am bullish on its cost controls and pricing strategy. DPZ has industry-leading returns on assets and invested capital, confirmng that management understands how to compete and expand. The 30%+ annual dividend growth is a bonus, and its same-store sales are impressive. Warren Buffett’s Berkshire Hathaway has been a notable institutional buyer of DPZ.

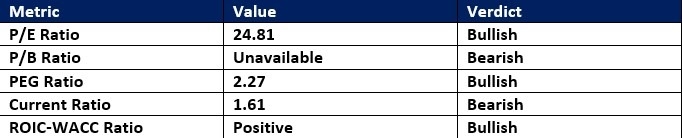

Domino’s Pizza Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 24.81 makes DPZ an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 30.27.

The average analyst price target for DPZ is $500.03. It suggests excellent upside potential and reasonable downside risk.

Domino’s Pizza Technical Analysis

Today’s DPZ Signal

Domino’s Pizza Price Chart

- The DPZ D1 chart shows price action breaking out above its horizontal support zone.

- It also shows price action between its descending 0.0% and 38.2% Fibonacci Retracement Fan level.

- The Bull Bear Power Indicator is bullish with an ascending trendline.

- The bullish trading volumes rose during the breakout, confirming the breakout.

- DPZ corrected as the S&P 500 advanced, a bearish confirmation, but bullish indicators are rising.

My Call on Domino’s Pizza

I am taking a long position in DPZ between $416.00 and $425.24. DPZ understands its business, as confirmed by industry-leading operational statistics. The dividend growth is exceptional, and institutional buying keeps a floor under potential selloffs.

- DPZ Entry Level: Between $416.00 and $425.24

- DPZ Take Profit: Between $496.00 and $500.03

- DPZ Stop Loss: Between $382.95 and $397.12

- Risk/Reward Ratio: 2.42

Ready to trade our free stock signals? Here is our list of the best stock brokers worth checking out.