What Are Nuclear Energy Stocks?

Nuclear energy stocks refer to publicly listed companies that are active in the nuclear energy sector. They are primarily involved in operating nuclear reactors to generate electricity. Alternatively, investors can participate in nuclear energy through uranium mining stocks.

Why Should You Consider Investing in Nuclear Energy Stocks?

Nuclear energy is a cornerstone of clean energy, and small modular reactors (SMEs) are the industry’s most significant breakthrough. They can address the tremendous energy demand posed by data centers and AI. With energy needs rising, energy security is a national security concern for most countries. Forecasts estimate nuclear energy investment to exceed $2 trillion by 2050. Factor in the need to lower carbon emissions, and nuclear energy has a bright future.

Here are a few things to consider when evaluating nuclear energy stocks:

- Invest in nuclear energy stocks that have signed deals with some of the most notable end-users like tech giants Meta Platforms, Microsoft, Amazon, and Alphabet

- Analyze next-generation nuclear energy stocks that can power the future with disruptive technologies, including nuclear fusion reactors

- Include established nuclear energy stocks, uranium miners, and next-generation players your nuclear energy portfolio to diversify your exposure

What Are the Downsides of Nuclear Energy Stocks?

Uranium miners may struggle to meet demand, and uranium prices are volatile. Despite its clean energy appeal, opponents will try to derail or limit its potential due to concerns regarding nuclear waste material and its environmental impact, which poses a notable storage problem. Nuclear energy experienced three major catastrophes: Chernobyl (1986), Three Mile Island (1979), and Fukushima (2011). Therefore, pushback against new nuclear reactors could delay deployment.

Here is a shortlist of attractive nuclear energy stocks:

NuScale Power (SMR)

Constellation Energy (CEG)

Cameco (CCJ)

BWX Technologies (BWXT)

Talen Energy (TLN)

Oklo (OKLO)

Duke Energy (DUK)

NextEra Energy (NEE)

Entergy Corporation (ETR)

Dominion Energy (D)

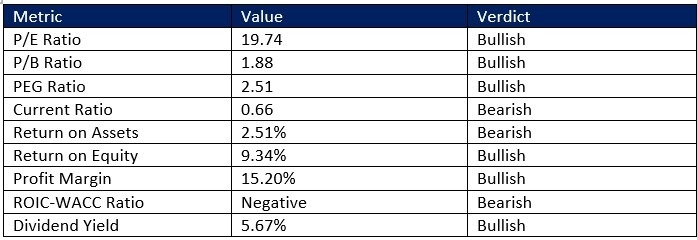

Duke Energy Fundamental Analysis

Duke Energy (DUK) operates seven nuclear facilities, amid a diverse mix of other power plants. Its service territory covers 104,000 square miles with 250,200 miles of distribution lines. Its nuclear power generation remains concentrated in North and South Carolina. Duke Energy is also a component of the Dow Jones Utility Average, the S&P 100, and the S&P 500.

So, why am I bullish on DUK despite its sell-off?

I appreciate that Duke Energy continues to modernize its nuclear power plants by integrating advanced monitoring systems to enhance operational efficiency and safety. Current valuations are reasonable, and profit margins should support its current business model. With a dividend yield above 5.50%, DUK is also an excellent dividend stock, and it should outperform the market during a correction as a defensive play.

The price-to-earnings (P/E) ratio of 19.74 makes DUK an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 29.07.

The average analyst price target for DUK is 132.00. It suggests moderate upside potential with fading downside risks.

Duke Energy Technical Analysis

- The DUK D1 chart shows price action breaking down below its ascending 61.8% Fibonacci Retracement Fan level

- It also shows Duke Energy inside its horizontal support zone with fading bearish trading volumes

- The Bull Bear Power Indicator turned bearish, but shows early signs of a reversal

My Call

I am taking a long position in DUK between 117.00 and 121.33. I expect short-term volatility as bulls and bears wrestle for control at a crucial junction. Still, I see Duke Energy riding the nuclear energy wave higher with its diverse portfolio and excellent dividend yield.

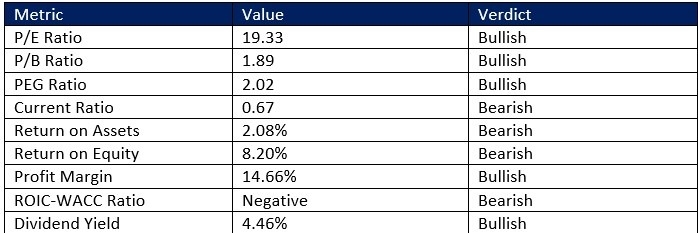

Dominion Energy Fundamental Analysis

Dominion Energy (D) is an energy company that produces 23% of its energy from nuclear power, primarily through its North Anna and Surry Power Stations. It is also a core player in small modular reactors (SMRs). In addition, Dominion Energy is a component of the Dow Jones Utility Average and the S&P 500.

So, why am I bullish on Dominion Energy despite its correction?

Dominion Energy continues to streamline its operations by selling non-core assets, while investing in SMRs, which I think will power its future. Demand from AI and data centers, as the current administration desires to take equity ownership in strategic assets, provides a floor under the current correction of D. The dividend yield is outstanding, profit margins are healthy, and I believe its business model will generate excellent results. D also trades at a superb price-to-book (P/B) value, and its PEG ratio suggests more value ahead.

The price-to-earnings (P/E) ratio of 19.33 makes AU an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 29.07.

The average analyst price target for Dominion Energy is 61.42. It suggests moderate upside potential with manageable downside risks.

Dominion Energy Technical Analysis

- The D D1 chart shows price action between its ascending 50.0% and 61.8% Fibonacci Retracement Fan

- It also shows Dominion Energy inside a horizontal support zone

- The Bull Bear Power Indicator turned bearish, but remains close to its trendline.

My Call

I am taking a long position in Dominion Energy between 57.78 and 59.05. I am buying the SMR strategy and appreciate its divestiture of non-core assets. The dividend yield compensates for short-term volatility, profit margins are in the top quartile of the industry, and the PEG ratio suggests more upside potential.

Ready to trade our analysis of the best nuclear energy stocks to buy? Here is our list of the best brokers for trading worth checking out.