- During trading on Wednesday, we have seen the US dollar go back and forth during the trading session on Wednesday against the Swiss franc, as we are basically just hanging around at the moment.

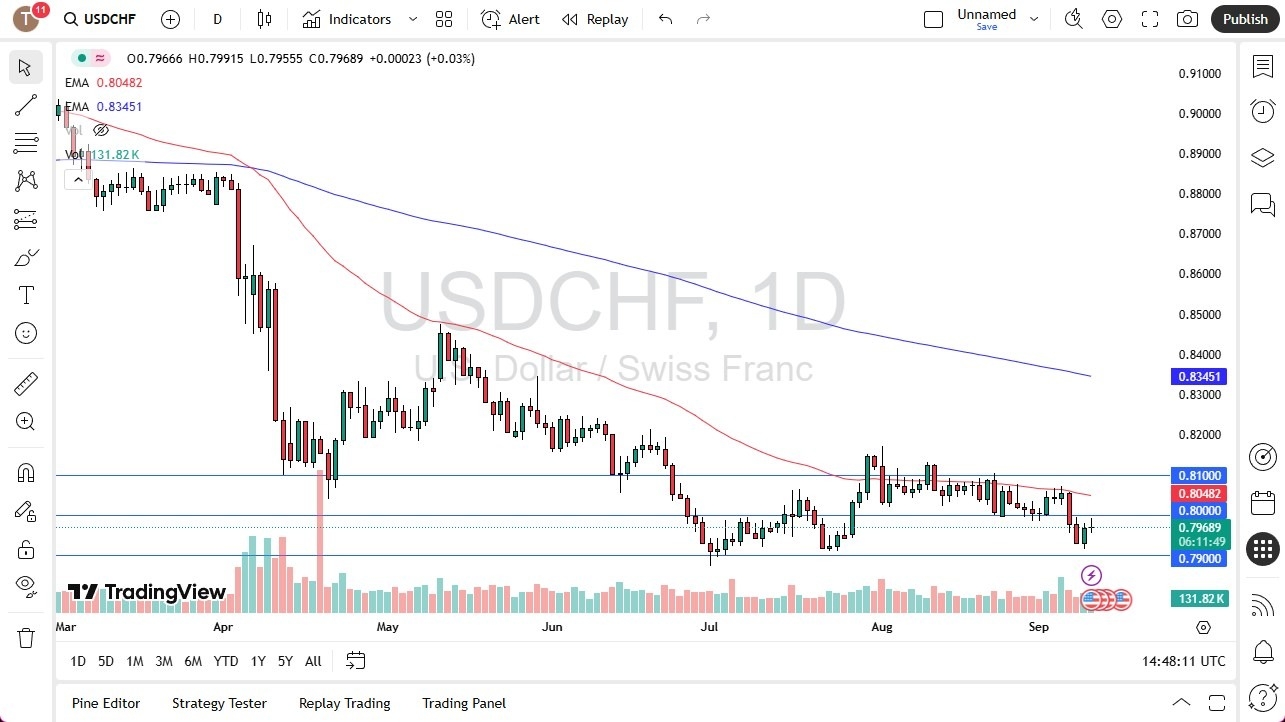

- This is a market that continues to see a lot of noisy trading, but what I would point out is that we are getting fairly close to a significant bottom, in the form of the 0.79 level.

If we were to hold the 0.79 level, you could in theory at least, see a bit of a “double bottom”, and as long as we can stay above that level, that could be something to trade off of. If the market were to break above the 0.80 level, then it could open up a move for the US dollar to go looking to the 50 Day EMA near the 0.8050 level. Anything above there opens up the possibility of a move to the 0.81 level, the top of the overall consolidation range.

Top Forex Brokers

Risk Appetite

Risk appetite has a major influence on most forex pairs, but this one is little bit different in the sense that the US dollar is considered to be the “safety currency” in this equation. While many other currencies will struggle against the US dollar in times of fear, the Swiss franc is the outlier. Furthermore, you also have to keep in mind that the EUR/CHF pair is very important to pay attention to, due to the fact that if we were to break down below some type of major bottom in that pair could cause the Swiss National Bank to intervene in the market as they have multiple times in the past.

As far as its exchange rate against the US dollar I don’t think that is as important. Because of this, the market is likely to continue to see more sideways action than anything else, and you can use the 3 levels, the 0.79 level, the 0.80 level, and the 0.81 level as markers for short-term trade. Ultimately, fairly neutral in this pair at the moment.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.