Short Trade Idea

Enter your short position between $239.49 (the intra-day low of its last bearish candlestick) and $244.53 (Friday’s intra-day high).

Market Index Analysis

- Salesforce (CRM) is a member of the Dow Jones Industrial Average, the S&P 100, and the S&P 500.

- All three indices remain near record highs, but breakdown signals have risen.

- The Bull Bear Power Indicator for the S&P 500 shows a negative divergence and does not confirm the uptrend.

Market Sentiment Analysis

Equity futures suggest a positive opening following Friday’s positive close but bearish week. Investors await the outcome of a looming government shutdown. These usually end in a last-second deal or a short shutdown. As AI appears to form a bubble with a projected near-trillion-dollar revenue shortfall, some analysts suggest high valuation could represent the new norm. Still, with over 95% of AI projects failing, and most companies accruing AI debt, markets swim in dangerous waters.

Salesforce Fundamental Analysis

Salesforce is a cloud-based software company focused on sales, customer service, marketing automation, e-commerce, analytics, artificial intelligence, and application development. CRM is one of the 100 largest companies by market capitalization globally, and the world’s largest enterprise applications firm.

So, why am I bearish on CRM despite its AI presence?

Lower-than-expected demand for its enterprise AI products, shareholder value destruction, and a decrease in its revenue growth rate raise concerns about the direction of Salesforce. Despite its growing AI presence, CRM has failed to capitalize on AI and is falling behind competitors. Its announcement to limit Slack data is a desperate attempt to prevent other AI companies from using its data and create a superior product, a sign that Salesforce is dealing with underlying issues that it does not know how to resolve.

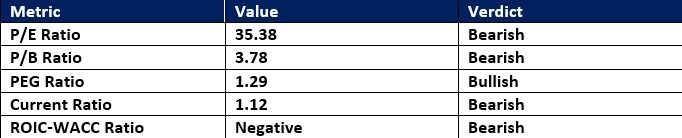

Salesforce Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 35.38 makes CRM an expensive stock. By comparison, the P/E ratio for the S&P 500 is 29.53.

The average analyst price target for CRM is $334.87. This suggests there could be excellent upside potential, but I see more downside ahead.

Top Regulated Brokers

Salesforce Technical Analysis

Today’s CRM Signal

Salesforce Price Chart

- The CRM D1 chart shows price action inside its bearish price channel.

- It also shows price action trading above its descending 61.8% Fibonacci Retracement Fan.

- The Bull Bear Power Indicator is bearish with a descending trendline.

- The average bearish trading volumes are higher than the average bullish trading volumes during last week’s trading session.

- CRM corrected as the S&P 500 Index advanced, a significant bearish development.

My Call on Salesforce

I am taking a short position in CRM between $239.49 and $244.53. Salesforce fails to capitalize on its data and AI tools, and its limits allowing unrestricted Slack data are the latest signs of a struggling company. I see more downside ahead.

- CRM Entry Level: Between $239.49 and $244.53

- CRM Take Profit: Between $204.69 and $212.00

- CRM Stop Loss: Between $255.34 and $265.64

- Risk/Reward Ratio: 2.20

Ready to trade our daily stock signals? Here is our list of the best stock brokers worth reviewing.