Polkadot (DOT) is trading just above $4.53 after climbing out of its recent range.

The push higher has revived momentum, but the real question is whether buyers can force a clean break or if this rally will stall where others have failed.

DOT Momentum Reclaims Moving Averages

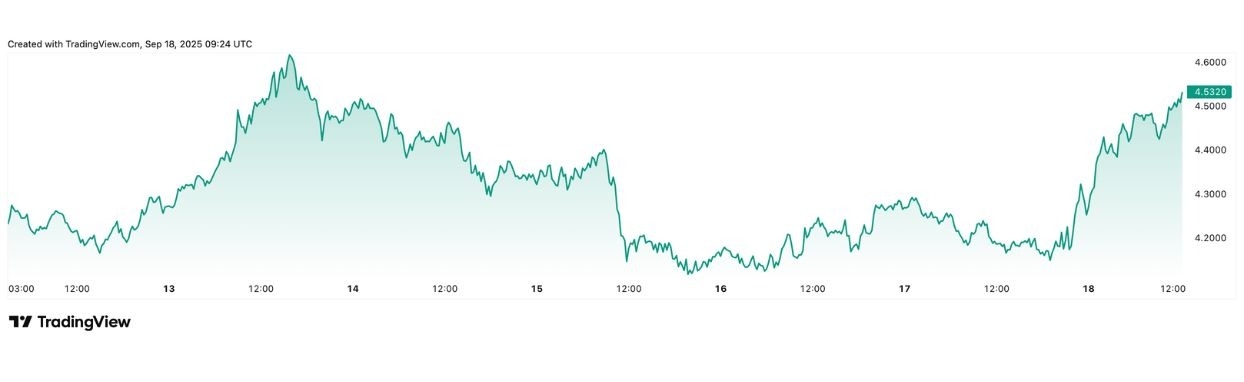

Polkadot Price | Source: Tradingview

After grinding sideways for most of September, DOT finally broke through the ceiling of its $3.70–$4.30 corridor. Thursday’s session stretched from $4.15 to $4.56, with the price now pressing into resistance. Importantly, volume has picked up. That shows buyers are genuinely active here, not just pushing on thin order books.

DOT also reclaimed key trend markers. The 50-day simple moving average, now near $4.05, and the 200-day at $3.90 both sit comfortably below the spot price. Trading back above these averages doesn’t guarantee follow-through, but it shifts the bias toward the upside and often triggers algorithmic and trend-following entries.

Momentum is healthy but not overheated. The daily Relative Strength Index hovers around 62, reflecting consistent demand without flashing an overbought warning.

That leaves room for continuation if the price can clear resistance, though the pressure will intensify the longer DOT lingers under $4.52.

Resistance and Indicators Define the Battleground

The $4.50–$4.52 pocket is proving stubborn. Every attempt to push through has been met with supply, a sign that short-term sellers are watching this level closely.

A strong daily close above it would confirm that buyers have absorbed the overhead pressure and would put $4.60–$4.65 in play. From there, the $5.00 psychological barrier becomes the obvious target.

If the breakout attempt fails, the market will quickly turn back to the $4.30 shelf as support. Lose that, and the structure weakens, opening room for a pullback toward $4.00 or even $3.80. A drop back under $3.65 would erase the entire breakout thesis and return DOT to the summer accumulation zone.

Indicators reflect the tension. Stochastic readings are tilting higher into overheated territory, suggesting that without a clean breakout, momentum could fade fast. That aligns with order book dynamics: buyers are active, but sellers remain just as determined to defend the highs.

Sentiment is being underpinned by recent fundamentals. The governance decision to cap DOT’s supply strengthens the long-term scarcity narrative, and staking flows continue to remove tokens from circulation.

Still, these structural positives cannot override market beta. If Bitcoin falters, DOT is unlikely to hold its ground on its own.

Final Thoughts

Polkadot’s move back to $4.50 is a constructive shift, but it’s also a stress test. A decisive close above $4.52 would give bulls a clear edge and set up a run at $4.60, with $5.00 the bigger milestone just beyond.

Failure here, on the other hand, would leave DOT stuck in its well-worn range and could invite another slide into the mid-$3s.

For now, the chart leans bullish, with moving averages turning supportive and RSI still shy of overbought territory. But until resistance gives way, DOT remains locked in a battle between motivated buyers and equally committed sellers. The next few daily closes will decide whether this rally turns into something lasting or fades back into another failed breakout attempt.

Ready to trade our technical analyses of Polkadot, Bitcoin, and Dogecoin? Here’s our list of the best crypto brokers worth checking out.