Binance ecosystem’s native token BNB surged to a record $1,370 on Monday, October 13, 2025, shattering previous records amid a marketwide recovery. This breakout follows a brutal $19 billion liquidation event, highlighting BNB's resilience and underlying strengths.

Binance Compensates Users $283 Million After $19B Crash

On Friday, a $19 billion liquidation storm, sparked by US-China trade tensions under new tariffs, rocked crypto markets. Bitcoin fell below $110,000, top-cap altcoins bled 20-30%, and some stablecoins like USDe depegged to $0.65.

Binance, the world’s largest crypto exchange by trading volume, faced chaos with wrapped tokens such as wBETH dropping as much as 90%, triggering erroneous margin calls and frozen withdrawals. Social media buzzed with user complaints of delays, amplifying allegations of insider manipulation.

Binance responded swiftly, launching a $283 million compensation fund on Sunday, which covered the losses of over 150,000 users from slippage and liquidations within 24 hours.

Source: Binance

In a Monday post on X, Former Binance CEO Changpen ‘CZ’ Zhao wrote:

“While others tried to ignore, hide, shift blame, or attack competitors, the key @BNBChain ecosystem players (Binance, Venus, and more) took hundreds of millions out of their own pockets to PROTECT USERS.”

Why bullish for BNB? The payout funneled $283 million back into Binance, boosting BNB buys for fee discounts and staking.

BscScan reported a 20% transfer spike, with platform volumes up 35% to $15 billion daily. Short liquidations added $45 million in forced longs. BNB burns for claim fees accelerated the 45% supply cut since 2017.

BlackRock’s 12% BNB allocation signaled institutional trust, decoupling BNB from Bitcoin’s 0.8 beta. DeFi TVL rose by $2 billion, cementing BNB as a safe haven. This wasn’t just recovery—it was a bullish catalyst, driving BNB past $1,300 to its ATH.

High Network Activity Boosts BNB Price

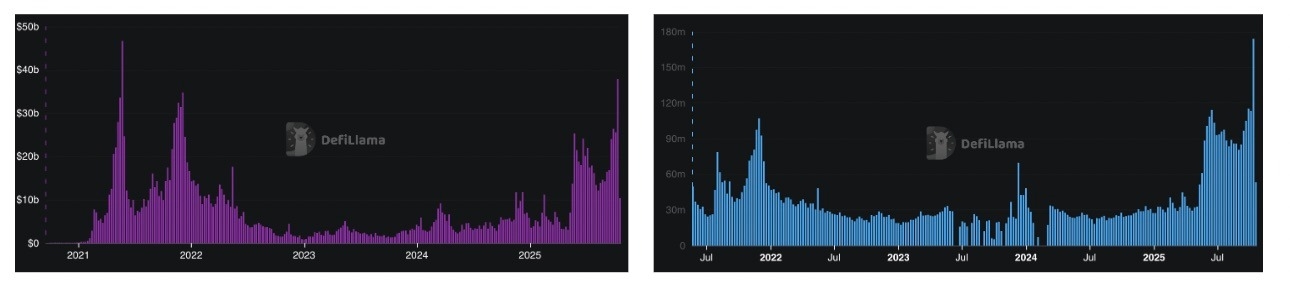

BNB Smart Chain (BSC) exploded post-crash, with weekly DEX volumes hitting $37.9 billion last week, surpassing June’s $25.3 billion seen in May, per DefiLlama.

Transactions reached a record high of 174.2 million weekly, surpassing the 107.35 million ATH seen in May 2021.

This surge followed traders fleeing Ethereum’s $5 fees and Solana’s downtimes to BSC’s $0.01 costs and 3-second finality.

BNB Chain: Weekly DEX volume and transaction count. Source: DefilLlama

memecoins led, capturing 60% of volumes. Over 1,200 launches on Four Meme and Pump.fun clones drove $1.2 billion in swaps, with $DOGGOBNB and $PEPEKING topping $700 million.

A $45 million BSC airdrop with Four Meme engaged 160,000 traders, injecting liquidity. Galaxy Research noted BSC’s 38% DeFi share, outpacing Solana by 45%, fueled by Binance Alpha’s exclusive token drops.

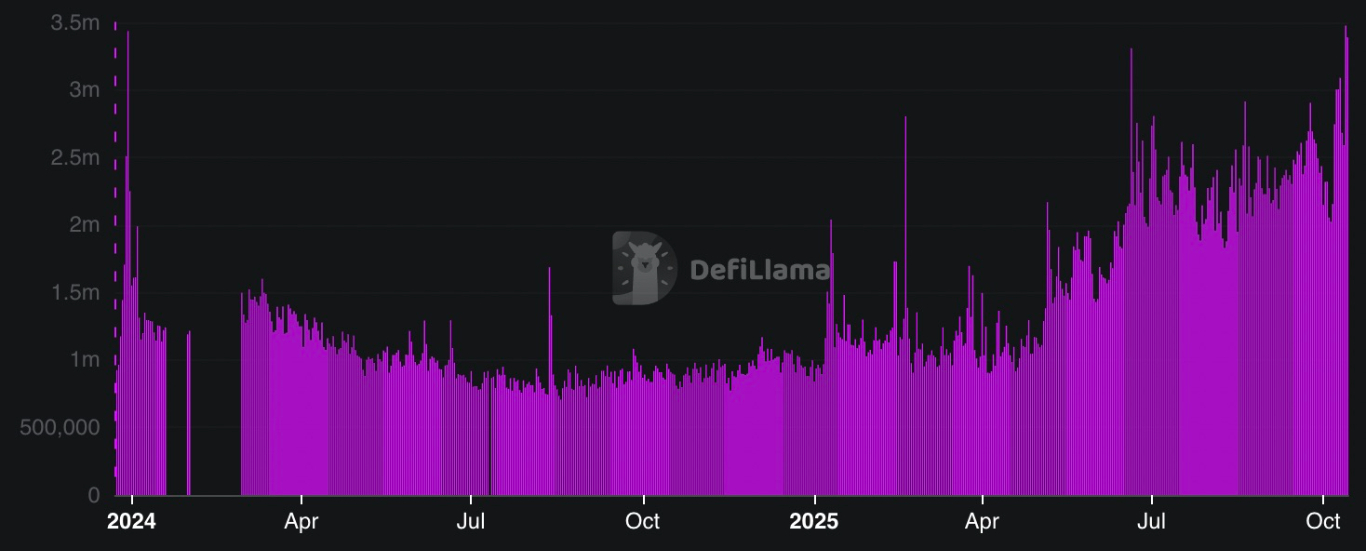

Daily active addresses rose 70% to 3.45 million on Monday from 2.06 million on Oct. 4; smart contract calls jumped 40% to 4.2 million over the same period.

BNB Chain: Daily active addresses. Source: DefilLlama

Venus and Alpaca TVL hit $8 billion, with 45% APYs on BNB pairs. Bridges like Anyswap saw $3.5 billion inflows, as $200 million flowed to BSC post-crash, dwarfing Solana’s $120 million.

BNB gas fees spiked 150%, with 500,000 tokens burned daily, tightening supply. Staking rose 33%, locking 28 million BNB. Over 5,500 dApps, including Mobox (800,000 sessions), bolstered utility. BSC’s 50% perp DEX share ($34 billion monthly) via Aster integration cements its edge. This frenzy—meme-driven yet DeFi-anchored—propels BNB’s value, eyeing $10 billion volumes by year-end.

BNB bull flag targets $1,825

BNB’s weekly chart shows that a textbook bull flag remains intact despite the Oct. 10 crash. Formed between October 2023 and November 2024, the flag was validated on Nov. 6, 204, when the price broke above the upper trendline at $570 during the US election pump.

The upper trendline of the flag acted as a formidable support for BNB between December 2024 and July 2025 before the price went parabolic, rising as much as 97% to its September all-time high of $1,190.

The crash retested the previous peak, but $2.2 billion in bids held firm. The breakout on October 13 cleared $1,200 on three times the volume, confirming the continuation.

The flag’s target is at $1,870, a 51% uptick from the current price.

BNB/USD weekly chart. Source: TradingView

In addition, the RSI at 72 suggests that there is still more room for the upside before extreme overbought conditions and buyer exhaustion set in.

If this happens, a correction might ensue, with the $1,000 psychological level and 20-week SMA at $860 being the first levels of support to watch out for.

Top Regulated Brokers