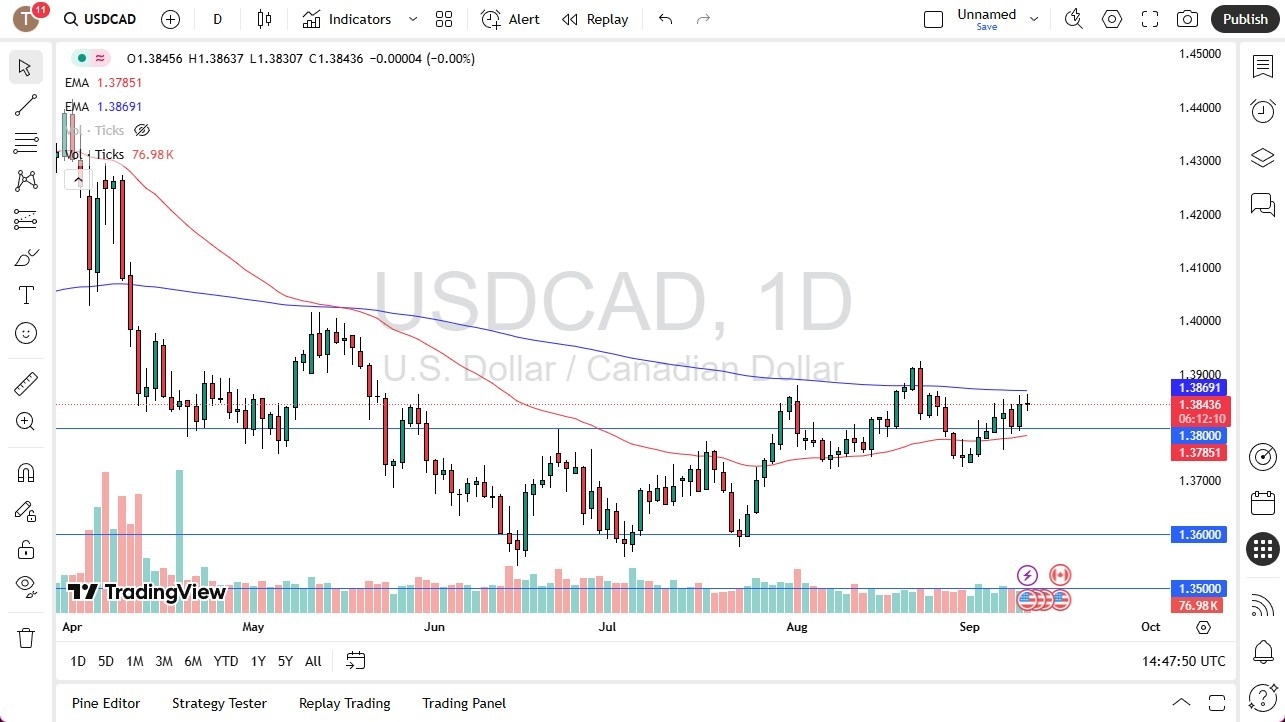

- The US dollar has gone back and forth during the course of the trading session on Wednesday, as we are hanging around just below the 200 Day EMA, which is a large, well-known, psychologically significant indicator.

- With that being the case, I think you’ve got a situation where a lot of traders are just simply looking to see if we can get above that level.

- That’s an area that I have been paying attention to, and has sent some signals out as potential trading entries.

That being said, we are currently between the 50 Day EMA and the 200 Day EMA, and as we are between those 2 significant indicators, and the fact that they are both flat, suggest that we are simply waiting around.

Top Regulated Brokers

Technical Analysis

The technical analysis for this market is somewhat sideways, but if we were to break to the upside, I think you’ve got a situation where we ended up forming a bit of a bottoming pattern, and as a result it makes a certain amount of sense that we could go much higher, perhaps reaching the 1.40 level. Short-term pullbacks are possible, but I also think you have a situation where there’s plenty of support near the 50 Day EMA as well as the 1.3750 level.

Keep in mind that the United States has seen lower inflation in its latest numbers, and now people are starting to question whether or not the Federal Reserve will cut rates. I think it probably will, but at the end of the day, Canada is in much worse shape and of course 25% of Canada’s GDP comes down to its exports to the United States, meaning that if the US slips, Canada is going to take the full brunt of it. I believe we go higher eventually, but I also recognize that there is a lot of back and forth to be had in the meantime.

Ready trade our USD/CAD Forex forecast? Here’s some of the best regulated forex brokers in Canada to check out.