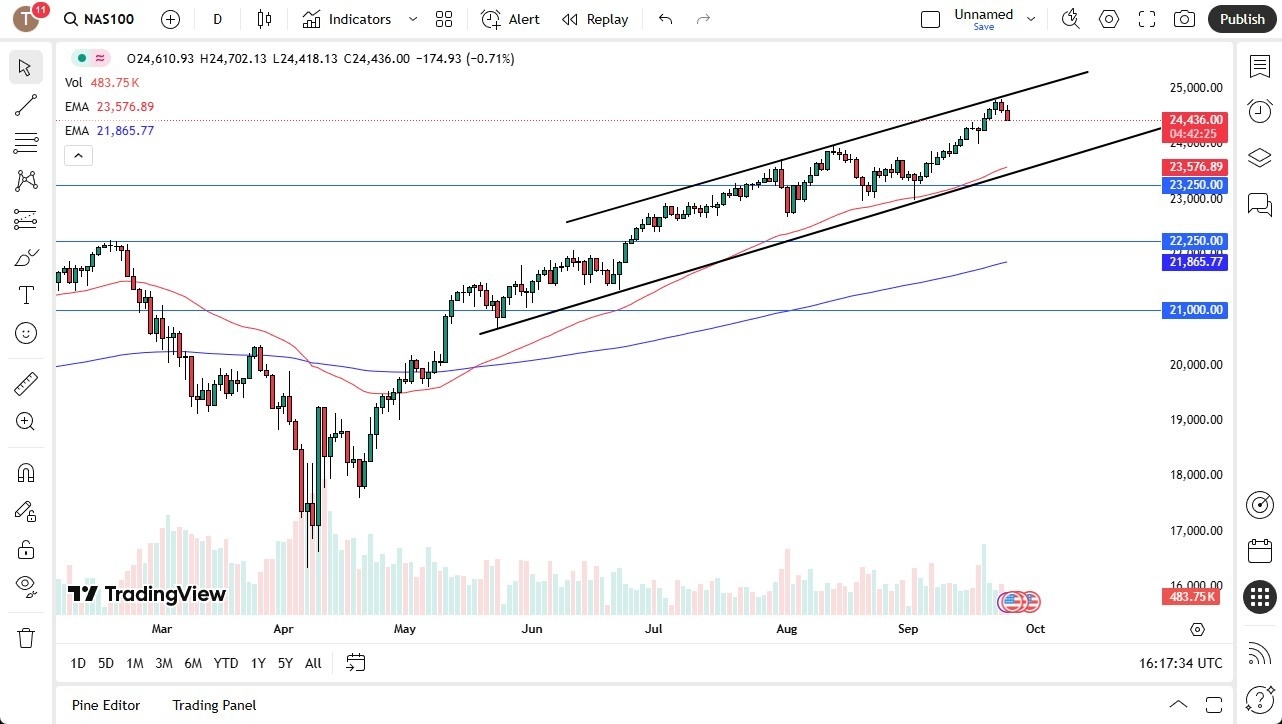

- The Nasdaq 100 initially did try to show signs of life, but we've seen more feckless trading out of New York again, as we have pulled back from a major a top in an up trending channel.

- Whether or not we are going to fall apart here remains to be seen, but I think we are just a touch overdone, and this pullback helps.

- Whether or not we bounce from here remains to be seen, but this is a market that is just waiting, hoping for some reason to go much higher.

The 25,000 level is an area that I think a lot of people would be looking at as a potential target. Short-term pullbacks at this point could open up the possibility of a move to the 24,000 level, but really at this point, I think you've got a situation where even if we fall all the way down to the 23,500 level, we still have plenty of support, especially with the 50 day EMA racing toward that area.

NASDAQ Tends to Move First

Top Forex Brokers

The Nasdaq 100 is the first place to attract attention and inflows, but I also recognize that we are a little stretched, so who knows? Maybe with the strengthening US dollar, we might see a little bit of trouble here, but I think it's short lived. I think a lot of what we've seen on Wall Street has been assuming that the Federal Reserve was going to come and save everybody with loose monetary policy. And while they may cut rates, they may not cut them fast enough to get all of the monetary policy junkies on Wall Street excited.

We'll just have to wait and see. Pay attention to the Magnificent Seven. They determine where everything goes. So, for example, I've noticed Nvidia has struggled a bit today. It's really hard when 14 % of the index Nvidia struggles and really that puts a little bit of a damper on the market to say the least. Either way, I'm looking for a buying opportunity after a pullback and a bounce.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.