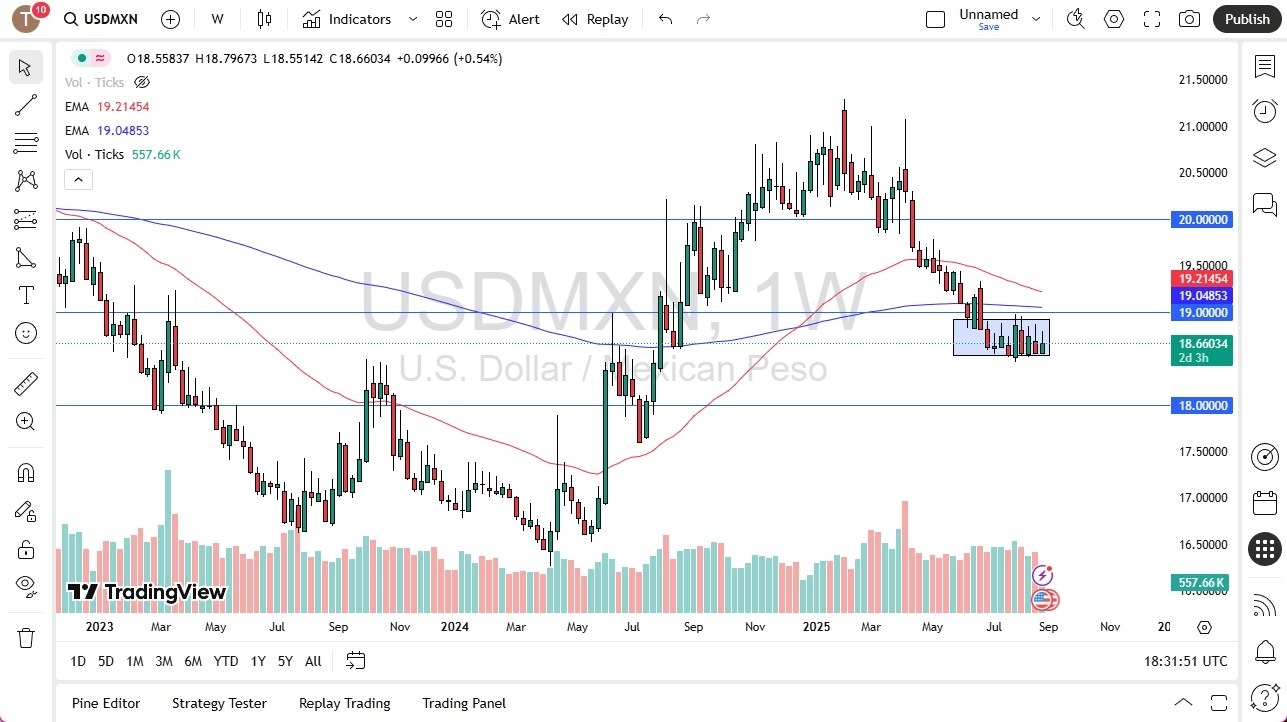

- The US dollar has seen a gradual downward pressure against the Mexican peso during the month of August, but it is worth noting that for the most part we have been consolidating.

- Yes, we have bounced a couple of times, and every time we have bounced, we have seen the weekly candlestick close at a lower level, but it is essentially a very choppy and noisy market at this point.

Technical Analysis

Top Regulated Brokers

I pay close attention to the 19 MXN level, because the 200 Week EMA is sitting just above there, and that of course will attract a certain amount of attention. Furthermore, the 19 MXN level is an area that has a certain amount of psychology attached to it, but the most important thing is going to be that it has been so stringent in its resistance, just as it was supported previously. Ultimately, this is a market that also sees a significant amount of support near the 18.50 MXN level, but it looks like we are trying to “grind our way lower.” If we can break down below the 18.50 MXN level, then it opens up significant selling pressure.

Keep in mind that the interest rate differential does favor the Mexican peso, and there are some questions as to whether or not that won’t end up expanding. However, there is also the problem with the Mexican peso being so heavily paired to the US economy as Mexico is the largest exporter to the United States globally. In other words, if the US starts to slow down drastically, that means that the Mexican economy will as well.

I think that’s part of what’s going on right now, the market is trying to sort out whether or not the US economy is okay. If it is, then this pair will break down, favoring the Mexican peso as more exports will be demanded out of Mexico. However, if it looks like the Federal Reserve is extremely concerned about the US economy, that could have a detrimental effect on the Mexican peso, ironically driving the value of the US dollar higher. Most of the decisions will be made at the September 17 announcement coming out of the FOMC.

Ready to trade our monthly forecast? We’ve made a list of the best forex brokers in Mexico worth using.