Short Trade Idea

Enter your short position between $101.55 (yesterday’s intra-day low) and $102.81 (the intra-day high of a previous price gap lower).

Market Index Analysis

- Walmart (WMT) is a member of the Dow Jones Industrial Average, the S&P 100, and the S&P 500 index.

- All three indices are near all-time highs, climbing a wall of worry, a bearish trading environment.

- The Bull Bear Power Indicator for the S&P 500 shows a negative divergence and does not confirm the uptrend.

Market Sentiment Analysis

The BLS revised the previous twelve-month job picture ending March 2025 down by 911,000 jobs, confirming the severe slowdown in the US labor market. Economists worry that the cool-down is beyond the repair of interest rate cuts, as it will not address labor conditions. All eyes are on today’s CPI report, which can dictate how fast and steeply the US Federal Reserve will slash interest rates. Investors should brace for volatility following the release of the CPI report.

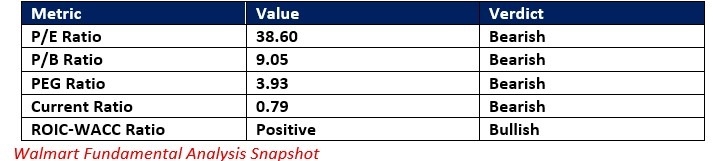

Walmart Fundamental Analysis

Walmart is one of the largest companies by revenue globally, and also the largest private employer and the largest publicly traded family-owned company. It has over 10,000 stores operating under over 45 names in 24 countries.

So, why am I bearish on WMT at its horizontal resistance zone?

Current valuations are too high and do not justify economic reality. While profit margins have been stable, the business model leaves no room for errors, and I am concerned about rising input costs. They can pressure profit margins and ignite a profit-taking sell-off. WMT also has a worse current ratio than most industry peers.

The price-to-earnings (P/E) ratio of 38.60 makes WMT an expensive stock. By comparison, the P/E ratio for the S&P 500 is 29.04.

The average analyst price target for WMT is $112.00. This suggests moderate upside potential, but downside risks are rising.

Walmart Technical Analysis

Today’s WMT Signal

- The WMT D1 chart shows price action at its horizontal resistance zone and the formation of a double top.

- It also shows price action trading between its ascending 38.2% and 50.0% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bullish with a descending trendline.

- The average bearish trading volumes are higher than the average bullish trading volumes.

- WMT corrected before its current reversal as the S&P 500 advanced, a significant bearish signal.

My Call

Top Regulated Brokers

I am taking a short position in WMT between $101.55 and $102.81. The high valuations, the PEG ratio, and the threat to razor-thin profit margins could pose too much of a headwind for price action to push through resistance. So, I expect a renewed push lower.

- WMT Entry Level: Between $101.55 and $102.81

- WMT Take Profit: Between $93.43 and $95.42

- WMT Stop Loss: Between $105.21 and $112.00

- Risk/Reward Ratio: 2.22

Ready to trade our free daily signals? Here is our list of the best brokers for trading worth checking out.