Long Trade Idea

Enter your long position between $65.24 (the lower band of its horizontal support zone) and $68.19 (yesterday’s intra-day high).

Market Index Analysis

- PayPal (PYPL) is a member of the NASDAQ 100, the S&P 100, and the S&P 500 Indices.

- All three indices trade near all-time highs without volume confirmation.

- The Bull Bear Power Indicator for the NASDAQ 100 shows a negative divergence and does not confirm the uptrend.

Market Sentiment Analysis

Equity markets continue to climb a wall of worry fueled by hopes that interest rate cuts by the Federal Reserve will suffice to reverse the sliding job market and spur capital inflows from money market funds, where over $7 trillion earn reasonable risk-free returns. The Senate confirmed President Trump’s Fed Governor pick Miran, while the SEC vows to fast-track the president’s push to end quarterly financial reports by publicly listed companies. Cautious bullish sentiment prevails as markets ignore the headwinds.

PayPal Fundamental Analysis

PayPal is a financial technology company focused on mobile and online payments. It added support for cryptocurrency purchases, operates in 202 markets, has 425M active accounts, and holds accounts in 25 fiat currencies.

So, why am I bullish on PYPL despite its sell-off?

I like the launch of PayPal Links, which simplifies payment requests and peer-to-peer transactions by allowing users to share a payment link. Cryptocurrency support will follow soon, and it could drive transaction volumes in its core markets. The valuations of PYPL are a screaming buy, the operational statistics rank among the best in its industry, and the upside potential is tremendous.

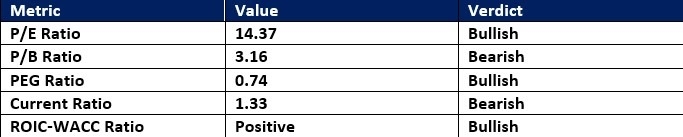

PayPal Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 14.37 makes PYPL an inexpensive stock. By comparison, the P/E ratio for the NASDAQ 100 is 35.72.

The average analyst price target for PYPL is $82.52. It suggests good upside potential with manageable downside risks.

PayPal Technical Analysis

Today’s PYPL Signal

PayPal Price Chart

- The PYPL D1 chart shows price action inside its horizontal support zone with a pending breakout.

- It also shows price action between its descending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bearish with an ascending trendline, approaching a bullish crossover.

- The average bullish trading volumes during positive sessions are higher than the average bearish trading volumes.

- PYPL corrected as the NASDAQ 100 pushed higher, a bearish trading signal, but bullish tailwinds emerged.

Top Regulated Brokers

My Call on PayPal

I am taking a long position in PYPL between $65.24 and $68.19. Current valuations following its correction and the PEG ratio suggest an undervalued company. PayPal Links should boost transaction flows and revenues. Therefore, I believe PayPal is ripe for a breakout.

- PYPL Entry Level: Between $65.24 and $68.19

- PYPL Take Profit: Between $79.50 and $82.52

- PYPL Stop Loss: Between $59.46 and $60.95

- Risk/Reward Ratio: 2.47

Ready to trade our free daily signals? Here is our list of the best brokers for trading worth checking out.