Short Trade Idea

Enter your short position between $752.05 (the intra-day low of its last bearish candlestick) and $766.30 (yesterday’s intra-day high).

Market Index Analysis

- Meta Platforms (META) is a member of the NASDAQ 100, the S&P 100, and the S&P 500 indices.

- All three indices are near all-time highs, climbing a wall of worry, a bearish trading environment.

- The Bull Bear Power Indicator for the NASDAQ 100 shows a negative divergence and does not confirm the uptrend.

Market Sentiment Analysis

The BLS revised the previous twelve-month job picture ending March 2025 down by 911,000 jobs, confirming the severe slowdown in the US labor market. Economists worry that the cool-down is beyond the repair of interest rate cuts, as it will not address labor conditions. All eyes are on today’s CPI report, which can dictate how fast and steeply the US Federal Reserve will slash interest rates. Investors should brace for volatility following the release of the CPI report.

Meta Platforms Fundamental Analysis

Meta Platforms is one of the world’s biggest spenders on research & development, a member of the US Big Five Tech Companies, and the Magnificent Seven. It is an industry leader in the metaverse and has now embarked on a hiring spree to become a leader in advanced AI and superintelligence.

So, why am I bearish on META despite its recent bounce higher?

I remain long-term bullish on Meta Platforms, but the worsening debt-to-asset ratio and stagnant operating margins make me medium-term bearish. META must invest heavily to realize its ambitions, and its current ratio continues to contract. The meager dividend does not compensate for the added risk over the next few months, and valuations are a bit high.

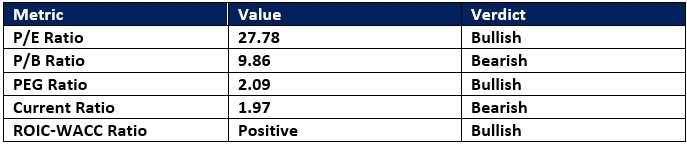

Meta Platforms Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 27.78 makes META an inexpensive stock. By comparison, the P/E ratio for the NASDAQ 100 is 31.98.

The average analyst price target for META is 863.20. It suggests excellent upside potential, but medium-term downside risks remain.

Meta Platforms Technical Analysis

Today’s META Signal

META Price Chart

- The META D1 chart above shows price action inside a bearish price channel.

- It also shows price action trading between its ascending 50.0% and 61.8% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bullish with a descending trendline.

- The average bearish trading volumes are higher than the average bullish trading volumes.

- META failed to match the record run of the NASDAQ 100, a significant bearish signal.

My Call on META

I am taking a short position in META between $752.05 and $766.30. I believe in the long-term potential of META, but the medium term raises concerns. Therefore, I think the bearish price channel will challenge the July lows.

- META Entry Level: Between $752.05 and $766.30

- META Take Profit: Between $678.67 and $691.20

- META Stop Loss: Between $784.75 and $796.25

- Risk/Reward Ratio: 2.24

Ready to trade our free daily signals? Here is our list of the best brokers for trading worth checking out.