Short Trade Idea

Enter your short position between $245.13 (the intra-day low of its last bearish candlestick) and $253.38 (Friday’s intra-day high).

Market Index Analysis

- Apple (AAPL) is a member of the NASDAQ 100, the Dow Jones Industrial Average, the S&P 100, and the S&P 500 indices.

- All four indices remain close to all-time highs with bearish cracks rising.

- The Bull Bear Power Indicator of the NASDAQ 100 is bearish with a descending trendline.

Market Sentiment Analysis

Equity markets have had a wild few sessions, but futures suggest a positive open is likely today. Investors hope a slew of blockbuster earnings reports will keep the AI-driven bull market alive. Markets will also receive fresh inflation data, which they hope will confirm more interest rate cuts. Volatility eased on Friday after President Trump noted that high tariffs on China are unsustainable. Gold and silver are pushing to new record highs, which usually occur during recessions and bear markets. In the meantime, the US government remains shut down.

Apple Fundamental Analysis

Apple is the largest tech company by revenue, and the third-largest company by market capitalization. It is at the core of the US tech industry, but it is missing out on several disruptive trends. Still, it has high brand loyalty and a massive following.

So, why am I bearish on AAPL ahead of its earnings release?

The growth rate at Apple is decreasing, and I think the lack of an AI strategy and its wait-and-see approach to other disruptive industry and consumer trends will catch up quickly in a negative blow. The promising iPhone 17 start will deliver less revenues, Apple is losing market share to its competition outside the US, and Berkshire Hathaway has been a notable seller of Apple. I think its upcoming earnings release on October 30th, 2025, will come with a less-than-expected upbeat outlook.

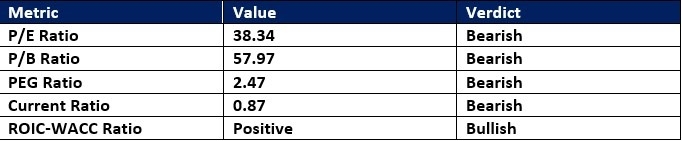

Apple Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 38.34 makes AAPL an expensive stock. By comparison, the P/E ratio for the NASDAQ 100 is 38.08.

The average analyst price target for AAPL is $248.12. It suggests no upside potential but rising downside risks.

Apple Technical Analysis

Today’s AAPL Signal

Apple Price Chart

- The AAPL D1 chart shows a price action inside a bearish price channel.

- It also shows price action between its ascending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bearish with a descending trendline.

- The average bearish trading volumes are higher than the average bullish trading volumes.

- AAPL drifted lower as the NASDAQ 100 moved higher, a significant bearish trading signal.

My Call on Apple

I am taking a short position in AAPL between $245.13 and $253.38. Input costs for the iPhone 17 were higher than for the iPhone 16, but selling prices remained identical. I doubt Apple can recover costs through volumes. I am selling AAPL before its earnings release.

Top Regulated Brokers

- AAPL Entry Level: Between $245.13 and $253.38

- AAPL Take Profit: Between $193.46 and $201.50

- AAPL Stop Loss: Between $267.02 and $272.36

- Risk/Reward Ratio: 2.36