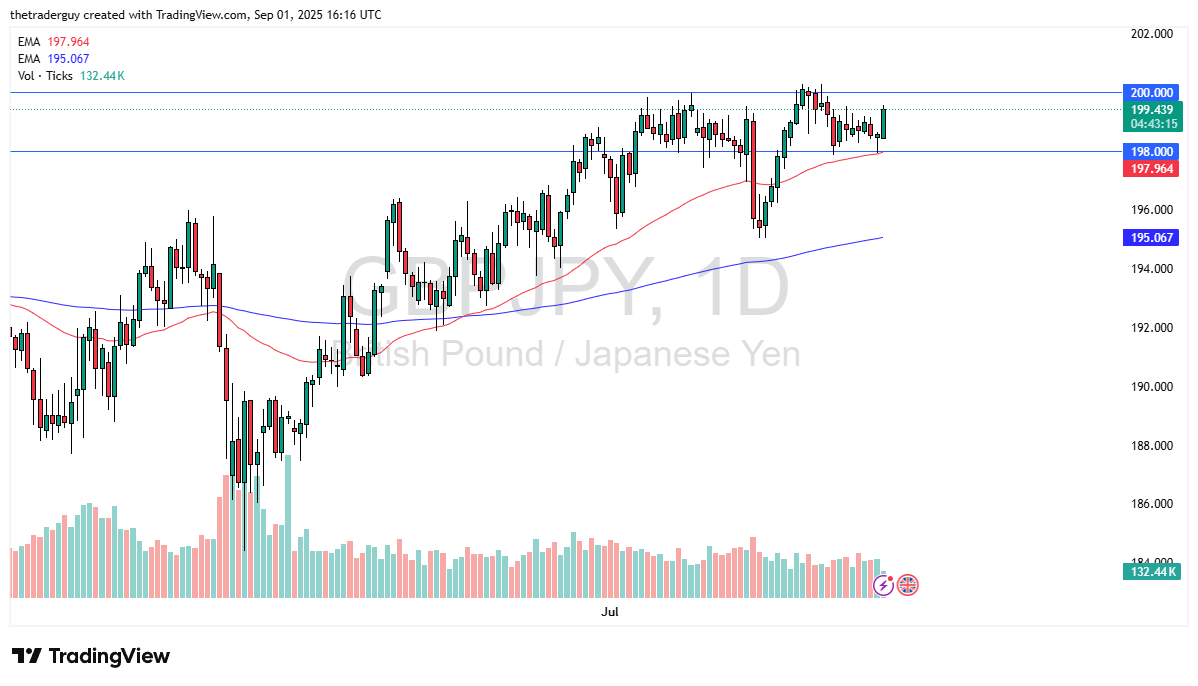

- The British pound has shown itself to be rather strong against the Japanese yen, but really at this point in time, we still face a mountain of resistance near the 200 yen level.

- This is an area that if you zoom out, you can see has been important multiple times going back a couple of years now, but it certainly looks like the pound is trying to build up enough pressure to finally break out.

- If we finally get a substantial break above the 200 yen level on a daily close, I think at that point in time, it kicks off a move toward the 202 yen level, followed by the 205 yen level.

Short-term pullbacks should end up being buying opportunities with the 198 yen level offering support.

Top Forex Brokers

50 Day EMA

I would also point out that right there at the 198 yen level, have the 50 day EMA, which of course attracts a lot of attention in and of itself. If we broke down below there, then we could drop to the 200 day EMA, which is basically at the 195 yen level. The interest rate differential does pay you to hang on to a long position in this market. And it is worth paying close attention to.

The size of the candlestick is impressive, but like I said, the big barrier just above is still something that's going to be difficult to overcome. This is the biggest candlestick that we've seen in the last two weeks or so, and that is worth paying close attention to.

The interest rate differential is going to continue to get you paid if you are patient, but I would not pile into the market, at least not get aggressive until we get above the 200 yen level. If and when we do, then you can start to build a longer term position. But in the short term, I prefer to buy dibs.

Begin trading our daily forecasts and analysis. Here is a list of Forex brokers in Japan to work with.